Get the free Online SBA 504 Loan Application Fax Email Print

Show details

SBA 504 Loan Application Florida Business Development Corporation 1715 N West shore Blvd. Suite 780 Tampa, FL 33607Document Instructions Please see instructions below for the documents within this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign online sba 504 loan

Edit your online sba 504 loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your online sba 504 loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit online sba 504 loan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit online sba 504 loan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out online sba 504 loan

How to fill out online sba 504 loan

01

Step 1: Start by visiting the official website of the Small Business Administration (SBA) and navigate to the SBA 504 loan application section.

02

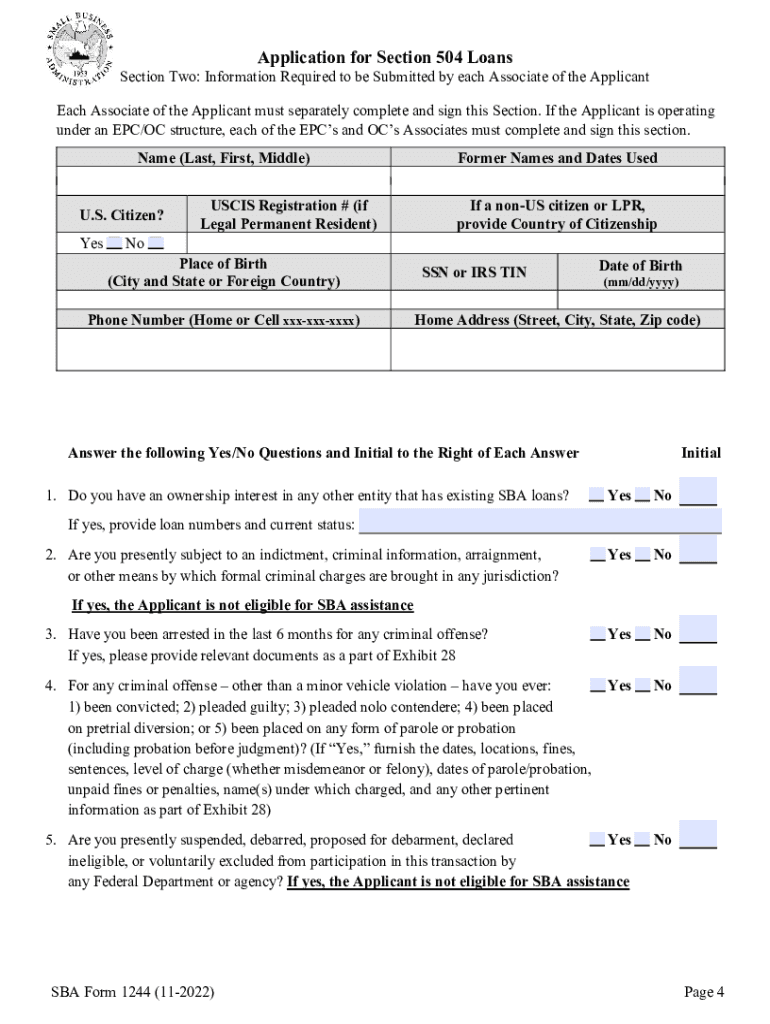

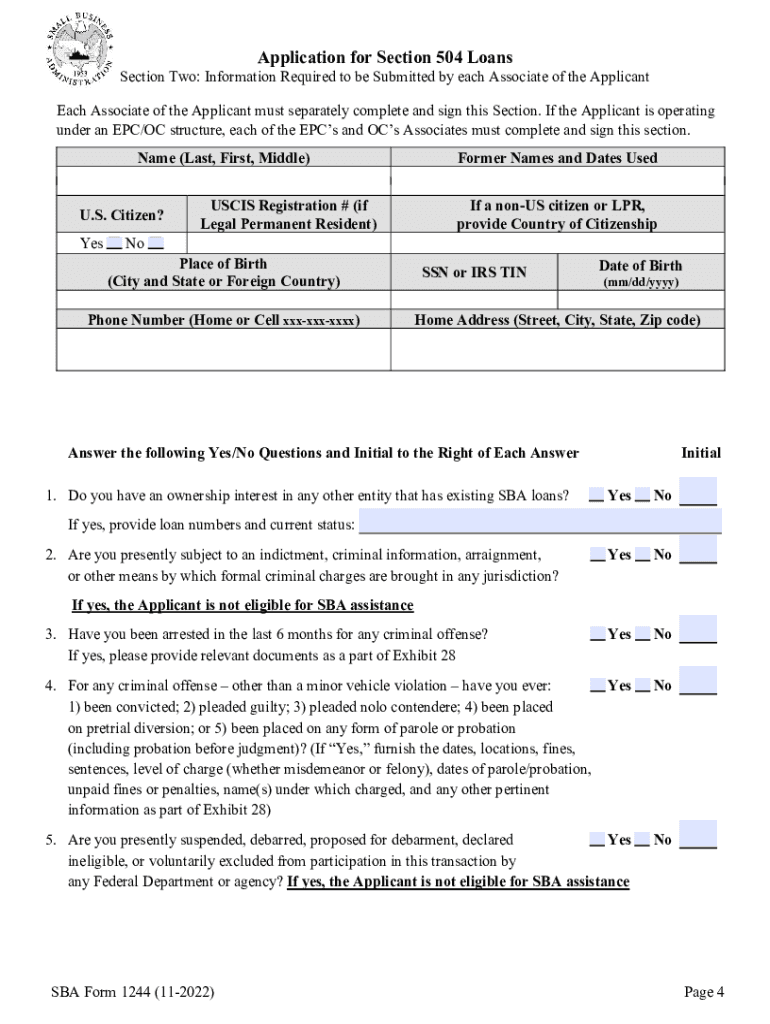

Step 2: Fill out the required personal and business information accurately, including your legal name, address, contact details, social security number, employer identification number (EIN), and financial statements.

03

Step 3: Provide details about your business, such as its legal structure, industry type, years in operation, and number of employees.

04

Step 4: Specify the loan amount you are requesting and provide details about how these funds will be used for your business expansion or real estate purchase.

05

Step 5: Submit any additional documents required by the SBA, such as business plan, income tax returns, financial projections, collateral information, or personal guarantees.

06

Step 6: Review and double-check all the information provided before submitting the application.

07

Step 7: Complete the online SBA 504 loan application by clicking on the submit button.

08

Step 8: Wait for the SBA to review your application and communicate their decision, which may include further documentation or an invitation for an interview.

09

Step 9: If approved, work with your lender and the SBA to finalize the loan terms and conditions.

10

Step 10: Once everything is in order, sign the necessary agreements and receive the funds in your business account.

11

Step 11: Make timely loan repayments according to the agreed schedule to maintain a good credit history.

12

Step 12: Track the progress of your business expansion or real estate project and utilize the loan funds effectively to achieve your goals.

13

Step 13: Seek professional advice from financial experts or counsel, if needed, to ensure compliance and maximize the benefits of the SBA 504 loan program.

Who needs online sba 504 loan?

01

Small business owners or entrepreneurs looking to purchase commercial real estate for their business operations.

02

Existing business owners seeking to expand their facilities, renovate existing properties, or purchase major fixed assets.

