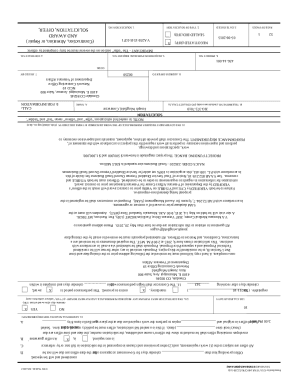

Get the free Homeownership Counseling Request and Budgeting Documents - nhsbaltimore

Show details

This document is designed for prospective homeowners seeking counseling and assistance in purchasing a home, specifically through Neighborhood Housing Services of Baltimore, Inc. It includes client

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign homeownership counseling request and

Edit your homeownership counseling request and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homeownership counseling request and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit homeownership counseling request and online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit homeownership counseling request and. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out homeownership counseling request and

How to fill out Homeownership Counseling Request and Budgeting Documents

01

Step 1: Gather necessary documents such as income statements, tax returns, and any existing debt information.

02

Step 2: Download the Homeownership Counseling Request form from the designated website.

03

Step 3: Fill in your personal information on the form including your name, address, and contact details.

04

Step 4: Provide details about your current housing situation, including your monthly rent or mortgage payments.

05

Step 5: Complete the budgeting document by listing all sources of income and expenses.

06

Step 6: Evaluate your budget, ensuring that your income covers your expenses.

07

Step 7: Review the completed documents for accuracy before submission.

08

Step 8: Submit the forms to the appropriate counseling agency either online or via mail.

Who needs Homeownership Counseling Request and Budgeting Documents?

01

First-time homebuyers seeking guidance on purchasing a home.

02

Individuals facing financial difficulties who need help with budgeting.

03

People looking to improve their financial literacy before entering the housing market.

04

Families planning to buy a home and wanting assistance with the necessary paperwork.

Fill

form

: Try Risk Free

People Also Ask about

What should all housing counseling files contain?

The client file should include: A log of activities that records date, time, duration, and description of each interaction performed on behalf of, and by, the client. An action plan, except in the case of reverse mortgage counseling.

What does a HUD certified counselor do?

A housing counselor though a HUD-approved agency is specially trained and certified by the government to help you assess your financial situation, evaluate options if you are having trouble paying your mortgage loan, and make a plan to get you help with your mortgage.

What is homeownership counseling?

Homeownership Counseling is housing counseling that covers: The decision to purchase a home, The selection and purchase of a home, Issues arising during or affecting the period of ownership of a home (including financing, refinancing, default, and foreclosure, and other financial decisions), and.

When must the list of homeownership counseling organizations be provided to the applicant?

The List of Homeownership Counseling Organizations (our Cx17874) is provided per 12 CFR § 1024.20, which requires the lender or mortgage broker supply the loan applicant a list of homeownership counseling organizations located closest to the applicant within three business days after receipt of application.

What is a housing counselor list?

This list will show you several approved agencies in your area. The counseling agencies on this list are approved by the U.S. Department of Housing and Urban Development (HUD) and they can offer independent advice, often at little or no cost to you.

Which is a responsibility of a housing counselor?

The Housing Counselor works one-on-one with clients to coach and motivate them to achieve their goals for housing stability and financial opportunity with money management, credit, rental, home ownership, and foreclosure counseling. This position also conducts financial education and homebuyer education classes.

How to pass the HUD counseling exam?

But studying, taking practice tests, and reviewing the material really broaden your knowledge so you can demonstrate competency in all counseling areas: financial management; property management; responsibilities of homeownership and tenancy; fair housing laws and requirements; housing affordability; and avoidance of,

Do applicants for loans for timeshares must receive a written list of homeownership counseling organizations?

Federally Related Mortgage Loans It does not include reverse mortgages and loans for timeshares. The list provided to applicants must include 10 U.S. Department of Housing and Urban Development (HUD) approved homeownership counseling agencies closest to the applicant's location.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

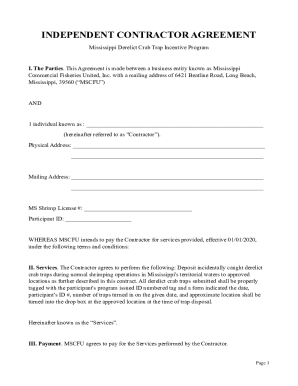

What is Homeownership Counseling Request and Budgeting Documents?

Homeownership Counseling Request and Budgeting Documents are forms that individuals must complete to seek guidance and assistance in managing their finances and preparing for homeownership.

Who is required to file Homeownership Counseling Request and Budgeting Documents?

Individuals who are looking to purchase a home, especially first-time homebuyers, or those seeking assistance with financial planning in relation to homeownership are required to file these documents.

How to fill out Homeownership Counseling Request and Budgeting Documents?

To fill out Homeownership Counseling Request and Budgeting Documents, individuals should provide accurate personal information, financial details, and any specific concerns or questions related to homeownership to ensure they receive tailored assistance.

What is the purpose of Homeownership Counseling Request and Budgeting Documents?

The purpose of these documents is to facilitate the assessment of an individual's financial situation and to identify resources or programs that can assist them in achieving homeownership.

What information must be reported on Homeownership Counseling Request and Budgeting Documents?

The documents typically require personal information such as income, expenses, debts, savings, credit history, and specific housing goals or challenges.

Fill out your homeownership counseling request and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Homeownership Counseling Request And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.