Get the free IRA QUALIFIED CHARITABLE DISTRIBUTION (QCD) FORM IRA ...

Show details

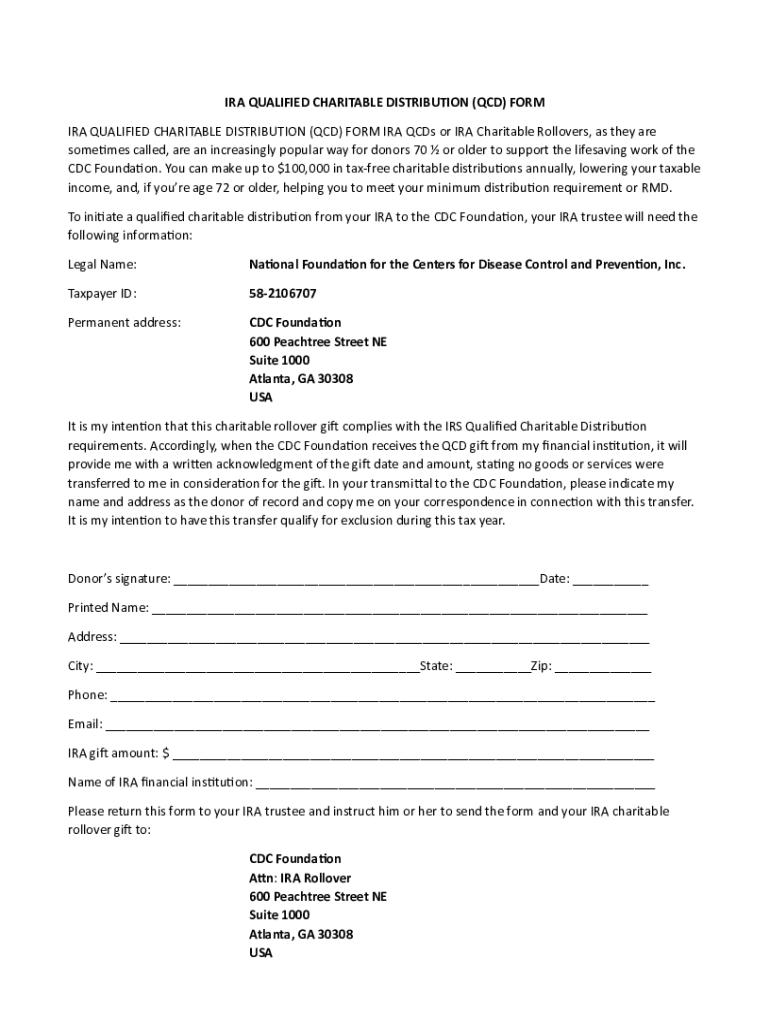

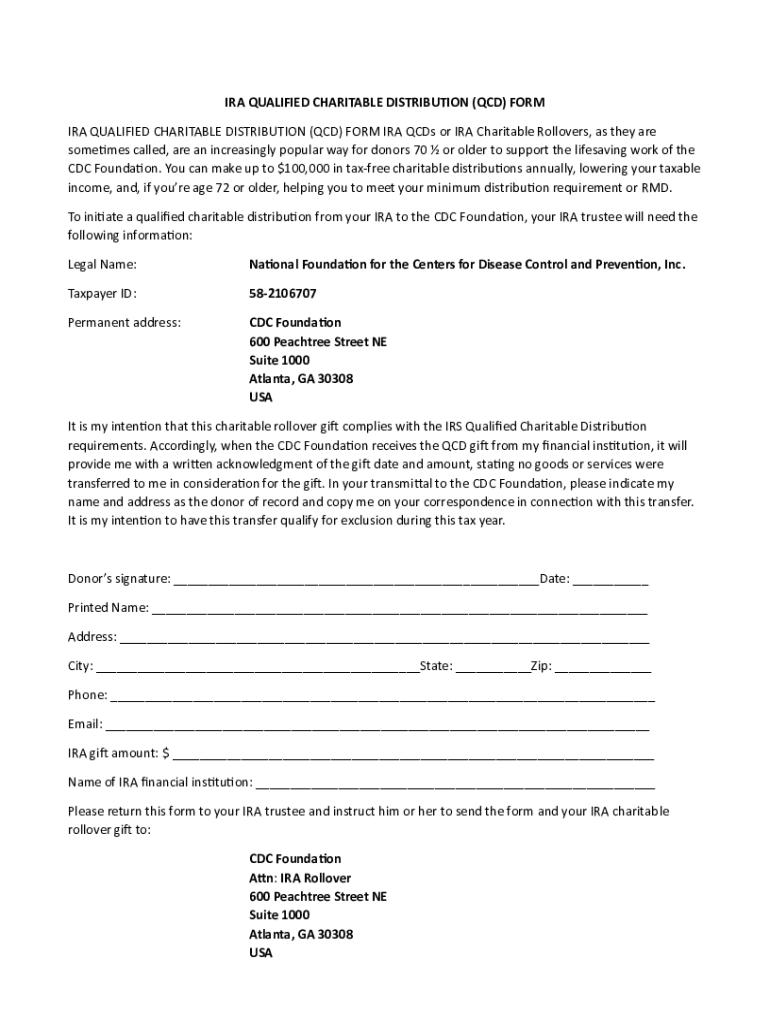

IRA QUALIFIED CHARITABLE DISTRIBUTION (CD) FORM IRA QUALIFIED CHARITABLE DISTRIBUTION (CD) FORM IRA CDs or IRA Charitable Rollovers, as they are sometimes called, are an increasingly popular way for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira qualified charitable distribution

Edit your ira qualified charitable distribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira qualified charitable distribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira qualified charitable distribution online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ira qualified charitable distribution. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira qualified charitable distribution

How to fill out ira qualified charitable distribution

01

Ensure you are eligible for an IRA qualified charitable distribution by being at least 70.5 years old.

02

Determine the amount you want to distribute to a qualified charitable organization.

03

Contact your IRA custodian or trustee and request the necessary forms and instructions for making a qualified charitable distribution.

04

Fill out the required forms, providing your personal information, including your name, IRA account details, and the amount you wish to distribute.

05

Specify the qualified charitable organization that will receive the distribution and provide their contact information.

06

Submit the completed forms to your IRA custodian or trustee, following their specific instructions.

07

Verify that the distribution has been made to the designated charitable organization and keep a record of the transaction for tax purposes.

08

Report the qualified charitable distribution on your annual tax return, using the appropriate IRS forms and guidelines.

Who needs ira qualified charitable distribution?

01

Individuals who have reached the age of 70.5 and have an Individual Retirement Account (IRA) may consider utilizing a qualified charitable distribution.

02

Those who have charitable intentions and want to donate a portion of their IRA funds directly to qualified charitable organizations.

03

Individuals who are looking for potential tax advantages and prefer to make charitable contributions through their retirement accounts.

04

People who want to fulfill their required minimum distributions (RMDs) from their IRA while contributing to causes they care about.

05

