Get the free Property Tax Drop Box at Kane County Government Center

Show details

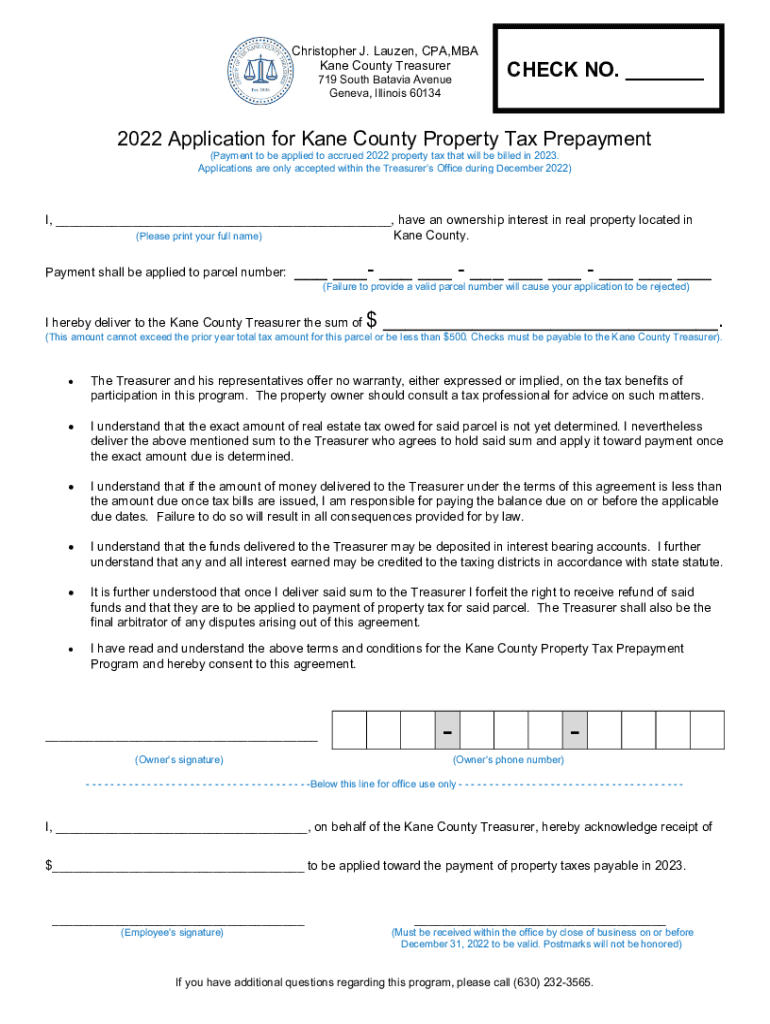

Christopher J. Lauren, CPA, MBA Kane County Treasurer 719 South Batavia Avenue Geneva, Illinois 60134CHECK NO. ___2022 Application for Kane County Property Tax Prepayment (Payment to be applied to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax drop box

Edit your property tax drop box form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax drop box form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property tax drop box online

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit property tax drop box. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax drop box

How to fill out property tax drop box

01

Step 1: Gather all necessary documents such as property tax statements and payment information.

02

Step 2: Locate your nearest property tax drop box location.

03

Step 3: Ensure the drop box is accessible during the required business hours.

04

Step 4: Fill out the property tax payment and information form completely and accurately.

05

Step 5: Double-check all the details filled in the form for any errors or omissions.

06

Step 6: Place the completed form along with the necessary payment inside an envelope.

07

Step 7: Seal the envelope securely.

08

Step 8: Clearly write your property tax account number and contact information on the envelope.

09

Step 9: Ensure the payment is in the acceptable form (check, money order, etc.) as specified by the tax authorities.

10

Step 10: Carefully insert the sealed envelope into the property tax drop box.

11

Step 11: Make sure the drop box is locked securely after depositing the envelope.

12

Step 12: Keep a copy of the filled form and payment receipt for your records.

13

Step 13: Check your property tax account online or via mail to confirm successful payment.

Who needs property tax drop box?

01

Property owners who are required to pay property taxes to the local government.

02

Individuals who prefer the convenience of using a drop box for property tax payment.

03

People who want to avoid mailing their property tax payment and the associated risks.

04

Taxpayers who want to ensure timely payment of their property taxes without visiting the tax office.

05

Residents with mobility issues or limited availability during the regular business hours of the tax office.

06

Property owners who don't feel comfortable or proficient in using online payment systems.

07

Taxpayers who prefer the security and reliability of a physical drop box for payment submission.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the property tax drop box in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your property tax drop box.

How do I fill out the property tax drop box form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign property tax drop box and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out property tax drop box on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your property tax drop box, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is property tax drop box?

A property tax drop box is a secure location provided by local tax authorities for residents to submit their property tax payments or related documents without the need for mailing or in-person visits.

Who is required to file property tax drop box?

Property owners and taxpayers who owe property taxes or are submitting related documents are required to use the property tax drop box.

How to fill out property tax drop box?

To fill out a property tax drop box, complete any required forms or documentation thoroughly and submit them along with the payment, if applicable, in the drop box.

What is the purpose of property tax drop box?

The purpose of the property tax drop box is to provide a convenient, secure, and accessible way for taxpayers to submit their property tax payments or documents, ensuring timely processing.

What information must be reported on property tax drop box?

Information that must be reported includes the taxpayer's name, property address, account number, the amount being paid, and any other relevant details as specified by the local tax authority.

Fill out your property tax drop box online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Drop Box is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.