Get the free tax increment financing (tif) district application for ...

Show details

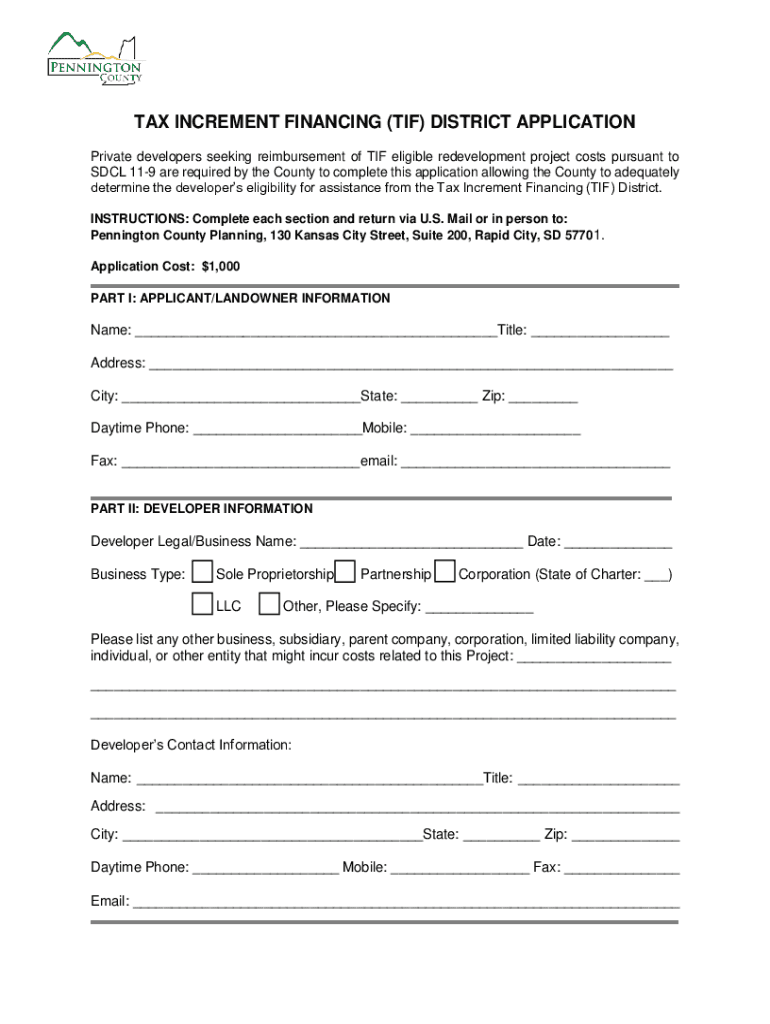

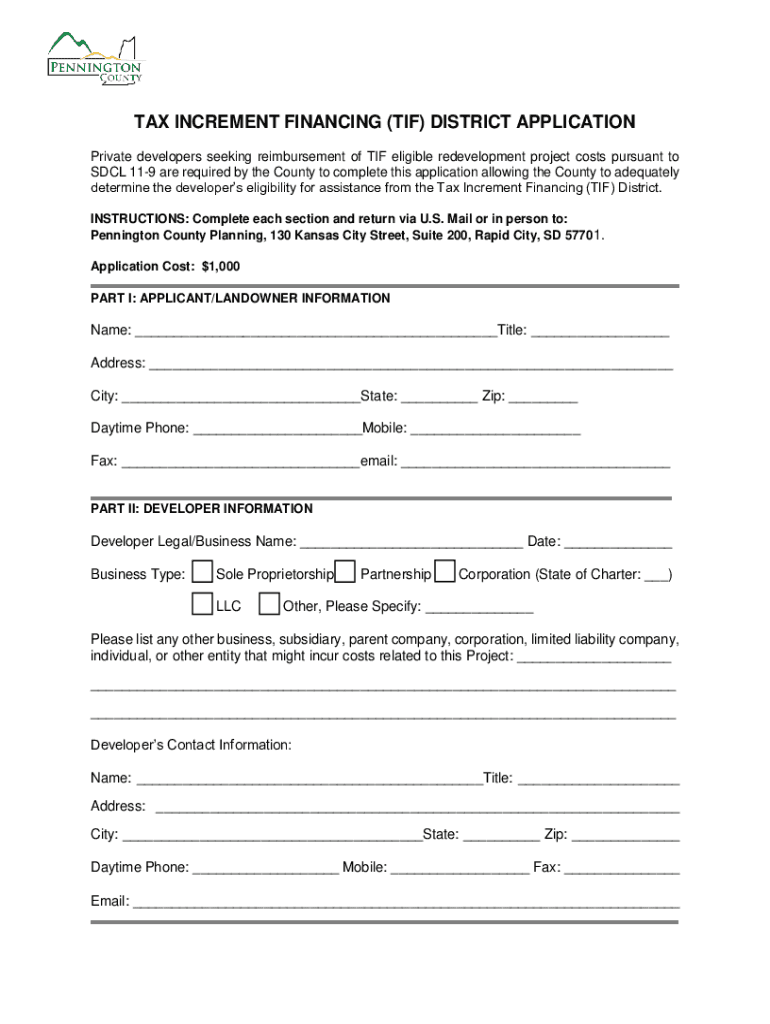

TAX INCREMENT FINANCING (TIF) DISTRICT APPLICATION Private developers seeking reimbursement of TIF eligible redevelopment project costs pursuant to DCL 119 are required by the County to complete this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment financing tif

Edit your tax increment financing tif form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment financing tif form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax increment financing tif online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax increment financing tif. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment financing tif

How to fill out tax increment financing tif

01

Start by gathering all the necessary documents and information such as property ownership details, project plans, and financial statements.

02

Consult with a tax professional or financial advisor to ensure you understand the specific requirements and regulations for your locality.

03

Review the guidelines and application process for the tax increment financing (TIF) program in your area.

04

Fill out the TIF application form accurately and completely, providing all requested information and supporting documentation.

05

Submit the filled-out application to the designated authority or agency responsible for the TIF program.

06

Wait for a response from the TIF program administrators who will review your application and may request additional information or documentation.

07

If approved, carefully follow the instructions provided by the TIF program administrators to access the funds and comply with reporting requirements.

08

Keep track of the use of TIF funds and ensure they are utilized according to the agreed-upon terms and conditions.

09

Regularly communicate with the TIF program administrators to provide updates on the progress of your project and address any concerns or questions that may arise.

10

Consider consulting with a professional accountant to handle any tax-related matters or reporting obligations associated with the TIF funding.

Who needs tax increment financing tif?

01

Developers or businesses planning to undertake a qualified development project that will generate significant economic or community benefits.

02

