Get the free Financial Goals Examples7 Personal Finance Goals

Show details

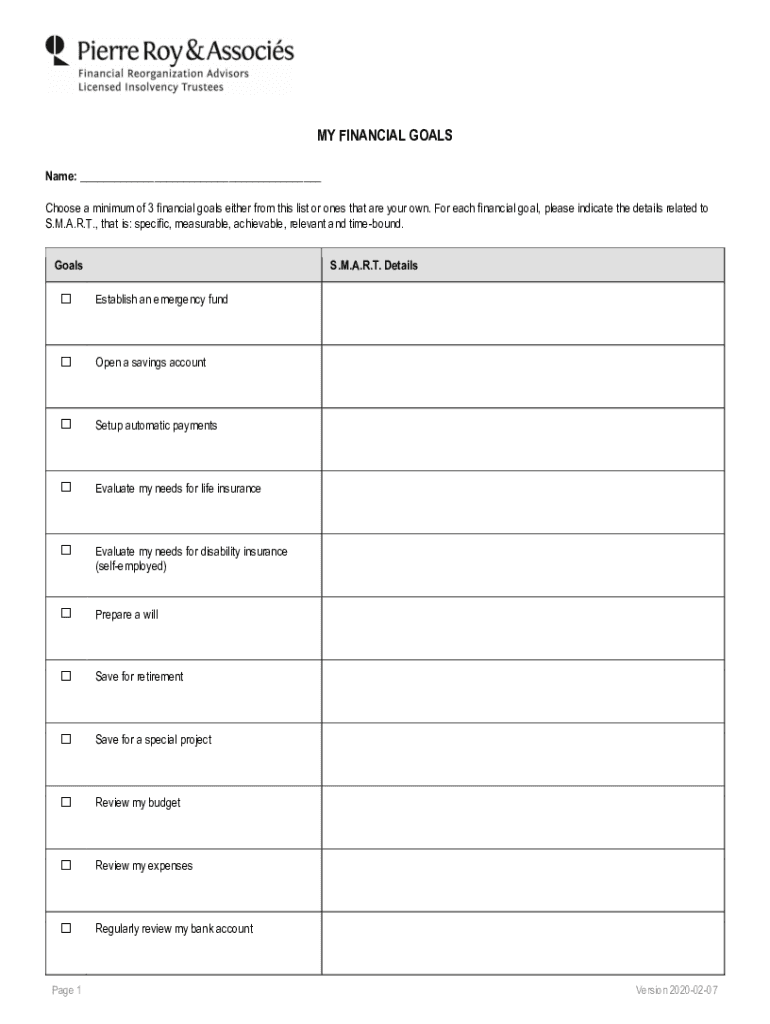

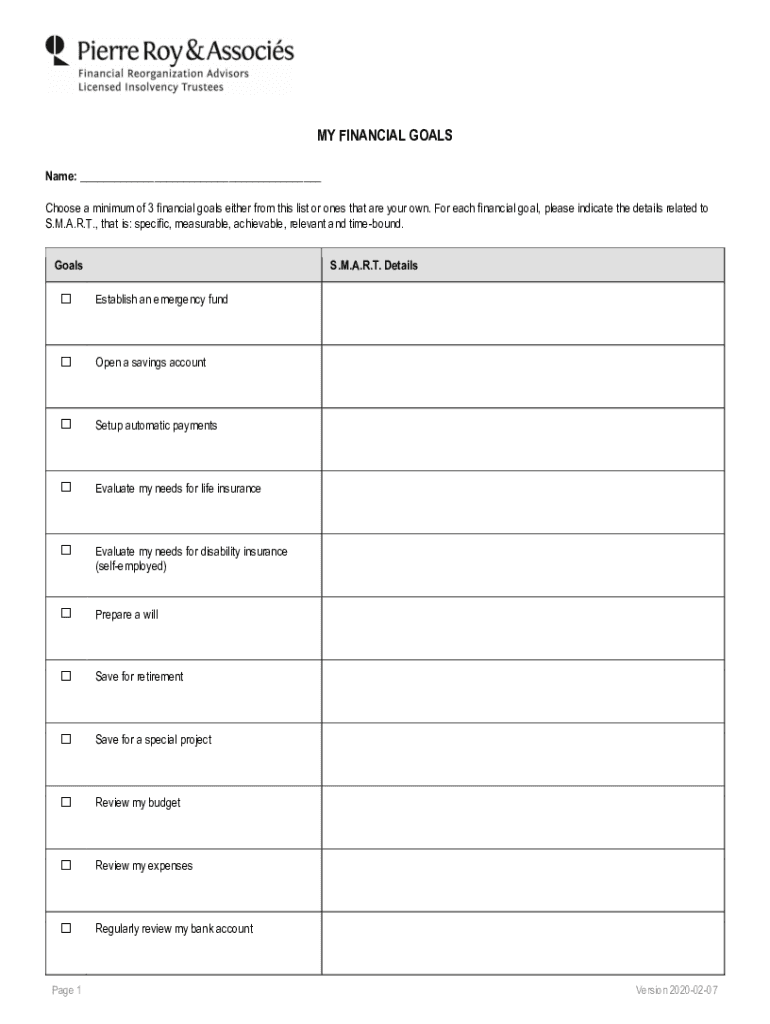

MY FINANCIAL GOALS Name: ___ Choose a minimum of 3 financial goals either from this list or ones that are your own. For each financial goal, please indicate the details related to S.M.A.R.T., that

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial goals examples7 personal

Edit your financial goals examples7 personal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial goals examples7 personal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial goals examples7 personal online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial goals examples7 personal. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial goals examples7 personal

How to fill out financial goals examples7 personal

01

Start by assessing your current financial situation. Take a look at your income, expenses, debts, and savings. This will help you understand where you stand financially.

02

Define your short-term and long-term financial goals. Short-term goals are things you want to achieve within the next one to three years, while long-term goals are those you want to achieve further down the line.

03

Make your financial goals specific and measurable. Instead of saying 'I want to save money,' specify an amount or a percentage of your income that you want to save.

04

Prioritize your financial goals. Determine which goals are most important to you and focus on those first.

05

Break down your goals into smaller, actionable steps. This will make them more achievable and easier to track your progress.

06

Create a budget that aligns with your financial goals. This will help you manage your income and expenses effectively and ensure you're on track to meet your goals.

07

Review and adjust your financial goals periodically. As your circumstances change, you may need to modify or update your goals to stay on track.

Who needs financial goals examples7 personal?

01

Anyone who wants to take control of their financial future.

02

Individuals who want to save money for a specific purpose, such as buying a house, starting a business, or funding their children's education.

03

People who want to achieve financial independence and retire comfortably.

04

Those who have struggled with managing their finances in the past and want to improve their financial situation.

