Get the free Michigan 1st Mortgage Broker/Lender/Servicer License Application Checklist - mortgag...

Show details

This document serves as a checklist for completing the application requirements for a mortgage broker/lender/servicer license in Michigan, detailing necessary documentation and instructions for submission

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign michigan 1st mortgage brokerlenderservicer

Edit your michigan 1st mortgage brokerlenderservicer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan 1st mortgage brokerlenderservicer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

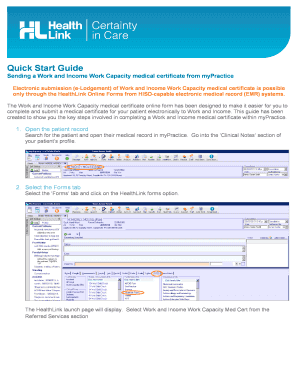

How to edit michigan 1st mortgage brokerlenderservicer online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit michigan 1st mortgage brokerlenderservicer. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out michigan 1st mortgage brokerlenderservicer

How to fill out Michigan 1st Mortgage Broker/Lender/Servicer License Application Checklist

01

Obtain the Michigan 1st Mortgage Broker/Lender/Servicer License Application Checklist from the Michigan Department of Licensing and Regulatory Affairs (LARA) website.

02

Review the requirements listed in the checklist to ensure you meet all necessary qualifications.

03

Gather all required documentation, including proof of business formation, financial statements, and surety bond information.

04

Complete the application form accurately and ensure all required signatures are present.

05

Pay the applicable application fee as specified in the checklist.

06

Submit the completed application along with the gathered documentation to the appropriate regulatory office.

07

Monitor the application status and be prepared to provide additional information or documentation if requested.

Who needs Michigan 1st Mortgage Broker/Lender/Servicer License Application Checklist?

01

Individuals or businesses looking to operate as mortgage brokers, lenders, or servicers in Michigan must complete the Michigan 1st Mortgage Broker/Lender/Servicer License Application Checklist.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my mortgage license in Michigan?

In the state of Michigan, mortgage loan originators are required to: Complete a Criminal Background Check (CBC). Authorize a credit report through the NMLS including the credit report fee is $15. Fulfill all state and federal education requirements as designated by your state agency. Take and pass a National Test.

How to get a mortgage broker license in Michigan?

How to Get an NMLS Mortgage License in Michigan Apply for Your NMLS Account and ID Number. Complete Your NMLS Pre-License Education. Need to Pass the SAFE NMLS Mortgage Licensing Test. Complete Background Checks and Pay All Fees. Apply for your Michigan Mortgage License. Associate your NMLS Account with your Employer.

How do I get a broker's license in Michigan?

Complete 90-hours of commission-approved Broker Pre-Licensing education (An MBA or law degree may substitute for 60-hours) Pass the coursework final exam with a score of 70% or greater. Pass the state-issued Broker License exam. Submit license application to the state.

How hard is the mortgage broker exam?

Mortgage Loan Originators must act ethically, and understand the business for both clients and larger financial systems as a whole. With that said, the NMLS licensing exam is purposely designed to be difficult. Did you know that only 56% of NMLS test takers pass the exam on their first attempt?

How hard is the mortgage broker exam?

Mortgage Loan Originators must act ethically, and understand the business for both clients and larger financial systems as a whole. With that said, the NMLS licensing exam is purposely designed to be difficult. Did you know that only 56% of NMLS test takers pass the exam on their first attempt?

What not to say to a mortgage broker?

0:00 1:26 Anything about property or negotiations. Because this is not their area of expertise. Don't ask themMoreAnything about property or negotiations. Because this is not their area of expertise. Don't ask them whether you should buy a brand new apartment or a house and land package.

How to become a mortgage broker in Michigan?

In Michigan, you must take 20 hours of pre-license education and pass a licensing exam. This pre-license education must include 18 hours of general education that is NMLS-approved. Additionally, you must take a two-hour Michigan state-specific elective.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Michigan 1st Mortgage Broker/Lender/Servicer License Application Checklist?

The Michigan 1st Mortgage Broker/Lender/Servicer License Application Checklist is a list of requirements and documents needed to apply for a mortgage broker, lender, or servicer license in the state of Michigan.

Who is required to file Michigan 1st Mortgage Broker/Lender/Servicer License Application Checklist?

Individuals or businesses that wish to operate as mortgage brokers, lenders, or servicers within the state of Michigan are required to file this application checklist.

How to fill out Michigan 1st Mortgage Broker/Lender/Servicer License Application Checklist?

To fill out the checklist, applicants must gather all required documentation, complete the application form with accurate information, and ensure all fees are paid before submission.

What is the purpose of Michigan 1st Mortgage Broker/Lender/Servicer License Application Checklist?

The purpose of the checklist is to ensure that applicants meet the necessary regulatory requirements to operate legally as mortgage brokers, lenders, or servicers in Michigan.

What information must be reported on Michigan 1st Mortgage Broker/Lender/Servicer License Application Checklist?

Information that must be reported includes the applicant's business structure, financial details, criminal history, business experience, and compliance with state laws.

Fill out your michigan 1st mortgage brokerlenderservicer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan 1st Mortgage Brokerlenderservicer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.