Get the free NEAIncome Protection Insurance Plan

Show details

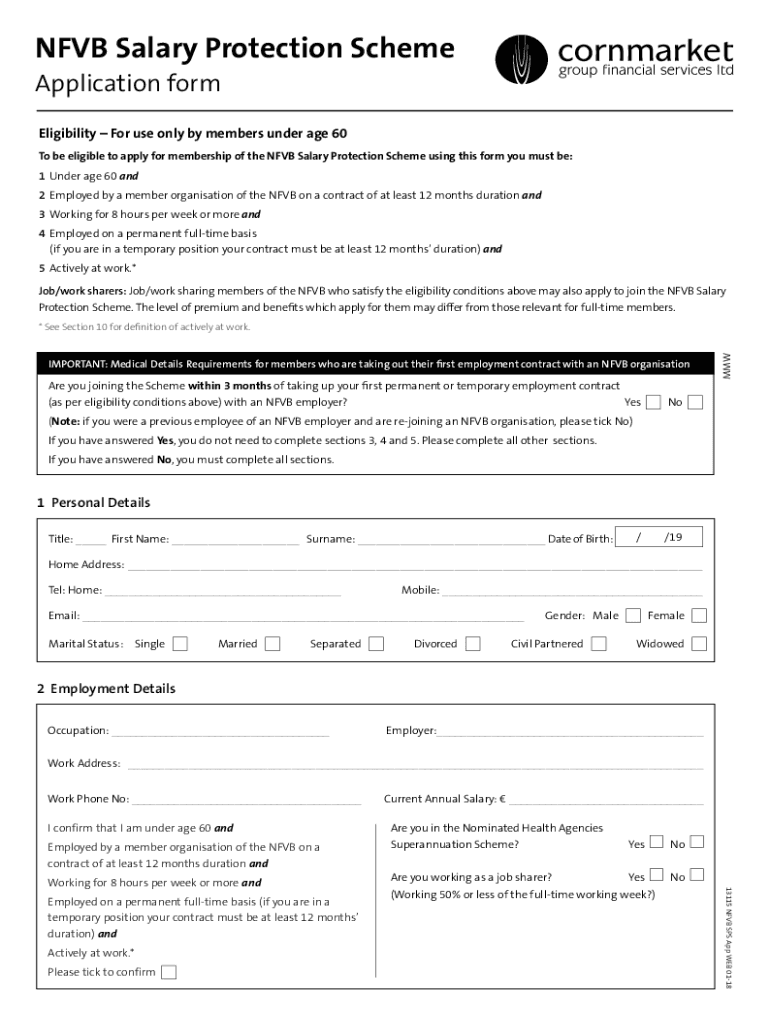

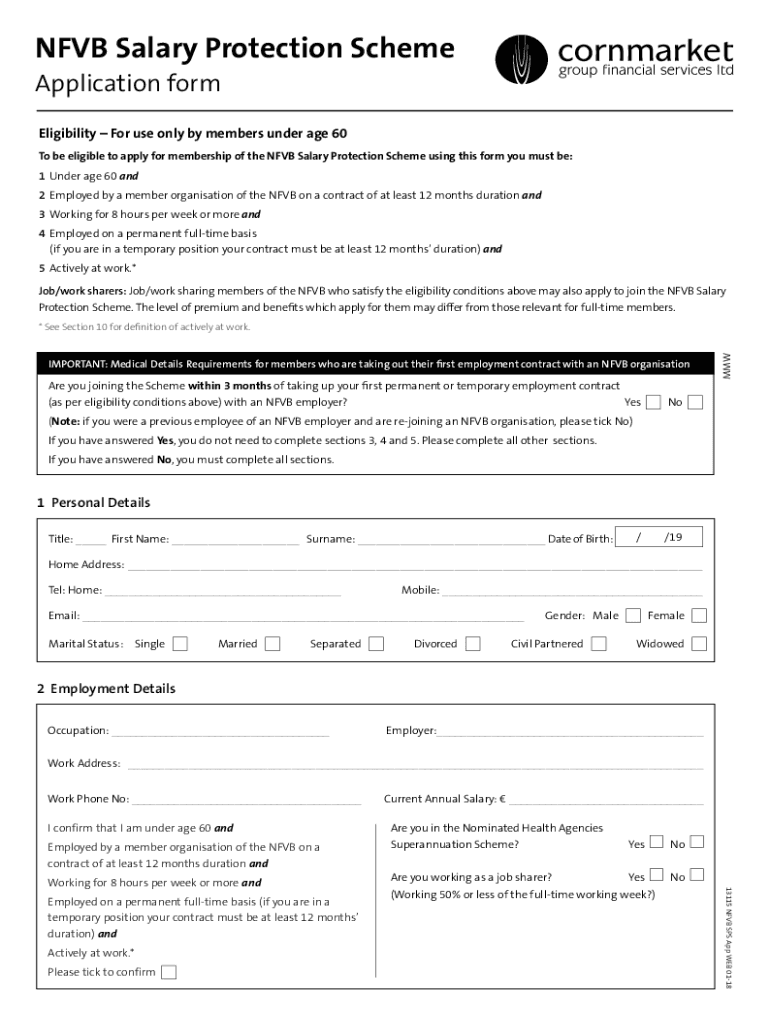

NFL Salary Protection Scheme Application form Eligibility For use only by members under age 60 To be eligible to apply for membership of the NFL Salary Protection Scheme using this form you must be:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign neaincome protection insurance plan

