Get the free Your Spending Your Savings Your future

Show details

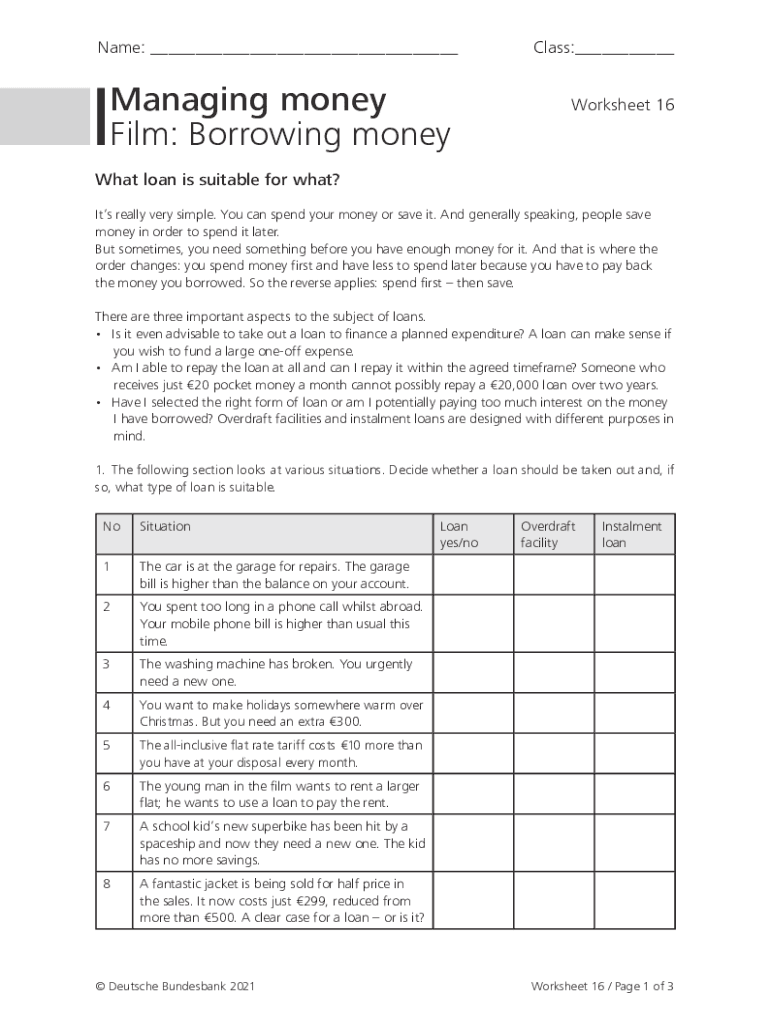

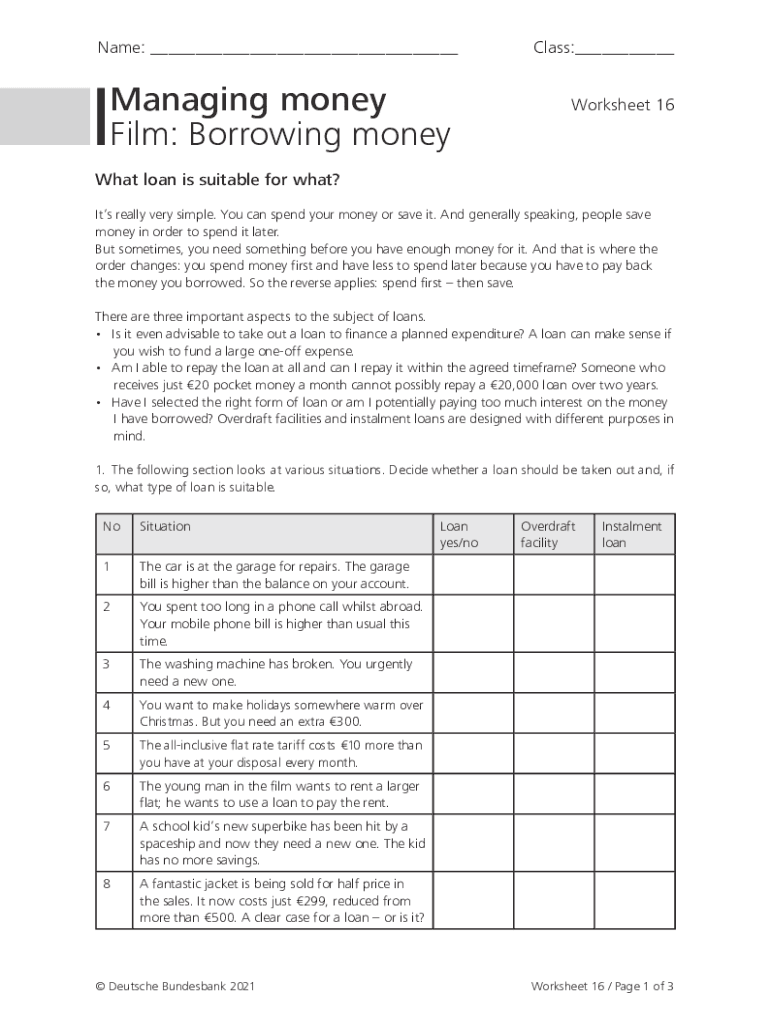

Name: ___Managing money Film: Borrowing manacles:___ Worksheet 16What loan is suitable for what? Its really very simple. You can spend your money or save it. And generally speaking, people save money

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your spending your savings

Edit your your spending your savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your spending your savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit your spending your savings online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit your spending your savings. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your spending your savings

How to fill out your spending your savings

01

To fill out your spending your savings, you can follow these steps:

02

Determine your financial goals: Start by identifying why you want to spend your savings. Whether it's for a specific purchase, debt repayment, or emergency fund, having a clear goal will help you allocate and prioritize your savings.

03

Evaluate your current expenses: Take a look at your current spending habits and identify any areas where you can reduce costs. This will free up more money to put towards your savings.

04

Create a budget: Develop a budget that outlines your income and all the necessary expenses. This will help you track and control your spending, allowing you to allocate a portion to your savings.

05

Set up automatic transfers: Once you have determined how much you can afford to save each month, set up automatic transfers from your main account to a separate savings account. Automating this process will ensure consistent savings without relying on willpower alone.

06

Track your progress: Regularly monitor your savings progress to stay motivated and make any necessary adjustments. Consider using financial management tools or apps to track and visualize your savings growth.

07

Maintain discipline: Stay committed to your savings goal and resist the temptation to dip into your savings for unnecessary purchases. Remember that every dollar saved brings you closer to financial security and peace of mind.

08

By following these steps, you can effectively fill out your spending your savings and achieve your financial goals.

Who needs your spending your savings?

01

Anyone who wants to improve their financial stability and secure their future can benefit from spending their savings effectively:

02

