Get the free Valuation standards - Tax.NY.gov

Show details

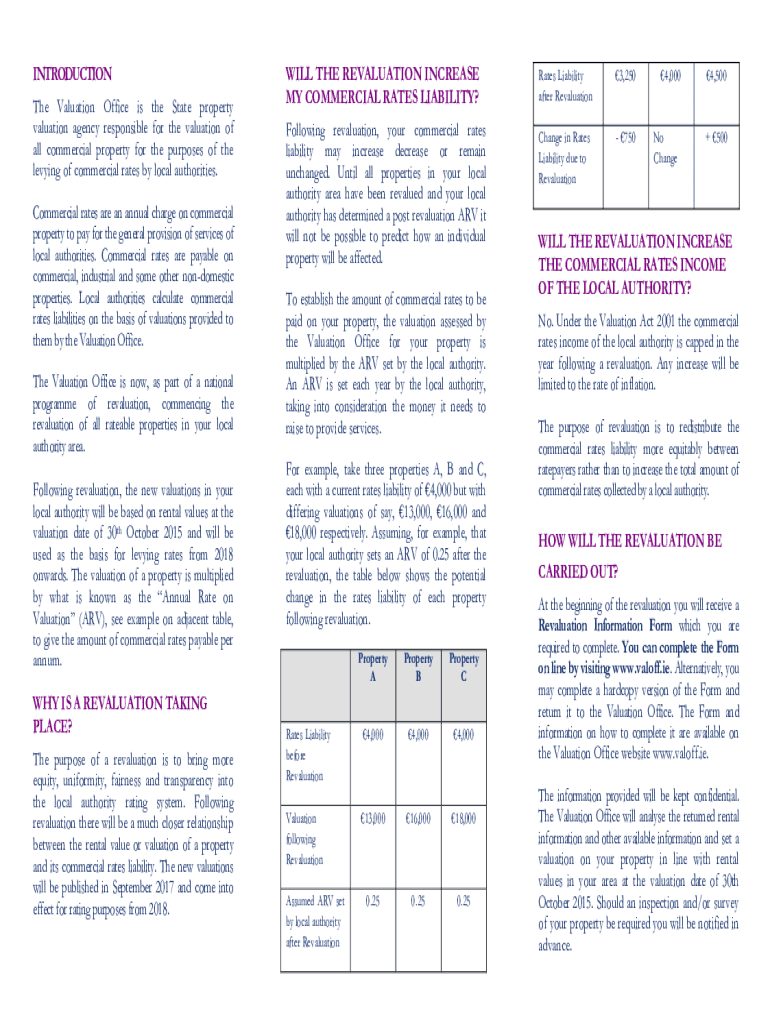

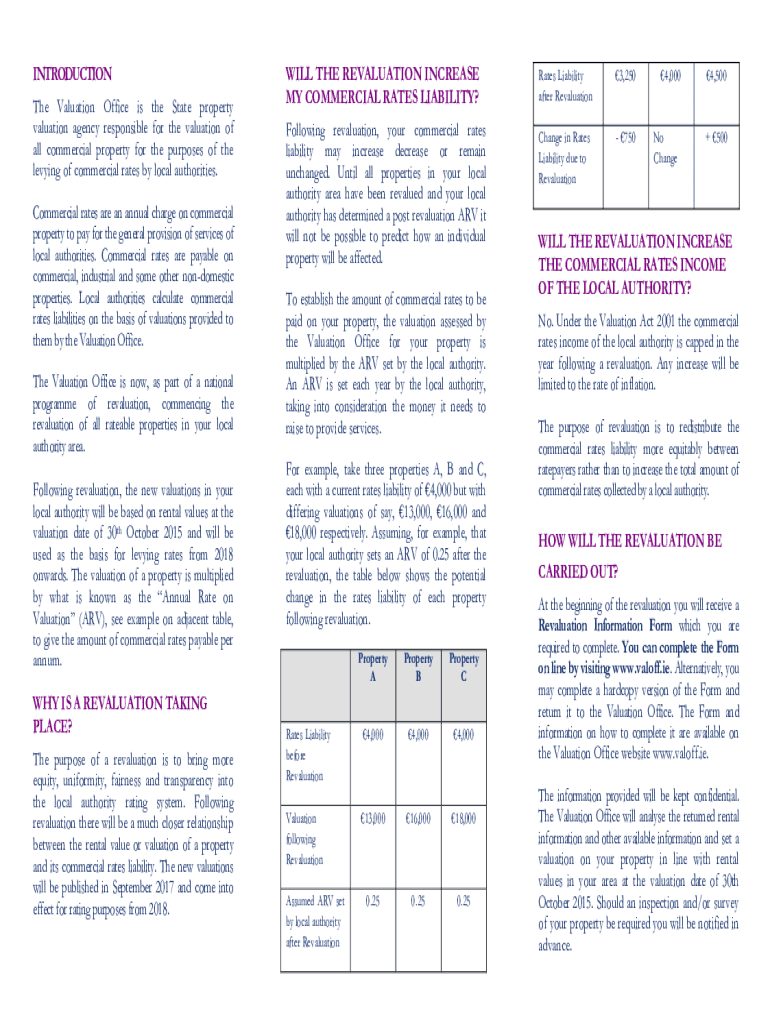

INTRODUCTION The Valuation Office is the State property valuation agency responsible for the valuation of all commercial property for the purposes of the levying of commercial rates by local authorities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign valuation standards - taxnygov