Edit your neaincome protection insurance plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your neaincome protection insurance plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit neaincome protection insurance plan online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit neaincome protection insurance plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out neaincome protection insurance plan

How to fill out neaincome protection insurance plan

01

Understand the coverage: Familiarize yourself with the different aspects of the neaincome protection insurance plan, including the coverage options, premium rates, waiting period, and benefit payment duration.

02

Gather necessary information: Collect all the required information such as personal details, employment information, financial documentation, and health records.

03

Choose the coverage amount: Determine the appropriate coverage amount based on your monthly income, expenses, and other financial commitments.

04

Compare plans: Research and compare different neaincome protection insurance plans offered by various providers, considering factors like cost, benefits, and policy terms.

05

Fill out the application form: Complete the application form accurately, providing all the requested information about yourself, your occupation, health history, and financial status.

06

Provide additional documentation: Attach any necessary supporting documents, which may include proof of income, medical records, or identity verification.

07

Review the application: Double-check all the information provided in the application form to ensure its accuracy and completeness.

08

Submit the application: Send the completed application form and supporting documents to the insurance provider either online or via mail, following their specified submission guidelines.

09

Wait for approval: After submitting the application, wait for the insurance provider's review and decision. This may involve additional medical exams or underwriting process.

10

Review policy terms: Upon approval, carefully review the policy terms and conditions, including the coverage details, premium payments, benefit payouts, and any exclusions or limitations.

11

Make premium payments: Set up a payment plan for your neaincome protection insurance premiums and ensure timely payments to maintain continuous coverage.

12

Keep the policy updated: Notify the insurance provider about any changes in personal information, employment status, or health conditions to keep the policy up to date.

13

Contact the provider for claims: In case of disability or income loss, contact the insurance provider as per their designated procedures to initiate the claim process.

14

Provide necessary documentation: Provide all the necessary documentation, such as medical certificates, income proof, and claim forms, as required by the insurance provider.

15

Follow up on the claim: Keep track of the claim progress, provide any additional information or requested documentation promptly, and follow up with the insurance provider until the claim is settled.

16

Seek professional advice: If you encounter any difficulties or have concerns during the process of filling out the neaincome protection insurance plan, consult with a financial advisor or insurance agent for guidance.

Who needs neaincome protection insurance plan?

01

Self-employed individuals: Those who are self-employed and rely on their income to support their business or livelihood.

02

Individuals with dependents: People with dependents, such as a spouse or children, who rely on their income to meet their financial needs.

03

Sole breadwinners: Individuals who are the sole or primary earners in their household and need to ensure financial stability in the event of income loss or disability.

04

Highly skilled professionals: Professionals with specialized skills or high incomes that may be difficult to replace or replicate.

05

Individuals with high financial obligations: Those who have significant financial responsibilities, like mortgage payments, loans, or debts, and need insurance coverage to meet these obligations in case of income loss.

06

People in physically demanding jobs: Occupations involving higher physical risks or potential health hazards that may increase the chances of disability or income loss.

07

Individuals without sufficient savings: Those who lack substantial savings or emergency funds to sustain themselves during a period of income loss or disability.

08

Anyone concerned about income protection: Individuals who prioritize financial security and want to ensure a steady income source during unforeseen circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send neaincome protection insurance plan to be eSigned by others?

Once your neaincome protection insurance plan is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit neaincome protection insurance plan on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing neaincome protection insurance plan, you can start right away.

How do I complete neaincome protection insurance plan on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your neaincome protection insurance plan. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is neaincome protection insurance plan?

Neaincome protection insurance plan is a type of insurance that provides financial support to individuals who are unable to work due to illness or injury. It offers a replacement income during the period of inability to work.

Who is required to file neaincome protection insurance plan?

Individuals who have taken out a neaincome protection insurance policy are required to file for benefits when they become unable to work due to qualifying conditions.

How to fill out neaincome protection insurance plan?

To fill out a neaincome protection insurance plan, individuals generally need to complete an application form provided by the insurance company, providing personal details, employment information, and medical history.

What is the purpose of neaincome protection insurance plan?

The purpose of neaincome protection insurance plan is to provide financial security and peace of mind by ensuring that individuals can still meet their financial obligations even when they are unable to work due to unforeseen circumstances.

What information must be reported on neaincome protection insurance plan?

Information that must be reported typically includes personal identification details, insurance policy number, reason for the claim, duration of inability to work, and any relevant medical documents or evidence.

Fill out your neaincome protection insurance plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Neaincome Protection Insurance Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.