Get the free Form GST REG-06 Registration Certificate - RERA - Rajasthan

Show details

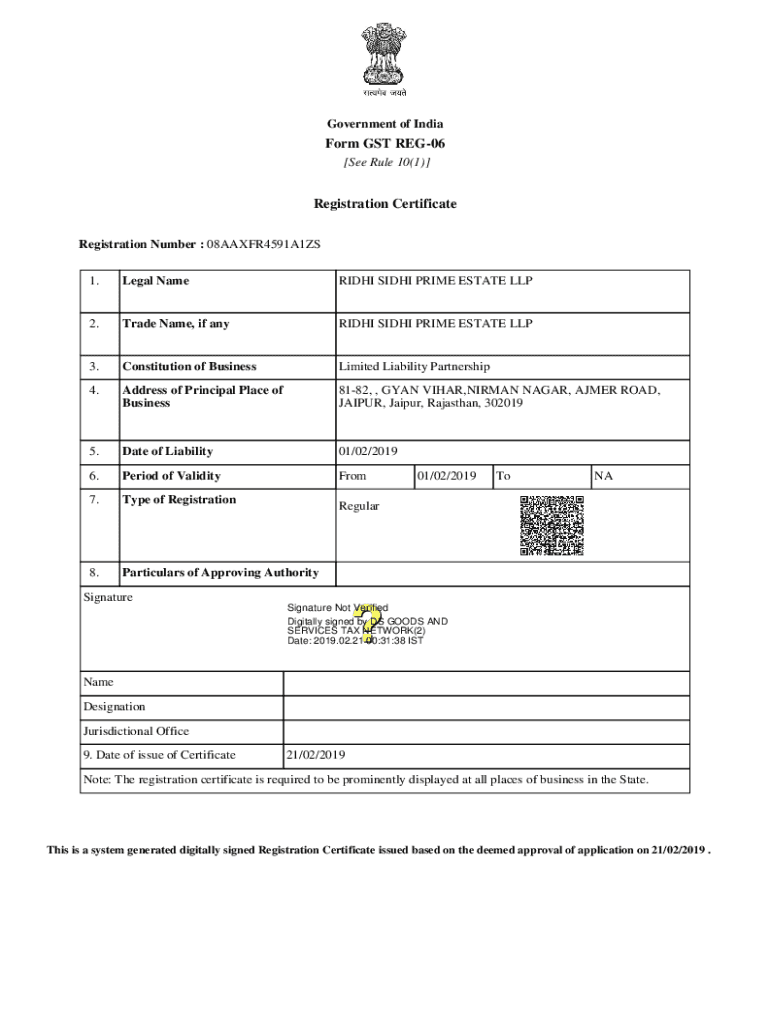

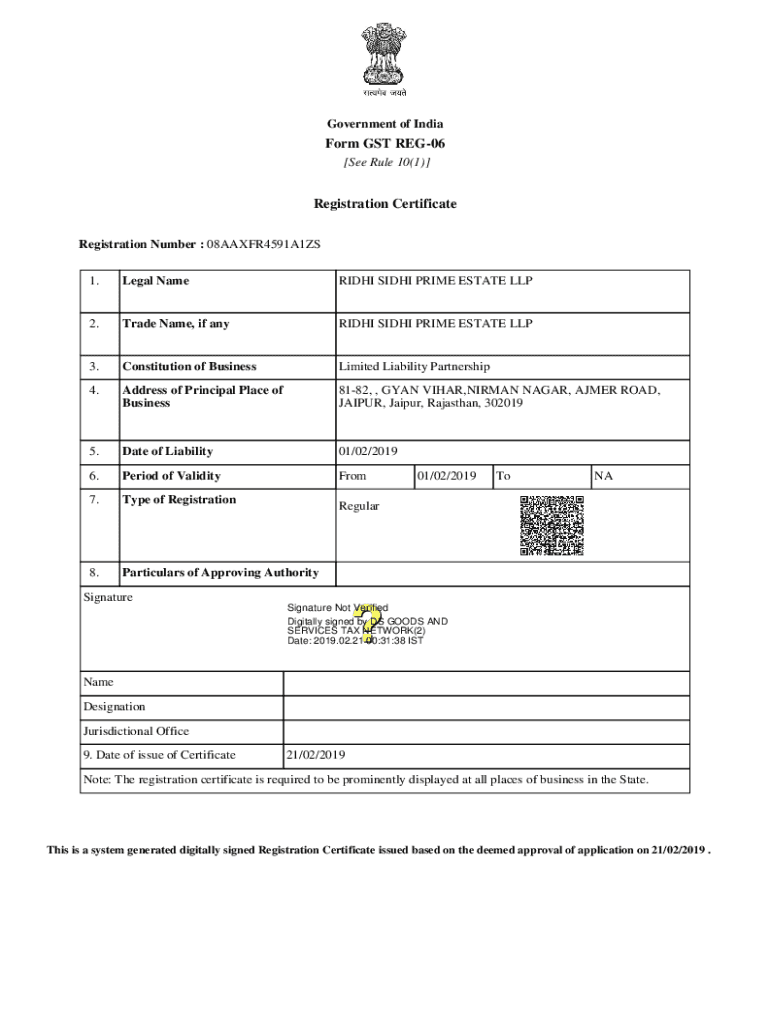

Government of IndiaForm GST REG06 [See Rule 10(1)]Registration Certificate Registration Number : 08AAXFR4591A1ZS 1.Legal NameRIDHI SIDHI PRIME ESTATE LLP2.Trade Name, if anyRIDHI SIDHI PRIME ESTATE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form gst reg-06 registration

Edit your form gst reg-06 registration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form gst reg-06 registration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form gst reg-06 registration online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form gst reg-06 registration. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form gst reg-06 registration

How to fill out form gst reg-06 registration

01

Step 1: Download Form GST Reg-06 registration from the official GST portal.

02

Step 2: Fill in your personal details, such as name, address, contact information, and PAN number.

03

Step 3: Provide your business details, including business name, address, type of organization, and principal place of business.

04

Step 4: Enter details of authorized signatory, if applicable.

05

Step 5: Fill in the details of the person-in-charge of the uploading of the registration application.

06

Step 6: Complete the sections regarding the nature of business activity, details of goods and services, director/partners details, and bank account details.

07

Step 7: Declaration and verification by the applicant.

08

Step 8: Submit the form online on the GST portal or via offline mode at the respective GST office.

09

Step 9: After submission, you will receive an acknowledgement with an Application Reference Number (ARN) for tracking the status of your registration application.

10

Step 10: You may also be required to submit certain documents along with the form, such as proof of business address, bank account details, identity and address proof of directors/partners, and other relevant documents. Make sure to attach these documents as per the guidelines provided.

Who needs form gst reg-06 registration?

01

