Get the free What is ACH Fraud and How to Prevent It

Show details

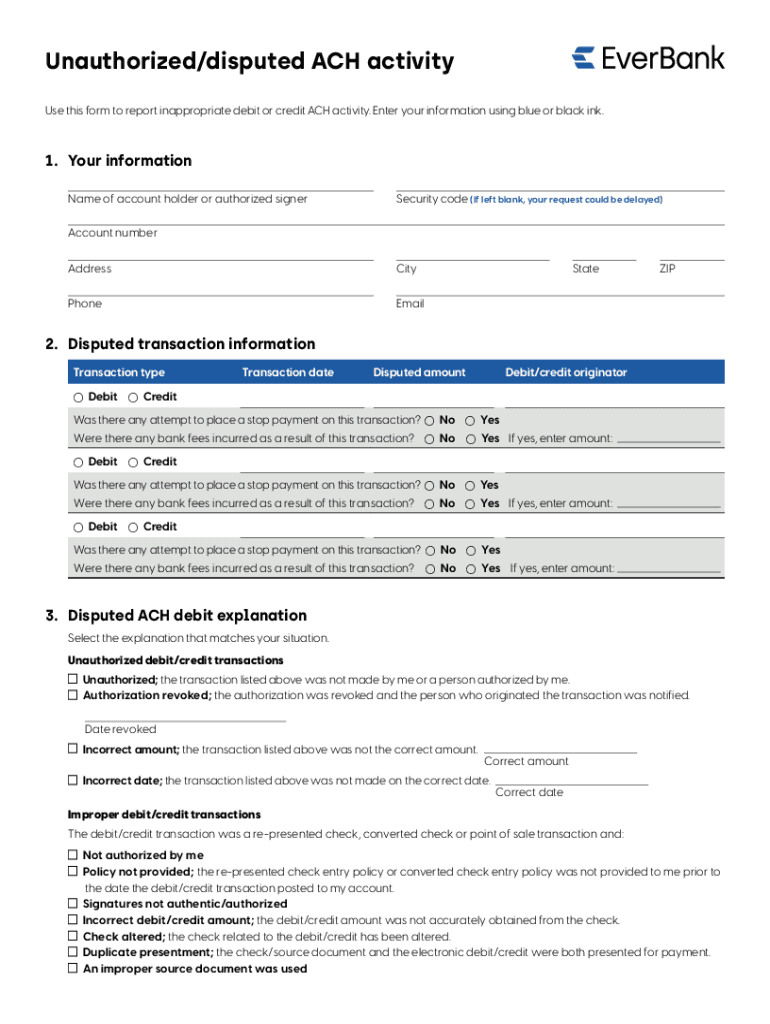

Unauthorized/disputed ACH activity

Use this form to report inappropriate debit or credit ACH activity. Enter your information using blue or black ink.1. Your informational of account holder or authorized

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign what is ach fraud

Edit your what is ach fraud form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your what is ach fraud form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit what is ach fraud online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit what is ach fraud. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what is ach fraud

How to fill out what is ach fraud

01

To fill out what is ach fraud, follow these steps:

02

Start by researching and gathering information about ACH fraud and its different types and methods.

03

Understand the risks associated with ACH fraud and how it can impact individuals, businesses, and financial institutions.

04

Learn about the preventive measures and best practices recommended to detect and prevent ACH fraud.

05

Familiarize yourself with ACH fraud detection tools and techniques, such as monitoring transactions and implementing secure authentication methods.

06

Educate yourself on the legal and regulatory aspects related to ACH fraud and the responsibilities of different stakeholders.

07

Stay updated with the latest trends and advancements in ACH fraud prevention, as fraud techniques evolve over time.

08

Implement appropriate security measures, such as strong passwords, encryption, and regular risk assessments, to mitigate the risk of ACH fraud.

09

Train your employees or team members on ACH fraud awareness and prevention to create a culture of security.

10

Regularly monitor your financial transactions and account statements for any signs of suspicious activity.

11

In case you suspect or encounter ACH fraud, promptly report it to the concerned financial institution and follow their recommended procedures.

Who needs what is ach fraud?

01

Various individuals and entities may need to understand what ACH fraud is, including:

02

Individuals who use electronic banking services or make online payments through automated clearing house (ACH) transactions.

03

Businesses and corporations that rely on ACH payments for payroll, vendor payments, or collecting customer payments.

04

Financial institutions, such as banks and credit unions, that facilitate ACH transactions and aim to protect their customers from fraud.

05

Cybersecurity professionals and fraud investigators who deal with incidents related to ACH fraud and work towards its prevention and detection.

06

Government agencies and regulatory bodies who oversee financial transactions and enforce laws and regulations related to ACH fraud.

07

Education and awareness programs that aim to educate the general public about the risks and prevention of ACH fraud.

08

Technology companies and developers who create software or systems related to ACH transactions and need to ensure security and fraud prevention measures are in place.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send what is ach fraud for eSignature?

When you're ready to share your what is ach fraud, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out what is ach fraud using my mobile device?

Use the pdfFiller mobile app to complete and sign what is ach fraud on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit what is ach fraud on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share what is ach fraud on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is ACH fraud?

ACH fraud refers to unauthorized transactions or fraudulent activities involving Automated Clearing House (ACH) transfers, where electronic payments are made directly from one bank account to another without the need for paper checks.

Who is required to file ACH fraud?

Individuals and businesses that have experienced unauthorized ACH transactions are required to file a report of ACH fraud with their bank and may also need to notify law enforcement.

How to fill out a report of ACH fraud?

To fill out a report of ACH fraud, gather relevant account information, transaction details, and evidence of the unauthorized activity, then complete the report provided by your financial institution or law enforcement agency.

What is the purpose of reporting ACH fraud?

The purpose of reporting ACH fraud is to help recover lost funds, prevent further unauthorized transactions, and assist in the investigation and prosecution of fraudulent activities.

What information must be reported on ACH fraud?

The information that must be reported on ACH fraud includes the account numbers involved, details of the fraudulent transactions, dates, amounts, any communications with the perpetrators, and identification of the affected parties.

Fill out your what is ach fraud online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is Ach Fraud is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.