Fannie Mae 1009 2010-2026 free printable template

Show details

Residential Loan Application for Reverse Mortgages This application is designed to be completed by the applicant(s) with the lender s assistance. Applicants should complete this form as Borrower or

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 1009 form

Edit your fannie mae 1009 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fannie mae site pdffiller com site blog pdffiller com form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fannie mae form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit get create make and sign pdffiller user ratings on g2 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out what is a 1009 form mortgage

How to fill out Fannie Mae 1009

01

Obtain the Fannie Mae Form 1009 from the official website or relevant source.

02

Fill out personal information, including name, address, and contact details.

03

Provide details about the property, including address and type of property.

04

Include information on the loan amount and terms.

05

Complete sections related to borrower and co-borrower income and employment history.

06

Fill out the financial section accurately, including assets and liabilities.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the form to the relevant lender or institution.

Who needs Fannie Mae 1009?

01

Homebuyers seeking mortgage financing.

02

Real estate professionals facilitating home purchases.

03

Lenders requiring standardized documentation for loan processing.

04

Investors interested in financing residential properties.

Fill

fannie mae form 1084

: Try Risk Free

People Also Ask about 1009 nec form

Does Fannie Mae require 2 years employment history?

A minimum history of two years of employment income is recommended. However, income that has been received for a shorter period of time may be considered as acceptable income, as long as the borrower's employment profile demonstrates that there are positive factors to reasonably offset the shorter income history.

How do you calculate self-employed borrower income?

How is self-employment income calculated? Self-employed individuals typically submit income tax forms to document their income for a mortgage loan. The lender will then average income over the past two years and divide that annual income by 12 to come up with an average monthly income.

What can you add back when calculating rental income?

Method for Calculating the Income When Schedule E is used to calculate qualifying rental income, the lender must add back any listed depreciation, interest, homeowners' association dues, taxes, or insurance expenses to the borrower's cash flow.

Does Fannie Mae require 2 years tax returns for self-employed?

Length of Self-Employment Fannie Mae generally requires lenders to obtain a two-year history of the borrower's prior earnings as a means of demonstrating the likelihood that the income will continue to be received.

What is Fannie Mae Form 1084?

This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. 5.

Can I get a mortgage without 2 years tax returns?

The majority of mortgage lenders require you to provide one to two years of tax returns. However, there are a small handful of lenders who may be willing to process a loan without seeing your tax returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute fannie mae form 1007 online?

Filling out and eSigning Fannie Mae 1009 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I edit Fannie Mae 1009 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share Fannie Mae 1009 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I complete Fannie Mae 1009 on an Android device?

Use the pdfFiller mobile app and complete your Fannie Mae 1009 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

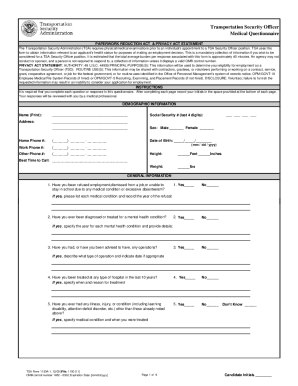

What is Fannie Mae 1009?

Fannie Mae 1009 is a form used by lenders to report the income and assets of borrowers for the purpose of underwriting mortgage loans.

Who is required to file Fannie Mae 1009?

Lenders and mortgage brokers who are originating loans that will be sold to Fannie Mae are required to file Fannie Mae 1009.

How to fill out Fannie Mae 1009?

To fill out Fannie Mae 1009, lenders need to provide detailed information about the borrower's income, asset verification, and other relevant financial information as specified in the form instructions.

What is the purpose of Fannie Mae 1009?

The purpose of Fannie Mae 1009 is to ensure accurate reporting of a borrower's financial position, which helps in determining their eligibility for mortgage loans.

What information must be reported on Fannie Mae 1009?

Information that must be reported on Fannie Mae 1009 includes borrower income sources, asset details, signatures, and any documentation that supports the reported data.

Fill out your Fannie Mae 1009 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fannie Mae 1009 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.