- Individuals looking to make a big purchase, such as a car or a house, can use their savings to cover a portion or the entire cost.

03

- People who want to build an emergency fund for unexpected expenses like medical bills or job loss can rely on their savings to provide a safety net.

04

- Those aiming to pay off debts can use their savings to make extra payments and reduce interest charges.

05

- Individuals planning for retirement can allocate a portion of their savings to retirement accounts, such as 401(k) or IRAs, to ensure a comfortable future.

06

Overall, anyone who values financial security, flexibility, and the ability to achieve their long-term goals can greatly benefit from effectively managing and spending their savings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit your spending your savings from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including your spending your savings, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find your spending your savings?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the your spending your savings in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out the your spending your savings form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign your spending your savings and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is your spending your savings?

Spending your savings refers to the act of using the money that you have saved for various purposes, such as purchasing goods, paying bills, or investing in opportunities.

Who is required to file your spending your savings?

Individuals who manage personal finances and track their expenses might choose to file a budget or financial report detailing their spending and savings.

How to fill out your spending your savings?

To fill out your spending and savings report, list your income sources, categorize your expenses, and compare your spending against your savings to evaluate your financial health.

What is the purpose of your spending your savings?

The purpose of spending your savings is to ensure financial stability, manage debts, prioritize needs, and achieve financial goals while maintaining a safety net.

What information must be reported on your spending your savings?

Information that must be reported includes total income, categorized expenses (such as housing, food, transportation), the amount saved, and any financial goals or investments.

Fill out your your spending your savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Spending Your Savings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.