Fidelity 529 College Savings Plan Distribution Request Form 2023-2025 free printable template

Show details

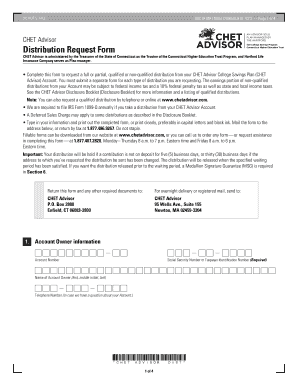

PrintReset529 College Savings PlanDistribution Request

Use this form to:

Request qualified or nonqualified distributions.

Make a rollover distribution to another 529 Plan by selling units in your

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Fidelity 529 College Savings Plan Distribution

Edit your Fidelity 529 College Savings Plan Distribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Fidelity 529 College Savings Plan Distribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Fidelity 529 College Savings Plan Distribution online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Fidelity 529 College Savings Plan Distribution. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fidelity 529 College Savings Plan Distribution Request Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Fidelity 529 College Savings Plan Distribution

How to fill out Fidelity 529 College Savings Plan Distribution Request

01

Start by logging into your Fidelity account.

02

Navigate to the 529 College Savings Plan section.

03

Look for the option to request a distribution.

04

Fill out the requested information, including the account number and amount to be withdrawn.

05

Specify the purpose of the distribution (e.g., tuition, fees, etc.).

06

Provide the recipient's information if the funds are being sent directly to a school.

07

Review the entire form for accuracy.

08

Submit the distribution request form as per the provided instructions.

Who needs Fidelity 529 College Savings Plan Distribution Request?

01

Parents or guardians of a beneficiary who intend to pay for qualified education expenses using their 529 plan funds.

02

Account owners who need to access the accumulated savings for educational purposes.

03

Students who require financial assistance for their college expenses.

Fill

form

: Try Risk Free

People Also Ask about

How do I withdraw money from my MN 529?

How to Do It Online Login to your account online. Select type of “withdrawal”: Select where the funds will be sent: For funds sent to the Owner or Beneficiary, select “Partial” or “Total” account balance withdrawal. If you have more than one investment option select “Prorated amount” or “By specific portfolio”

What form do I need for 529 withdrawal?

If you're paying for school expenses from a 529 plan or a Coverdell ESA, you will likely receive an IRS Form 1099-Q, which reports the total withdrawals you made during the year.

How do I withdraw money from my 529 tax free?

The 529 plan explicitly states that earnings can be withdrawn from the account tax-free “when used for qualified education expenses of the designated beneficiary, such as tuition, fees, books, as well as room and board at an eligible education institution,” ing to the IRS.

What form do I get from IRS for 529 withdrawal?

What is IRS Form 1099-Q? IRS Form 1099-Q is a statement issued by a 529 plan or Coverdell ESA administrator that lists the amount of distributions in a given tax year. The Form 1099-Q will be issued to the beneficiary if the 529 distribution was paid to: The 529 plan beneficiary.

How do I withdraw money from my 529 plan?

You can call your plan administrator, make a request online, or submit a withdrawal request form. The plan can send withdrawals by check to the account owner, the beneficiary, or the school. You can transfer the money to yourself or the beneficiary electronically and then make payment to the school.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in Fidelity 529 College Savings Plan Distribution without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing Fidelity 529 College Savings Plan Distribution and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the Fidelity 529 College Savings Plan Distribution electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your Fidelity 529 College Savings Plan Distribution in minutes.

How do I edit Fidelity 529 College Savings Plan Distribution on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute Fidelity 529 College Savings Plan Distribution from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is Fidelity 529 College Savings Plan Distribution Request?

The Fidelity 529 College Savings Plan Distribution Request is a formal application used by account holders to request withdrawals from their 529 college savings accounts for qualified education expenses.

Who is required to file Fidelity 529 College Savings Plan Distribution Request?

The account owner or legal guardian of the beneficiary of the 529 plan is required to file the Fidelity 529 College Savings Plan Distribution Request to access funds.

How to fill out Fidelity 529 College Savings Plan Distribution Request?

To fill out the request, you need to provide your account information, specify the amount to be withdrawn, detail the purpose of the distribution, and sign the form to verify the request.

What is the purpose of Fidelity 529 College Savings Plan Distribution Request?

The purpose of the request is to allow account holders to access funds from their 529 college savings accounts for paying tuition fees, room and board, and other qualified educational expenses.

What information must be reported on Fidelity 529 College Savings Plan Distribution Request?

The request must report the account owner's information, beneficiary's information, amount requested, intended use of funds, and a signature to confirm the request.

Fill out your Fidelity 529 College Savings Plan Distribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity 529 College Savings Plan Distribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.