Get the free ASO or Payroll Only - New Employee Hire Form - Galactic, Inc.

Show details

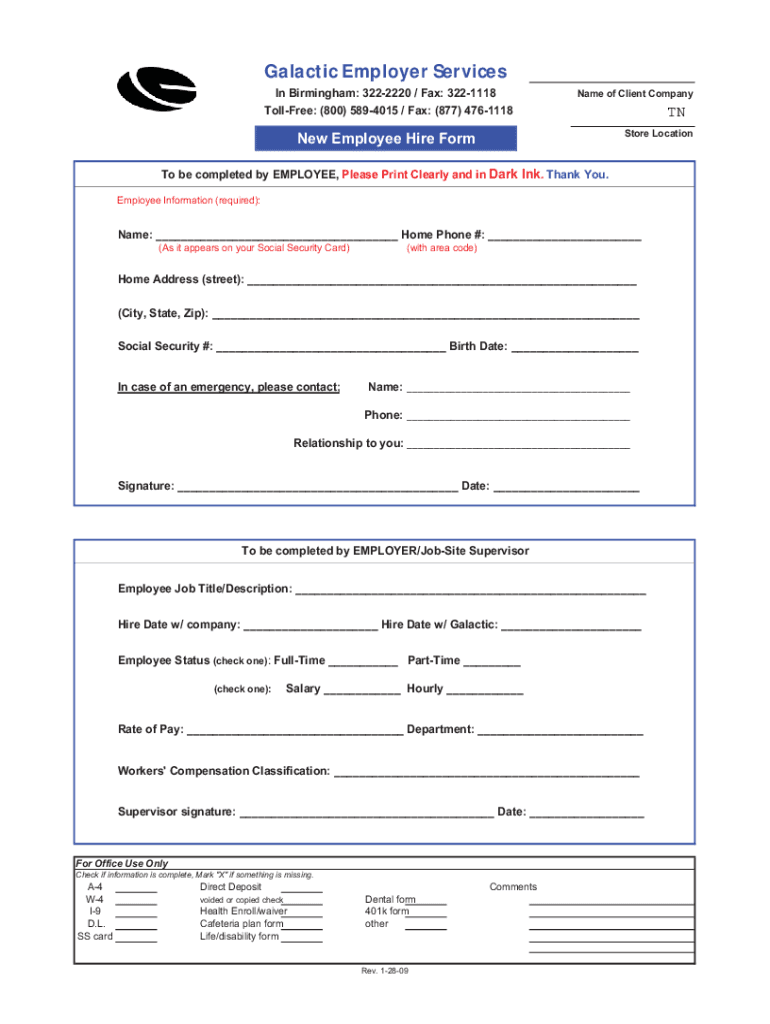

Galactic Employer Services In Birmingham: 3222220 / Fax: 3221118 Toll-free: (800) 5894015 / Fax: (877) 4761118Name of Client Company TN Store Location Employee Hire Form To be completed by EMPLOYEE,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aso or payroll only

Edit your aso or payroll only form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aso or payroll only form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aso or payroll only online

Follow the steps down below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit aso or payroll only. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aso or payroll only

How to fill out aso or payroll only

01

To fill out ASO (Administrative Services Only), follow these steps:

02

Gather all necessary employee information such as names, addresses, contact details, Social Security numbers, and employment dates.

03

Determine the specific ASO services required, such as payroll management, benefits administration, or HR support.

04

Choose an ASO provider that offers the desired services and fits your budget and requirements.

05

Contact the ASO provider and provide them with the employee information and service requirements.

06

Work closely with the ASO provider to ensure proper setup and integration of their services with your existing systems.

07

Train your HR staff or designated personnel on how to use the ASO services effectively.

08

Regularly review and monitor the ASO provider's performance and address any concerns or issues that arise.

09

To fill out payroll only, follow these steps:

10

Collect all essential employee details including names, addresses, tax information, and salary or hourly rates.

11

Choose a reliable payroll software or service provider that suits your business size and requirements.

12

Set up the payroll system by entering the employee information, tax settings, and payment frequency.

13

Calculate employee wages or salaries based on their working hours, overtime, bonuses, and deductions.

14

Generate payroll reports and ensure accuracy before processing the payments.

15

Process the payroll by either using the software's direct deposit feature or issuing manual checks.

16

Keep records of the payroll transactions and comply with tax and labor regulations.

Who needs aso or payroll only?

01

ASO or payroll services are beneficial for:

02

- Small businesses that don't have dedicated HR departments or payroll managers.

03

- Companies that want to outsource administrative tasks and focus on core business functions.

04

- Businesses experiencing growth and needing scalable HR and payroll solutions.

05

- Organizations that want to ensure compliance with labor laws and tax regulations.

06

- Employers wanting to offer comprehensive benefits packages to their employees while minimizing administrative burdens.

07

- Startups and entrepreneurs who want to streamline HR and payroll processes from the beginning.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the aso or payroll only in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your aso or payroll only in minutes.

Can I create an electronic signature for signing my aso or payroll only in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your aso or payroll only and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How can I edit aso or payroll only on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit aso or payroll only.

What is aso or payroll only?

ASO (Administrative Services Only) or payroll only refers to a service arrangement where a company outsources its payroll processing and related administrative tasks to a third-party service provider without transferring other HR responsibilities.

Who is required to file aso or payroll only?

Typically, companies that choose to outsource their payroll processes to a third-party provider are required to file ASO or payroll only. This includes businesses of all sizes that want to streamline payroll management and compliance.

How to fill out aso or payroll only?

To fill out ASO or payroll only, a company must gather employee information, including names, social security numbers, wages, and hours worked. This data is then submitted to the payroll service provider, who processes the payroll and generates necessary forms.

What is the purpose of aso or payroll only?

The purpose of ASO or payroll only is to allow businesses to efficiently manage payroll functions, reduce administrative burdens, ensure compliance with tax regulations, and gain access to expert payroll services without fully outsourcing their HR functions.

What information must be reported on aso or payroll only?

Information that must be reported on ASO or payroll only includes employee wages, hours worked, tax withholdings, benefits contributions, and any other deductions. Additionally, necessary tax forms and filings must be completed accurately.

Fill out your aso or payroll only online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aso Or Payroll Only is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.