Get the free Financial reporting and disclosure requirements for trade ...

Show details

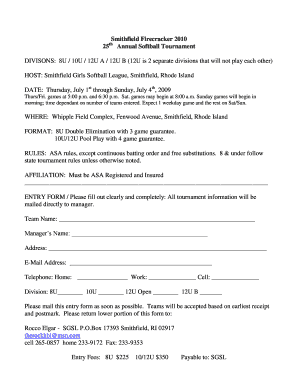

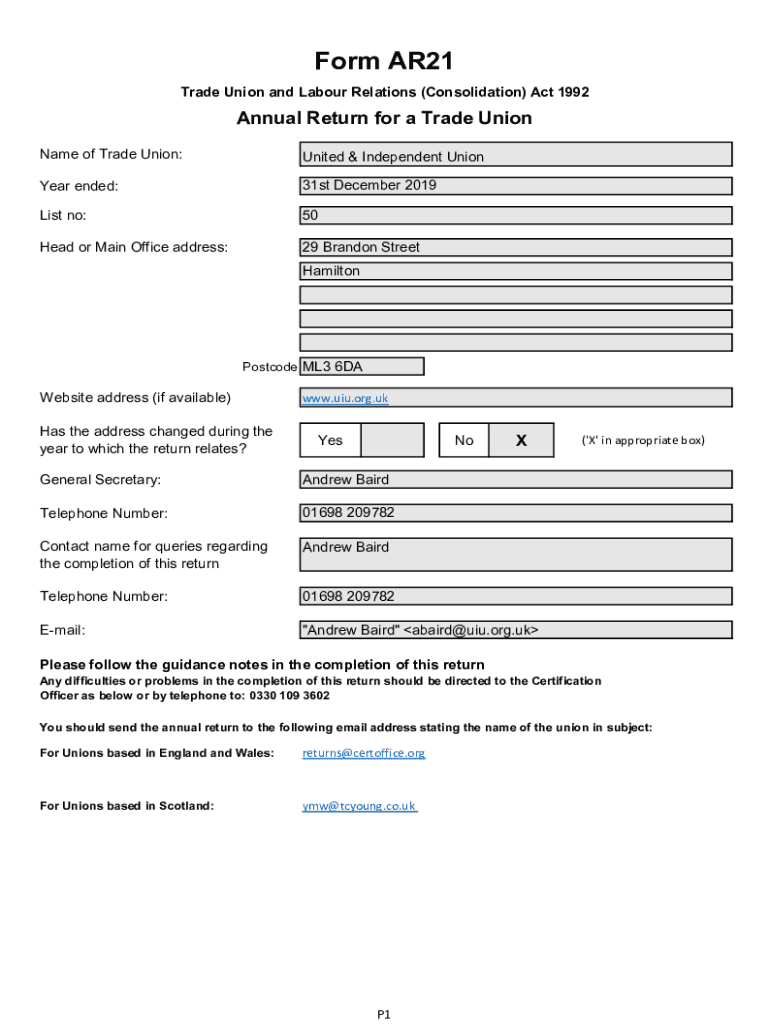

Form AR21

Trade Union and Labor Relations (Consolidation) Act 1992Annual Return for a Trade Union

Name of Trade Union:United & Independent Uniondale ended:31st December 2019List no:50Head or Main

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial reporting and disclosure

Edit your financial reporting and disclosure form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial reporting and disclosure form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial reporting and disclosure online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial reporting and disclosure. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial reporting and disclosure

How to fill out financial reporting and disclosure

01

Gather all the necessary financial records and documents.

02

Identify the specific financial reporting and disclosure requirements applicable to your organization or business.

03

Prepare the financial statements, including the balance sheet, income statement, and cash flow statement.

04

Ensure that the financial statements are accurate and comply with the relevant accounting standards.

05

Include any required disclosure notes, such as information about significant accounting policies or contingent liabilities.

06

Review the financial statements and disclosures to identify any errors or inconsistencies.

07

Get them audited or reviewed by a qualified external auditor, if required.

08

File the financial statements and disclosures with the appropriate regulatory authorities within the specified timeframe.

09

Make sure to keep copies of all the financial reporting and disclosure documents for future reference.

Who needs financial reporting and disclosure?

01

Publicly traded companies that are required to comply with securities regulations and provide transparency to shareholders and investors.

02

Private companies that seek loans or investments from financial institutions or angel investors.

03

Non-profit organizations that receive government grants or funding and need to demonstrate accountability.

04

Government agencies that collect and manage public funds and need to provide financial reports to ensure transparency.

05

Individuals or businesses involved in legal disputes or lawsuits that require financial disclosure as part of the litigation process.

06

Financial analysts and investment professionals who rely on accurate and detailed financial reporting for analysis and decision-making.

07

Tax authorities who use financial reports to assess and verify tax liabilities.

08

Credit rating agencies who evaluate the creditworthiness of organizations based on their financial disclosure.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial reporting and disclosure in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your financial reporting and disclosure and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send financial reporting and disclosure for eSignature?

When you're ready to share your financial reporting and disclosure, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit financial reporting and disclosure on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign financial reporting and disclosure right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is financial reporting and disclosure?

Financial reporting and disclosure refer to the process of providing relevant financial information about a company to external stakeholders, such as investors, creditors, and regulators, through financial statements like balance sheets, income statements, and cash flow statements.

Who is required to file financial reporting and disclosure?

Publicly traded companies, certain private companies, and not-for-profit organizations are generally required to file financial reports and disclosures as mandated by regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States.

How to fill out financial reporting and disclosure?

To fill out financial reporting and disclosure, companies must gather financial data, prepare accurate financial statements according to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), and ensure that all required disclosures are included, then file them with the appropriate regulatory body.

What is the purpose of financial reporting and disclosure?

The purpose of financial reporting and disclosure is to provide transparency, enable informed decision-making by stakeholders, assess a company's financial health, and comply with legal and regulatory requirements.

What information must be reported on financial reporting and disclosure?

Financial reporting and disclosure typically require the reporting of financial statements, including the income statement, balance sheet, cash flow statement, notes to the financial statements, and management's discussion and analysis (MD&A), along with any other relevant financial and non-financial information.

Fill out your financial reporting and disclosure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Reporting And Disclosure is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.