05

Young adults who want to lay a strong foundation for their financial well-being.

06

Couples who are planning their financial future together and want to align their goals.

07

Entrepreneurs who want to set financial milestones for their business and track their progress.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit financial goals examples7 personal from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your financial goals examples7 personal into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send financial goals examples7 personal for eSignature?

When your financial goals examples7 personal is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit financial goals examples7 personal online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your financial goals examples7 personal to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

What is financial goals examples7 personal?

Examples of financial goals include saving for retirement, paying off debt, building an emergency fund, saving for a home, investing in education, planning for a child's education, and saving for a vacation.

Who is required to file financial goals examples7 personal?

Individuals who are looking to manage their personal finances effectively or seeking financial advice may need to document their financial goals for clarity and planning. This includes anyone planning for major life changes or investments.

How to fill out financial goals examples7 personal?

To fill out personal financial goals, individuals should start by identifying their short-term and long-term goals, specifying amounts needed, setting deadlines, and regularly reviewing and adjusting their plans as necessary.

What is the purpose of financial goals examples7 personal?

The purpose of setting personal financial goals is to provide direction for managing finances, prioritize spending and saving, measure progress, and achieve financial stability and security.

What information must be reported on financial goals examples7 personal?

Information to report on personal financial goals should include the types of goals (short-term vs. long-term), estimated costs for each goal, target completion dates, action steps required, and current financial status.

Fill out your financial goals examples7 personal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Goals examples7 Personal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.