Get the free Personal Guarantee Deed

Show details

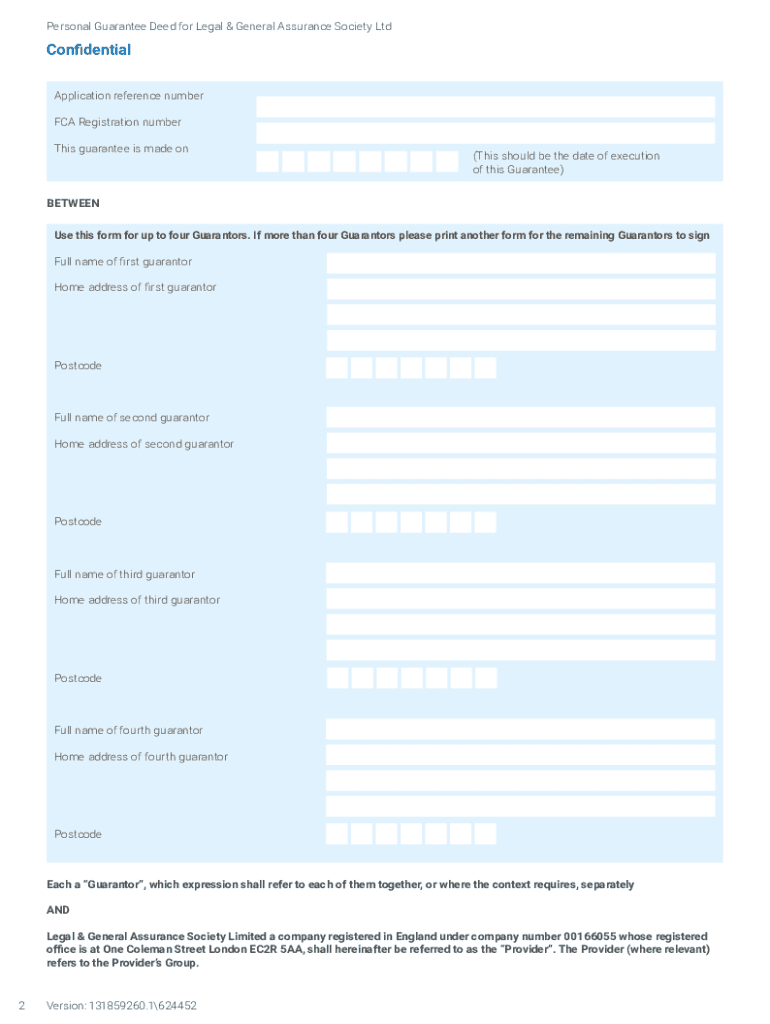

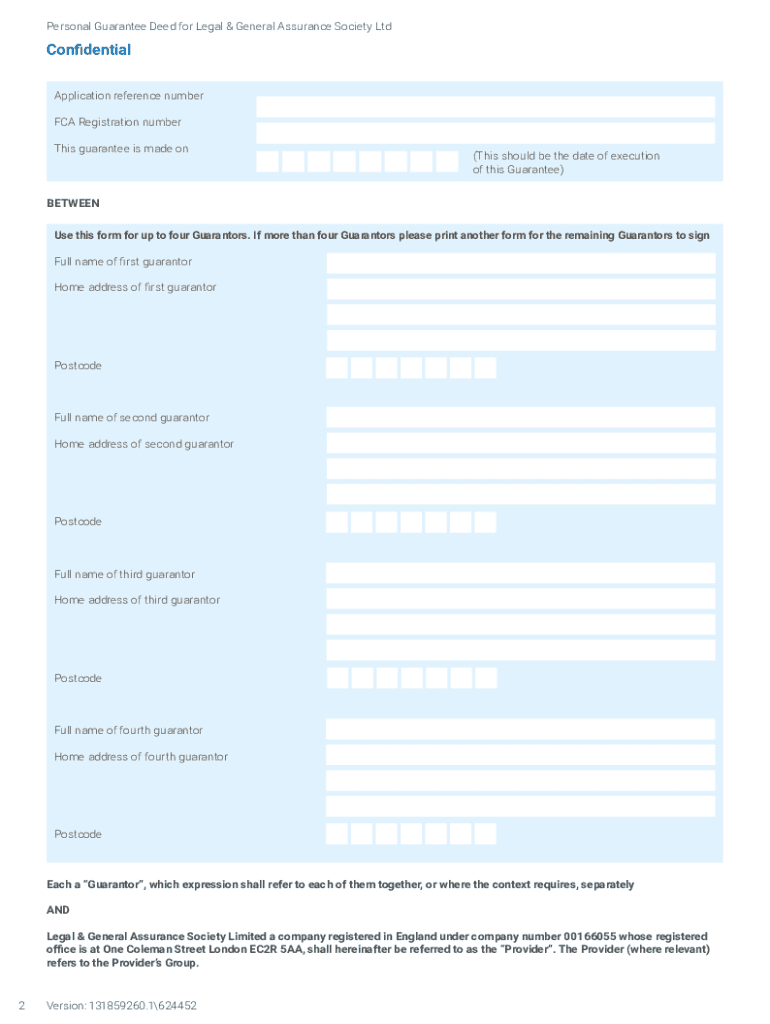

ConfidentialPersonal Guarantee Deed for Legal & General Assurance Society Ltd This is an important document. Before you sign it, you should: Read it carefully. GET ADVICE FROM A SOLICITOR. Ensure

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal guarantee deed

Edit your personal guarantee deed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal guarantee deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal guarantee deed online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal guarantee deed. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal guarantee deed

How to fill out personal guarantee deed

01

Step 1: Start by obtaining a personal guarantee deed form. You can find these forms at your local county courthouse or online.

02

Step 2: Read the instructions carefully to understand the requirements and elements of the personal guarantee deed.

03

Step 3: Gather all the necessary information about the parties involved, including their full names, addresses, and contact information.

04

Step 4: Fill in the personal guarantee deed form with accurate and complete information. Follow the prompts and provide all required details.

05

Step 5: Review the completed form for any errors or missing information. Make sure everything is filled out correctly.

06

Step 6: Sign and date the personal guarantee deed. Typically, all parties involved in the agreement must sign the document.

07

Step 7: Make copies of the signed personal guarantee deed for all parties involved. Retain the original deed for your records.

08

Step 8: Consider consulting with a legal professional to ensure the document is legally binding and enforceable in your jurisdiction.

09

Step 9: Deliver the copies of the personal guarantee deed to the relevant parties. Ensure that everyone receives a copy of the signed document.

10

Step 10: Keep a record of the delivery of the personal guarantee deed for future reference.

Who needs personal guarantee deed?

01

Business owners who want to secure a loan or credit line for their business may need a personal guarantee deed. Lenders often require a personal guarantee to ensure repayment in case the business defaults on the loan.

02

Landlords who want to protect their rental income may require tenants to sign a personal guarantee deed. This helps ensure that if the tenant fails to pay rent or damages the property, the landlord can seek compensation from the guarantor's personal assets.

03

Investors or lenders who want additional security for their investment or loan may request a personal guarantee deed. This provides them with a legal recourse to recover their investment in case of default or financial loss.

04