Any individual, partnership firm, company, LLP, or any other entity engaged in the supply of goods or services and whose annual turnover exceeds the threshold limit specified by the GST council needs to fill out Form GST Reg-06 registration. This form is required for new registration under GST for the purpose of obtaining Goods and Services Tax Identification Number (GSTIN). It is mandatory for businesses to register under GST if their turnover exceeds the prescribed limit to ensure compliance with the GST regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form gst reg-06 registration without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including form gst reg-06 registration, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get form gst reg-06 registration?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific form gst reg-06 registration and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I edit form gst reg-06 registration on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share form gst reg-06 registration on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is form gst reg-06 registration?

Form GST REG-06 is a registration form used by taxpayers to amend their existing Goods and Services Tax (GST) registration details.

Who is required to file form gst reg-06 registration?

Any registered taxpayer who needs to update or amend their business details, such as their business name, address, or other relevant information, is required to file form GST REG-06.

How to fill out form gst reg-06 registration?

To fill out Form GST REG-06, taxpayers must provide their GSTIN, select the type of amendment required, fill in the necessary details, and submit the form through the GST portal.

What is the purpose of form gst reg-06 registration?

The purpose of Form GST REG-06 is to facilitate registered taxpayers in updating their registration details in the GST system to ensure compliance and maintain accurate records.

What information must be reported on form gst reg-06 registration?

The information that must be reported on Form GST REG-06 includes the GSTIN, type of amendment, updated business details (such as name, address, and contact information), and any other relevant amendments.

Fill out your form gst reg-06 registration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Gst Reg-06 Registration is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.