Get the free HOUSEHOLD INCOME SCHEDULE

Show details

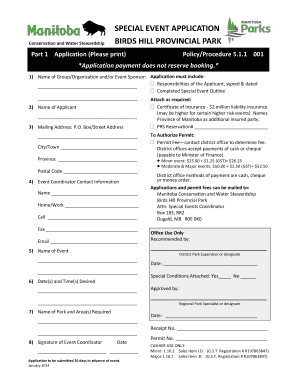

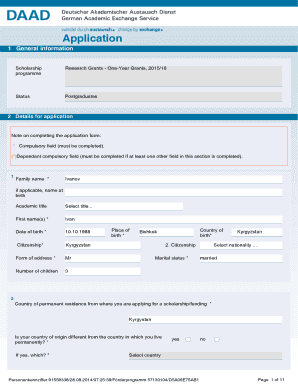

A form designed for households to report income and household members' information to qualify for low-income refunds associated with park maintenance and open space protection taxes in the City of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign household income schedule

Edit your household income schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your household income schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing household income schedule online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit household income schedule. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out household income schedule

How to fill out HOUSEHOLD INCOME SCHEDULE

01

Gather all household income sources, including salaries, benefits, and any additional revenue.

02

Use the provided form to list each member of the household and their respective income amounts.

03

Ensure to include any non-taxable income such as child support or social security.

04

Double-check all figures for accuracy before submitting the form.

05

Attach any required documentation that supports the reported income.

Who needs HOUSEHOLD INCOME SCHEDULE?

01

Individuals applying for government assistance programs.

02

Families seeking loans or financial aid.

03

Households filing taxes that require detailed income records.

04

Anyone involved in legal matters where household income is relevant.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I don't file Schedule H?

Omitting Schedule H from your 2024 tax return can have serious consequences. Both the IRS and the Social Security Administration may question the accuracy of your federal tax payments. This could result in notices from either agency requesting clarification and supporting documents, potentially leading to penalties.

What should I put for total household income?

Household income is the adjusted gross income from your tax return plus any excludible foreign earned income and tax-exempt interest you receive during the taxable year.

What happens if you forgot to report interest income?

Cross-checking with IRS records: Your bank also sends a copy of the 1099-INT to the IRS. This means if you don't report the interest, or if there is a discrepancy, the IRS will likely identify the issue, and you may receive a notice to amend your return or pay additional taxes.

Do I have to file a schedule H?

Your tax return needs to include Schedule H only if you pay any single employee at least $2,700 for the 2024 tax year ($2,800 for 2025), or cash wages to all household employees totaling $1,000 or more during any three-month calendar quarter during either the current or previous tax year.

Is it okay to skip a year of filing taxes?

What happens if you do not file? Not filing a federal tax return can be costly — whether you end up owing more or missing out on a refund. The IRS may also impose a wide range of civil and criminal sanctions on persons who fail to file returns.

What are the 7 income tax brackets?

In both 2024 and 2025, the federal income tax rates for each of the seven brackets in the U.S. are the same: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

What are schedules 1, 2, and 3 for taxes?

Schedule 1 for additional income and "above the line" deductions. Schedule 2 for additional taxes. Schedule 3 for additional credits and payments.

Will I get in trouble if I don't file my tax return?

This can include such actions as a levy on your wages or bank account or the filing of a notice of federal tax lien. If you repeatedly do not file, you could be subject to additional enforcement measures, such as additional penalties and/or criminal prosecution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HOUSEHOLD INCOME SCHEDULE?

The Household Income Schedule is a document used to report the total income of all members of a household for tax purposes or eligibility assessments for various programs.

Who is required to file HOUSEHOLD INCOME SCHEDULE?

Individuals or families applying for financial assistance, tax credits, or other programs that require income verification are typically required to file a Household Income Schedule.

How to fill out HOUSEHOLD INCOME SCHEDULE?

To fill out the Household Income Schedule, list all household members, report their individual incomes, and provide any other requested information such as deductions or benefits received.

What is the purpose of HOUSEHOLD INCOME SCHEDULE?

The purpose of the Household Income Schedule is to assess the financial status of a household to determine eligibility for government programs, tax benefits, or other financial assistance.

What information must be reported on HOUSEHOLD INCOME SCHEDULE?

Information that must be reported includes names of household members, their income sources, total income amounts, and possibly information about dependents and expenses.

Fill out your household income schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Household Income Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.