Get the free Revenue Neutral Rate & What You Need to Know

Show details

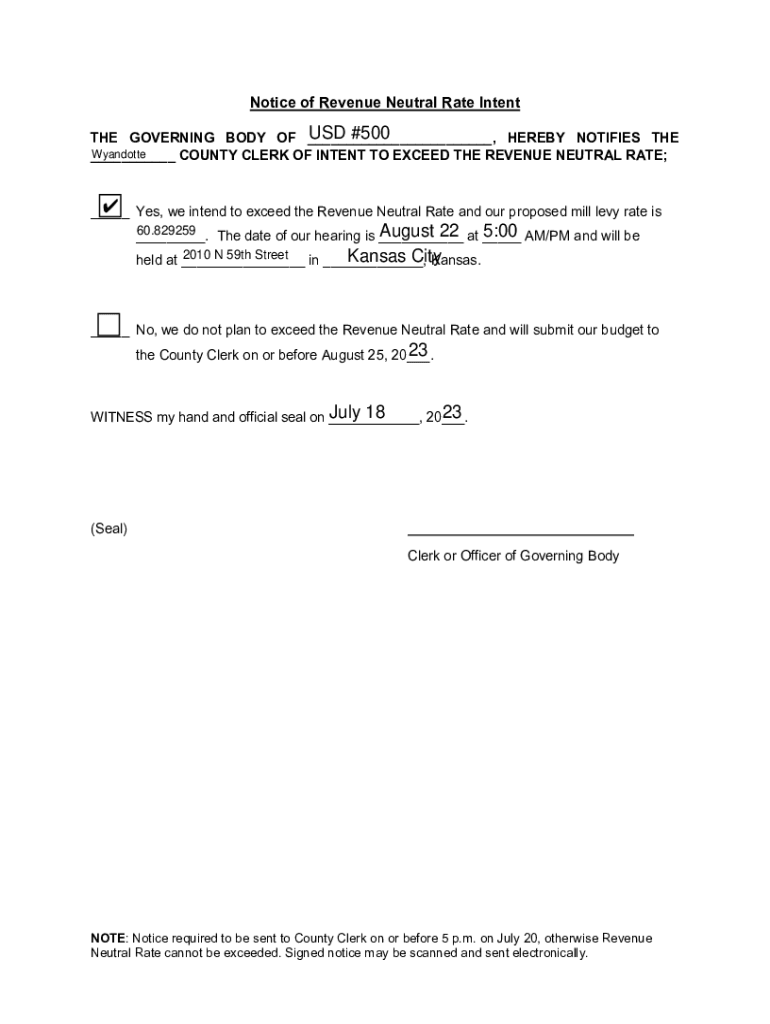

Notice of Revenue Neutral Rate Intent USD #500 HEREBY NOTIFIES THE GOVERNING BODY OF ___, Wyandotte ___ COUNTY CLERK OF INTENT TO EXCEED THE REVENUE NEUTRAL RATE; Yes, we intend to exceed the Revenue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue neutral rate amp

Edit your revenue neutral rate amp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue neutral rate amp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revenue neutral rate amp online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit revenue neutral rate amp. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue neutral rate amp

How to fill out revenue neutral rate amp

01

Start by gathering all the necessary information and documents required for filling out the revenue neutral rate amp form.

02

Carefully read the instructions provided with the form to understand the requirements and guidelines.

03

Fill out the personal information section of the form accurately, including your name, address, and contact details.

04

Provide any additional information or documents required to support your application, such as income statements or tax returns.

05

Calculate the revenue neutral rate using the formula provided in the instructions or as per the guidelines.

06

Double-check all the information entered in the form for accuracy and completeness.

07

If applicable, attach any supporting documents or evidence along with the form.

08

Submit the completed revenue neutral rate amp form to the appropriate authority or department.

09

Keep a copy of the filled-out form and the supporting documents for your records.

10

Follow up with the relevant authority to track the progress of your application if necessary.

Who needs revenue neutral rate amp?

01

Businesses and individuals who want to calculate and maintain a revenue neutral rate may need the revenue neutral rate amp.

02

Tax consultants or professionals may also use the revenue neutral rate amp as a tool for their clients.

03

Organizations or government bodies involved in economic or tax policy analysis may require the revenue neutral rate amp for their research and calculations.

04

Individuals or businesses considering tax reforms or adjustments may find the revenue neutral rate amp useful in determining the impact of such changes.

05

Financial institutions or banks may use the revenue neutral rate amp to assess the financial stability or viability of potential borrowers or investments.

06

Policy makers or legislators may rely on the revenue neutral rate amp to determine the feasibility and impact of proposed tax measures.

07

Researchers or academicians studying taxation or public finance may utilize the revenue neutral rate amp in their studies or analysis.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find revenue neutral rate amp?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific revenue neutral rate amp and other forms. Find the template you need and change it using powerful tools.

How do I make edits in revenue neutral rate amp without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing revenue neutral rate amp and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I fill out revenue neutral rate amp on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your revenue neutral rate amp. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is revenue neutral rate amp?

The revenue neutral rate (RNR) AMP refers to a calculation used by local governments to determine a tax rate that will generate the same amount of revenue as the previous year, without additional revenue from new property. It ensures that tax revenue remains stable regardless of changes in property values.

Who is required to file revenue neutral rate amp?

Local governments and taxing authorities that levy property taxes are required to file the revenue neutral rate AMP to inform taxpayers of the tax rate that maintains consistent revenue levels.

How to fill out revenue neutral rate amp?

To fill out the revenue neutral rate AMP, local governments must calculate their proposed tax rate, document their current year’s revenue from property taxes, and indicate any changes in property values. Detailed guidance is often provided by the state or relevant taxing authority.

What is the purpose of revenue neutral rate amp?

The purpose of the revenue neutral rate AMP is to promote transparency in property taxation and to keep taxpayers informed about proposed tax rates that do not increase overall revenue from property taxes.

What information must be reported on revenue neutral rate amp?

The information reported on the revenue neutral rate AMP includes the current tax rate, estimated property valuations, proposed changes to the tax rate, and any exemptions or reductions in tax revenue.

Fill out your revenue neutral rate amp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Neutral Rate Amp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.