Local governments or municipalities seeking to revitalize blighted or underdeveloped areas.

03

Public-private partnerships aiming to fund infrastructure improvements, such as roads, utilities, or public amenities.

04

Entities looking to attract private investment and stimulate economic growth in a particular region or district.

05

Individuals or organizations that qualify for TIF assistance based on the specific eligibility criteria established by the TIF program administrators.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax increment financing tif from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your tax increment financing tif into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I edit tax increment financing tif on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing tax increment financing tif, you can start right away.

Can I edit tax increment financing tif on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as tax increment financing tif. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is tax increment financing tif?

Tax Increment Financing (TIF) is a public financing method used to subsidize redevelopment, infrastructure, and other projects in a specific area by redirecting future property tax revenue increases back into the area.

Who is required to file tax increment financing tif?

Entities or municipalities that utilize TIF to fund projects or developments are required to file tax increment financing documents, including local governments and development authorities.

How to fill out tax increment financing tif?

To fill out TIF documentation, one typically needs to provide information about the project, the estimated increment, public benefits, and financing plans, often accompanied by forms and reports specific to the local jurisdiction.

What is the purpose of tax increment financing tif?

The purpose of TIF is to stimulate economic development by financing public improvements that will attract private investment, increase property values, and enhance local tax revenues.

What information must be reported on tax increment financing tif?

Information that must be reported includes assessed property values, the allocation of tax increments, project budgets, expenditures, and progress reports on the development goals and outcomes.

Fill out your tax increment financing tif online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Financing Tif is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.