Get the free MORTGAGE MODIFICATION AGREEMENT

Show details

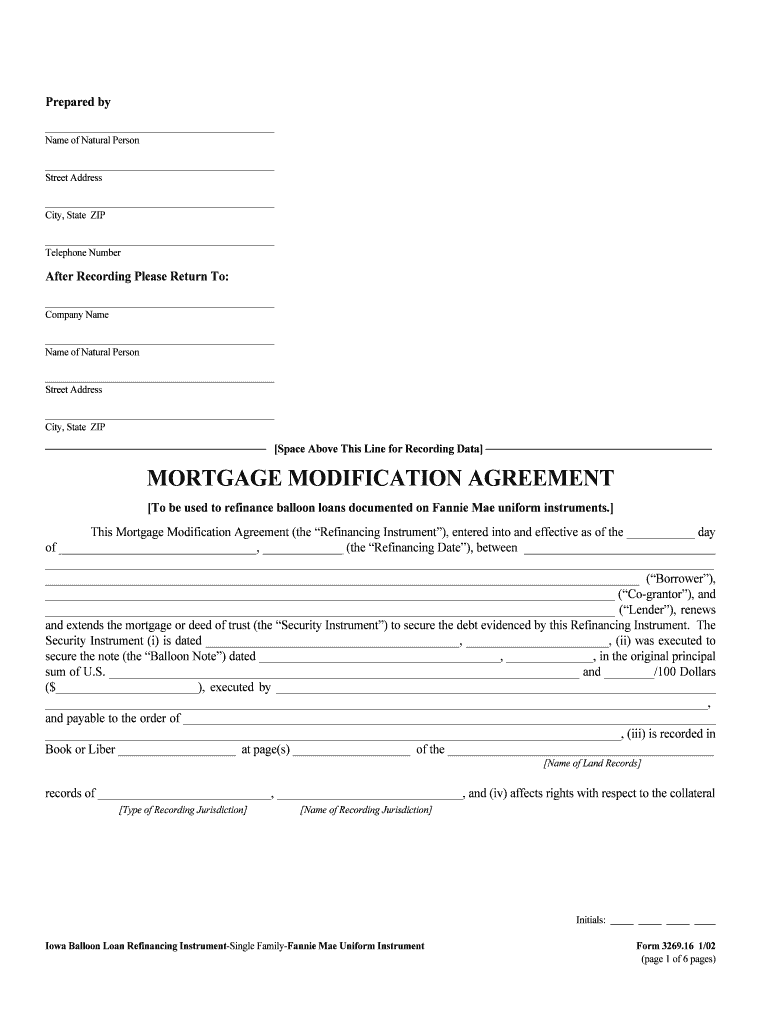

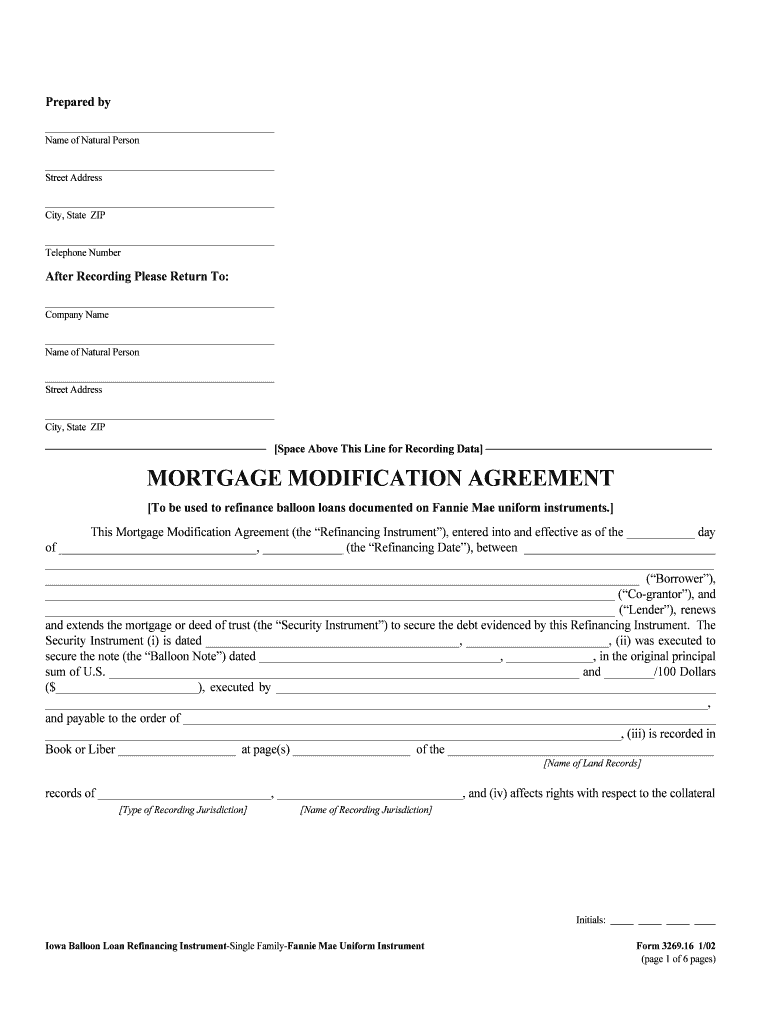

This document is a Mortgage Modification Agreement intended to refinance balloon loans documented on Fannie Mae uniform instruments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage modification agreement

Edit your mortgage modification agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage modification agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage modification agreement online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage modification agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage modification agreement

How to fill out MORTGAGE MODIFICATION AGREEMENT

01

Gather all necessary documentation, including your current mortgage statement, proof of income, and any financial hardship statements.

02

Contact your mortgage lender to request a MORTGAGE MODIFICATION AGREEMENT application.

03

Carefully fill out the application form, providing accurate information about your financial situation.

04

Attach any required documentation as specified by your lender, such as tax returns or bank statements.

05

Review the completed application and documentation to ensure all information is correct.

06

Submit the application and documentation to your lender, either online, by mail, or in person, as directed.

07

Follow up with your lender after submission to check the status of your application.

Who needs MORTGAGE MODIFICATION AGREEMENT?

01

Homeowners struggling to make their mortgage payments due to financial hardship.

02

Individuals experiencing changes in income, such as job loss or medical expenses.

03

Borrowers facing foreclosure and seeking alternatives to keep their home.

Fill

form

: Try Risk Free

People Also Ask about

What are the qualifications for a loan modification?

Lenders differ in their mortgage modification requirements, but typically they require you to show that: You're at least one regular mortgage payment behind, or a missed payment is imminent. You've incurred significant financial hardship, for reasons including: Long-term illness or disability.

Is it hard to get approved for a loan modification?

Here are some drawbacks to modifying your home loan: It could lower your credit score. Your loan servicer might report the loan modification to the credit bureaus. Because a loan modification shows you're experiencing financial challenges, it could lower your score.

What is the downside of loan modification?