Creditors who want to secure their loans may require borrowers to provide a personal guarantee deed. This helps ensure that if the borrower defaults on the loan, the creditor can seek repayment from the guarantor's personal assets.

05

Individuals who co-sign a loan or financial agreement on behalf of another person may be asked to sign a personal guarantee deed. This makes them personally liable for the repayment of the debt if the primary borrower fails to fulfill their obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get personal guarantee deed?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific personal guarantee deed and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out personal guarantee deed using my mobile device?

Use the pdfFiller mobile app to complete and sign personal guarantee deed on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit personal guarantee deed on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign personal guarantee deed right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is personal guarantee deed?

A personal guarantee deed is a legal document wherein an individual agrees to be personally responsible for the debts or obligations of another party, typically a business. This means that if the business fails to meet its financial obligations, the individual's personal assets may be used to settle those debts.

Who is required to file personal guarantee deed?

Individuals who are providing a personal guarantee for a loan or obligation of a business are typically required to file a personal guarantee deed. This often includes business owners, partners, or anyone who has a financial stake in the business.

How to fill out personal guarantee deed?

To fill out a personal guarantee deed, one should start by identifying the parties involved, including the creditor and the guarantor. Next, specify the obligations being guaranteed and include relevant details such as the amount of debt, terms, and conditions. Finally, both parties should sign the document, and it may need to be notarized or filed with the appropriate authorities.

What is the purpose of personal guarantee deed?

The purpose of a personal guarantee deed is to provide assurance to lenders or creditors that the guarantor is legally responsible for the repayment of a loan or fulfillment of an obligation in case the primary party defaults. It serves as a risk mitigation tool for creditors.

What information must be reported on personal guarantee deed?

A personal guarantee deed must include the names and contact information of the guarantor and the lender, the specific obligation being guaranteed, the amount of the debt, the terms and conditions of the guarantee, and the signatures of all parties involved. Additional information may include dates and notary acknowledgment if required.

Fill out your personal guarantee deed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Guarantee Deed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.