03

Entrepreneurs planning to construct new facilities or renovate existing properties to accommodate their business growth.

04

Business owners who are unable to obtain conventional financing and require assistance in financing their real estate projects.

05

Companies needing long-term funding options with favorable interest rates and attractive repayment terms.

06

Small business owners who prefer working with government-backed loan programs, such as the SBA, for added security and support.

07

Businesses involved in industries eligible for SBA 504 loan programs, such as manufacturing, hospitality, healthcare, or commercial real estate development.

08

Entities looking for an opportunity to refinance existing debt with a lower interest rate and longer repayment period.

09

Entrepreneurs looking to create job opportunities and contribute to economic development in their local community.

10

Business owners willing to fulfill the eligibility criteria and meet the necessary requirements set by the SBA.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my online sba 504 loan in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your online sba 504 loan along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I fill out the online sba 504 loan form on my smartphone?

Use the pdfFiller mobile app to fill out and sign online sba 504 loan. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit online sba 504 loan on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign online sba 504 loan right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is online sba 504 loan?

The online SBA 504 loan is a government-backed financing option designed to provide long-term loans for purchasing fixed assets like real estate and equipment, aimed at helping small businesses grow.

Who is required to file online sba 504 loan?

Businesses seeking to finance the purchase of fixed assets through an SBA 504 loan must file online. Typically, these are small businesses that meet the SBA's size standards.

How to fill out online sba 504 loan?

To fill out an online SBA 504 loan application, businesses need to gather necessary financial documents, complete the required forms on the SBA's platform, and submit them along with supporting documentation.

What is the purpose of online sba 504 loan?

The purpose of the online SBA 504 loan is to provide small businesses with affordable financing options for acquiring major fixed assets, which can help stimulate growth and job creation.

What information must be reported on online sba 504 loan?

Applicants must report details such as business financial statements, credit history, asset information, and the intended use of loan proceeds on the online SBA 504 loan application.

Fill out your online sba 504 loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Online Sba 504 Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.