Get the free Monument Advisor Individual Variable Annuity Prospectus

Show details

This document provides detailed information about the Monument Advisor Variable Annuity Contract offered by Jefferson National Life Insurance Company, including investment options, fees, taxation,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign monument advisor individual variable

Edit your monument advisor individual variable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your monument advisor individual variable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing monument advisor individual variable online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit monument advisor individual variable. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out monument advisor individual variable

How to fill out Monument Advisor Individual Variable Annuity Prospectus

01

Obtain the Monument Advisor Individual Variable Annuity Prospectus from a licensed financial advisor or the company's website.

02

Carefully read the introductory section to understand the product's purpose and benefits.

03

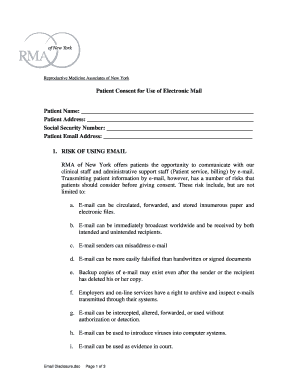

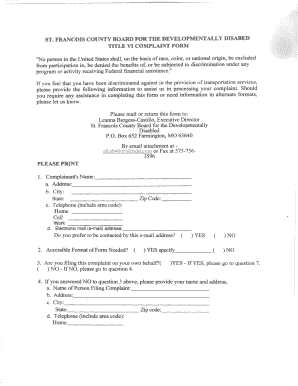

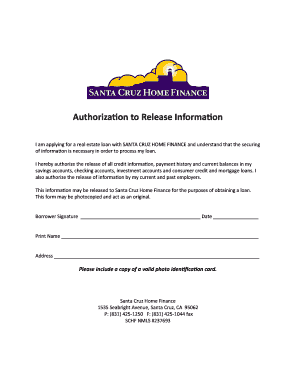

Fill out your personal information in the designated sections, including name, address, and social security number.

04

Provide details about your financial situation, including income, investments, and savings.

05

Indicate your risk tolerance and investment goals in the relevant fields.

06

Review the various investment options available in the prospectus and select those that align with your objectives.

07

Make sure to sign and date the document where indicated, verifying that the information provided is accurate.

08

Submit the completed prospectus to your financial advisor or the designated company representative.

Who needs Monument Advisor Individual Variable Annuity Prospectus?

01

Individuals seeking a tax-deferred investment option for retirement savings.

02

Clients looking for a combination of insurance and investment features.

03

People who want to invest for long-term financial goals with flexible withdrawal options.

04

Those who require lifetime income guarantees and protection against market volatility.

Fill

form

: Try Risk Free

People Also Ask about

What is the average fee for a variable annuity?

New rule 498A under the Securities Act of 1933 will permit a person to satisfy its prospectus delivery obligations under the Securities Act for a variable annuity or variable life insurance contract by sending or giving a summary prospectus to investors and making the statutory prospectus available online.

How much does a $100 000 annuity pay per month?

Variable annuities are the odd man out when it comes to market crashes, however. You can lose money in subaccounts when markets don't perform well. But you also have the most growth potential with a variable annuity because of that market exposure.

What is the problem with variable annuities?

The benefits of a variable annuity include tax-deferred growth, guaranteed income in retirement, and a death benefit for beneficiaries. The downsides are complexity, layered fees, and withdrawal penalties.

What is the greatest risk in a variable annuity?

ing to Schwab's Income Annuity Estimator, a $100,000 immediate annuity in March 2025 could provide monthly payments ranging from around $542 to $1,031, depending on the annuitant's age, gender, and the payout option chosen.

Do variable annuities need a prospectus?

Variable annuities are offered and sold by prospectus only.

What are the downsides of a variable annuity?

The benefits of a variable annuity include tax-deferred growth, guaranteed income in retirement, and a death benefit for beneficiaries. The downsides are complexity, layered fees, and withdrawal penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Monument Advisor Individual Variable Annuity Prospectus?

The Monument Advisor Individual Variable Annuity Prospectus is a legal document that provides detailed information about the Monument Advisor Variable Annuity, including investment options, fees, and terms. It is designed to assist investors in making informed decisions.

Who is required to file Monument Advisor Individual Variable Annuity Prospectus?

The issuer of the Monument Advisor Individual Variable Annuity, typically an insurance company or financial institution, is required to file the prospectus with regulatory authorities, such as the SEC (Securities and Exchange Commission), to ensure compliance with securities laws.

How to fill out Monument Advisor Individual Variable Annuity Prospectus?

Filling out the Monument Advisor Individual Variable Annuity Prospectus involves providing personal and financial information, selecting investment options, and signing the document. It's advisable to review all sections thoroughly and consult a financial advisor if needed.

What is the purpose of Monument Advisor Individual Variable Annuity Prospectus?

The purpose of the Monument Advisor Individual Variable Annuity Prospectus is to provide potential investors with essential information about the product, enabling them to understand the risks, benefits, and choices associated with the annuity before making an investment decision.

What information must be reported on Monument Advisor Individual Variable Annuity Prospectus?

The prospectus must report information such as the investment objectives, fees and expenses, the performance history of the investment options, risks associated with the investment, and details about the contract provisions.

Fill out your monument advisor individual variable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Monument Advisor Individual Variable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.