Get the free Direct Component Non-Federal Share of Another Federally - treasury

Show details

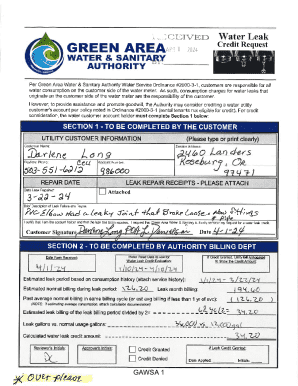

RESTORE Act Direct Component Non-Federal Share of Another Federally Funded Activity Non-Construction or Real Property Activities U.S. Department of the Treasury Office of Gulf Coast Restoration Initial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct component non-federal share

Edit your direct component non-federal share form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct component non-federal share form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing direct component non-federal share online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit direct component non-federal share. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct component non-federal share

To fill out the direct component non-federal share, follow these steps:

01

Review the funding guidelines: Familiarize yourself with the specific requirements and guidelines outlined by the funding agency. Make sure you understand what constitutes an acceptable non-federal share.

02

Determine the project budget: Calculate the total project cost and identify the portion that can be covered by federal funds. The direct component non-federal share refers to the amount that needs to be financed from non-federal sources.

03

Identify eligible sources: Explore potential sources of non-federal funds that can be used to fulfill the non-federal share. These sources can include cash contributions, in-kind contributions, or third-party contributions.

04

Calculate the non-federal share amount: Determine the exact amount that needs to be provided as the non-federal share based on the funding agency's guidelines. This can be a percentage or a specific dollar amount.

05

Document the non-federal contributions: Keep a record of all non-federal contributions that will be used to meet the non-federal share requirement. This documentation may include financial statements, donation receipts, or contracts.

06

Submit the proposal: When the non-federal share has been calculated and documented, include this information in the funding proposal or application form. Clearly outline the sources and amounts of non-federal funds committed to the project.

07

Maintain proper records: After the project is approved and funded, ensure that you keep accurate records of all non-federal expenditures and contributions throughout the project's duration, as they may be subject to audit.

The direct component non-federal share is typically required by organizations or individuals seeking funding for a project from federal agencies or grant programs. It serves as a way to demonstrate the financial commitment and accountability of the applicant, ensuring that the project's costs are shared between federal and non-federal sources. The specific entities that require the direct component non-federal share vary depending on the funding agency and the nature of the project being funded. It is crucial to carefully review the grant guidelines or program requirements to determine if the direct component non-federal share is applicable to your particular funding application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is direct component non-federal share?

Direct component non-federal share is the portion of project costs that must be covered by non-federal sources.

Who is required to file direct component non-federal share?

The organization or entity receiving the federal funds for the project is required to file the direct component non-federal share.

How to fill out direct component non-federal share?

Direct component non-federal share can be filled out by providing a detailed breakdown of the non-federal funds that will be used to cover project costs.

What is the purpose of direct component non-federal share?

The purpose of direct component non-federal share is to ensure that projects receiving federal funds have adequate financial support from non-federal sources.

What information must be reported on direct component non-federal share?

Information such as the source of non-federal funds, the amount of non-federal funds, and any restrictions on the use of non-federal funds must be reported on the direct component non-federal share.

How can I manage my direct component non-federal share directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign direct component non-federal share and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit direct component non-federal share on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing direct component non-federal share, you need to install and log in to the app.

How do I edit direct component non-federal share on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as direct component non-federal share. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your direct component non-federal share online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Component Non-Federal Share is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.