Edit your valuation standards - taxnygov form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your valuation standards - taxnygov form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing valuation standards - taxnygov online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit valuation standards - taxnygov. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out valuation standards - taxnygov

How to fill out valuation standards - taxnygov

01

To fill out valuation standards according to taxnygov, follow these steps:

02

Start by gathering all the necessary information and documentation related to the valuation process.

03

Familiarize yourself with the specific valuation standards outlined by taxnygov. This may include understanding the criteria, methodologies, and guidelines for valuation.

04

Assess the assets or properties that require valuation and determine the purpose of the valuation (e.g., for tax assessment, financial reporting, or legal compliance).

05

Follow the prescribed valuation methodologies specified by taxnygov. This could involve using various approaches such as the cost approach, market approach, or income approach.

06

Apply the valuation standards to the assets or properties, ensuring accuracy and adherence to the specified guidelines.

07

Document the valuation process, including any assumptions made, data sources utilized, and calculations performed.

08

Validate and review the completed valuation report, ensuring it meets the required standards set by taxnygov.

09

Submit the valuation report to the appropriate authority or entity as instructed by taxnygov, following any additional filing requirements or deadlines.

10

Keep a record of the valuation report and supporting documentation for future reference or potential audits.

11

Regularly stay updated with any changes or updates to the valuation standards provided by taxnygov and adapt your practices accordingly.

12

By following these steps, you can effectively fill out valuation standards according to taxnygov.

13

Note: It is recommended to consult with a professional valuer or tax advisor for specific guidance tailored to your unique situation.

Who needs valuation standards - taxnygov?

01

Valuation standards provided by taxnygov can be useful for various individuals and organizations, including:

02

Business owners or managers: They may need valuation standards to assess the worth of their company or its assets for various purposes such as mergers and acquisitions, financial planning, or tax compliance.

03

Accountants and auditors: They may require valuation standards to ensure accurate financial reporting and compliance with relevant accounting principles.

04

Tax professionals: They can utilize valuation standards to determine fair market values for tax assessment, estate planning, or transfer pricing purposes.

05

Legal professionals: Valuation standards can assist lawyers in accurately determining the value of assets or properties in legal matters such as divorce settlements, litigation, or property disputes.

06

Financial institutions: Banks, lenders, or insurance companies may rely on valuation standards to evaluate the collateral value of assets or properties for lending or insurance purposes.

07

Government entities: Tax authorities and regulatory bodies may implement valuation standards to ensure consistency and fairness in tax assessments, property valuations, or regulatory compliance.

08

By providing a standardized framework for valuation, taxnygov's valuation standards cater to the needs of various stakeholders and promote transparency and reliability in valuation practices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send valuation standards - taxnygov to be eSigned by others?

To distribute your valuation standards - taxnygov, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the valuation standards - taxnygov in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your valuation standards - taxnygov in seconds.

Can I edit valuation standards - taxnygov on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign valuation standards - taxnygov right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is valuation standards - taxnygov?

Valuation standards refer to the guidelines and criteria established by the New York State government for determining the value of property for tax purposes. These standards ensure that property assessments are fair, equitable, and consistent.

Who is required to file valuation standards - taxnygov?

Property owners and businesses in New York State that are subject to property taxes are required to comply with valuation standards. This includes individuals and entities that own real estate or possess personal property.

How to fill out valuation standards - taxnygov?

To fill out valuation standards, taxpayers must gather relevant property information, including property type, location, and market analysis. The completed forms can usually be submitted online or by mail to the appropriate tax authority, following the specific guidelines provided.

What is the purpose of valuation standards - taxnygov?

The purpose of valuation standards is to provide a framework for accurately assessing the value of properties for taxation. They aim to ensure fairness in property taxation and uphold the integrity of the tax system.

What information must be reported on valuation standards - taxnygov?

Information that must be reported includes the property description, ownership details, assessed value, property use, and any applicable exemptions. Additionally, comparable sales data may also need to be included for valuation purposes.

Fill out your valuation standards - taxnygov online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Valuation Standards - Taxnygov is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.