Retirees who have sufficient retirement savings in their IRA and want to support charitable causes during their lifetime.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete ira qualified charitable distribution online?

pdfFiller has made it simple to fill out and eSign ira qualified charitable distribution. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in ira qualified charitable distribution?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your ira qualified charitable distribution to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit ira qualified charitable distribution on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share ira qualified charitable distribution from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is ira qualified charitable distribution?

An IRA Qualified Charitable Distribution (QCD) is a provision that allows individuals aged 70½ or older to transfer up to $100,000 directly from their individual retirement account (IRA) to a qualified charity without recognizing the distribution as taxable income.

Who is required to file ira qualified charitable distribution?

Individuals aged 70½ or older who wish to make charitable contributions directly from their IRA can utilize the qualified charitable distribution option. However, they are not required to file anything specifically for QCDs if the donation is made correctly and within IRS guidelines.

How to fill out ira qualified charitable distribution?

To fill out an IRA Qualified Charitable Distribution, individuals must instruct their IRA custodian to transfer an amount to a qualified charity. It is advisable to complete any necessary forms provided by the IRA custodian and ensure the charity is eligible under IRS rules.

What is the purpose of ira qualified charitable distribution?

The purpose of an IRA Qualified Charitable Distribution is to allow older adults to support charitable organizations while minimizing their taxable income. QCDs also count towards required minimum distributions (RMDs), helping retirees manage their mandatory withdrawals.

What information must be reported on ira qualified charitable distribution?

When reporting an IRA Qualified Charitable Distribution, individuals must include the amount distributed to the charity on their tax return. They should retain documentation from both the charity and the IRA custodian confirming the transfer and ensure that it meets IRS criteria for QCDs.

Fill out your ira qualified charitable distribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Qualified Charitable Distribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.