Conventional loan modification: If you have a conventional mortgage backed by Fannie Mae or Freddie Mac, you might be eligible for the Flex Modification program, which can reduce your monthly payments by up to 20 percent, extend the loan term up to 40 years and potentially lower the interest rate.

What is a mortgage modification agreement?

Often, a homeowner won't get approved for a loan modification unless there is evidence of one or several missed payments. Those missed payments hurt your credit score. A home loan modification does the same.

Do most loan modifications get approved?

Understand that your lender may not agree to a loan modification. You are requesting a change to the loan terms to which you and the lender already agreed. There is no obligation for the lender to approve your request for any change, and the loan modification request may be denied.

Why would you be denied a loan modification?

How To Get A Mortgage Loan Modification Contact Your Mortgage Lender. First, inform your lender that you're having trouble keeping up with your monthly mortgage payments. Complete Loss Mitigation Application. Provide Proof Of Finances. Write A Financial Hardship Letter. Accept Or Deny The Offer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MORTGAGE MODIFICATION AGREEMENT?

A Mortgage Modification Agreement is a legal document that modifies the terms of an existing mortgage loan, allowing the borrower to alter their repayment obligations to better suit their financial situation.

Who is required to file MORTGAGE MODIFICATION AGREEMENT?

Typically, the borrower or homeowner looking to change the terms of their mortgage must file the Mortgage Modification Agreement, often in collaboration with the lender or mortgage servicer.

How to fill out MORTGAGE MODIFICATION AGREEMENT?

To fill out a Mortgage Modification Agreement, borrowers should provide their personal information, loan details, current financial situation, and new proposed terms, and then review it with their lender for accuracy and approval before signing.

What is the purpose of MORTGAGE MODIFICATION AGREEMENT?

The purpose of a Mortgage Modification Agreement is to help borrowers manage their mortgage payments more effectively, potentially reducing interest rates, extending repayment periods, or altering payment amounts to prevent foreclosure.

What information must be reported on MORTGAGE MODIFICATION AGREEMENT?

The information that must be reported on a Mortgage Modification Agreement includes the borrower's name, loan number, details of the original loan, the proposed modified terms, and both parties' signatures, along with any additional documentation required by the lender.

Fill out your mortgage modification agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Modification Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.