Get the free Supplemental Line of Credit Agreement No

Show details

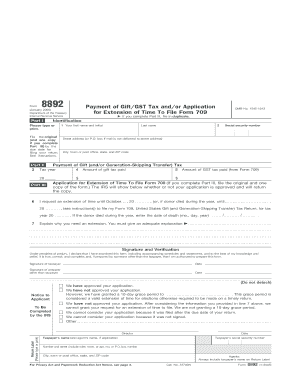

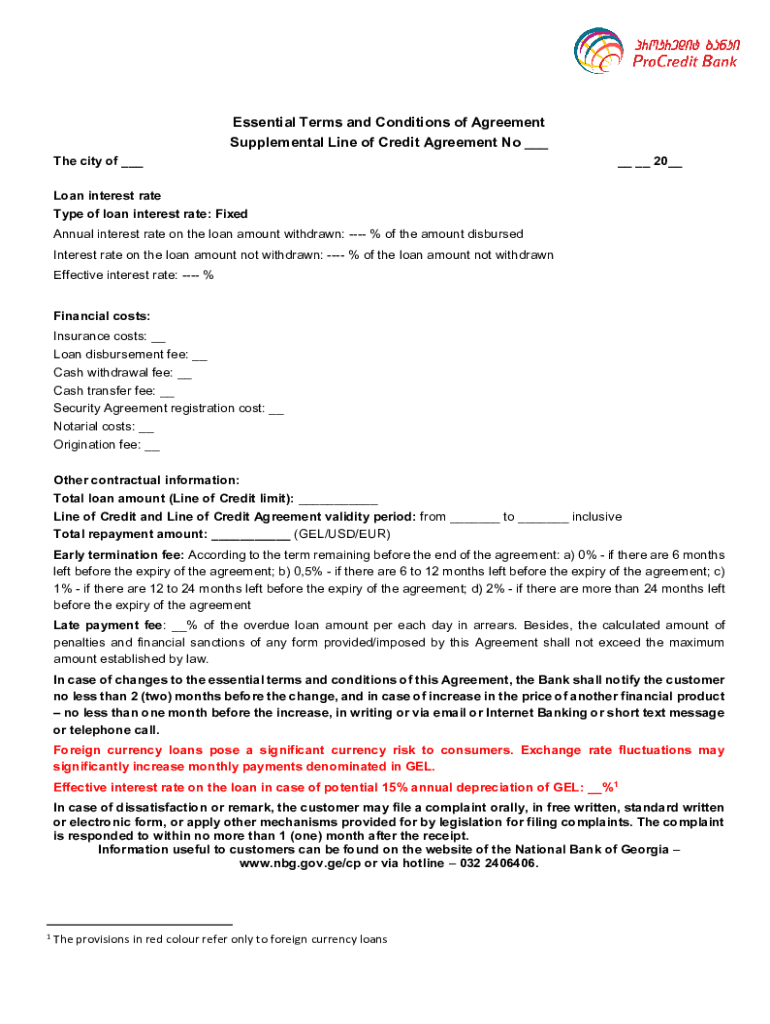

Essential Terms and Conditions of Agreement Supplemental Line of Credit Agreement No ___ The city of _____ __ 20__Loan interest rate Type of loan interest rate: Fixed Annual interest rate on the loan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplemental line of credit

Edit your supplemental line of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplemental line of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit supplemental line of credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit supplemental line of credit. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplemental line of credit

How to fill out supplemental line of credit

01

Step 1: Gather all the required documents such as financial statements, business plans, and tax returns.

02

Step 2: Review the terms and conditions of the line of credit to understand the eligibility criteria and repayment terms.

03

Step 3: Complete the application form accurately and provide all the necessary information about your business, its financial standing, and your credit history.

04

Step 4: Attach any supporting documents requested by the lender, such as collateral documents or personal guarantees.

05

Step 5: Submit the application along with all the required documents to the lender.

06

Step 6: Await approval from the lender, which may involve a credit check and evaluation of your financial stability.

07

Step 7: Once approved, review and understand the terms of the supplemental line of credit provided by the lender.

08

Step 8: Use the line of credit responsibly, making sure to make timely repayments and only utilizing the funds for business purposes.

09

Step 9: Monitor your credit limit and repayments regularly to maintain a good credit score and ensure the line of credit remains available for future use.

10

Step 10: If necessary, maintain communication with the lender and provide any requested updates or information.

Who needs supplemental line of credit?

01

Small businesses looking for additional funds to support their operations or expansion plans.

02

Entrepreneurs who need flexible financing options to manage cash flow fluctuations.

03

Startups in need of capital to launch their business or bring their products/services to the market.

04

Companies experiencing seasonality or cyclical sales patterns, requiring additional working capital during slower periods.

05

Business owners who want to take advantage of growth opportunities or unexpected business expenses.

06

Individuals or organizations looking to bridge temporary financial gaps or handle emergency situations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my supplemental line of credit directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your supplemental line of credit and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit supplemental line of credit online?

The editing procedure is simple with pdfFiller. Open your supplemental line of credit in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out supplemental line of credit using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign supplemental line of credit. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is supplemental line of credit?

A supplemental line of credit is a credit facility offered to borrowers in addition to their existing credit lines, often used to boost funding availability for specific projects or needs.

Who is required to file supplemental line of credit?

Entities or individuals who have an existing line of credit and wish to report additional borrowing or changes to their credit terms may be required to file a supplemental line of credit.

How to fill out supplemental line of credit?

To fill out a supplemental line of credit, borrowers must provide details such as the amount of the supplemental credit, the purpose of the credit, terms of repayment, and any associated fees.

What is the purpose of supplemental line of credit?

The purpose of a supplemental line of credit is to provide additional borrowing capacity to meet short-term funding needs or specific financial obligations without going through a full loan application process.

What information must be reported on supplemental line of credit?

Information typically reported includes the amount of the credit, the interest rate, term of the loan, purpose of the funds, and current usage of the existing and supplemental lines of credit.

Fill out your supplemental line of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplemental Line Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.