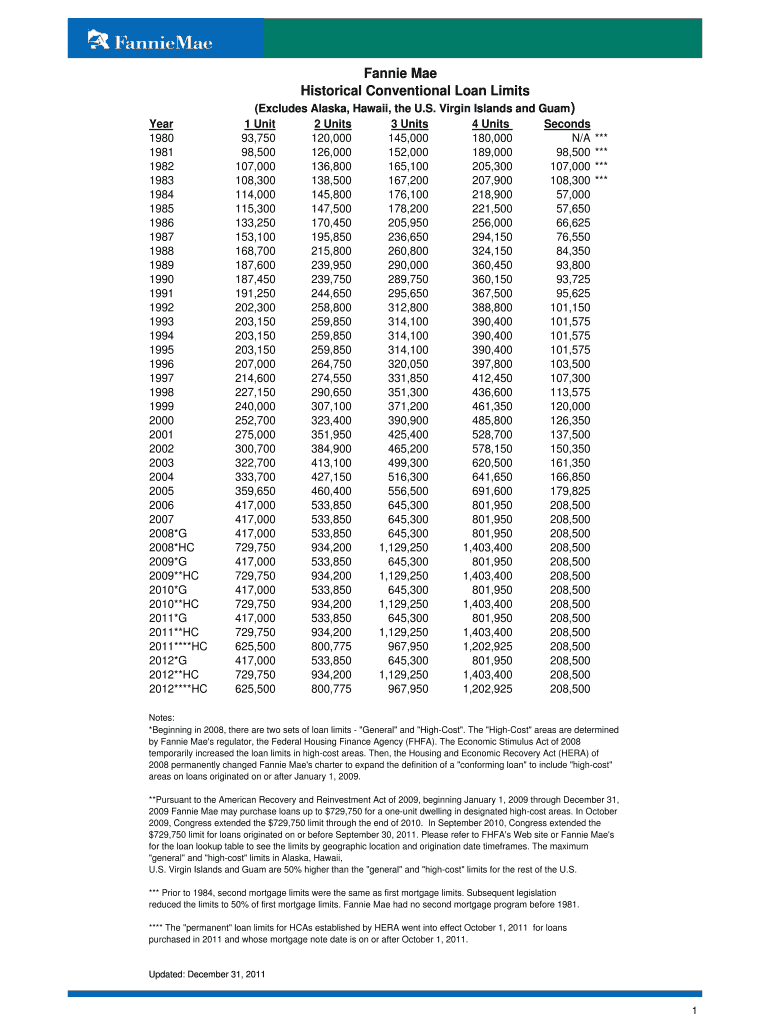

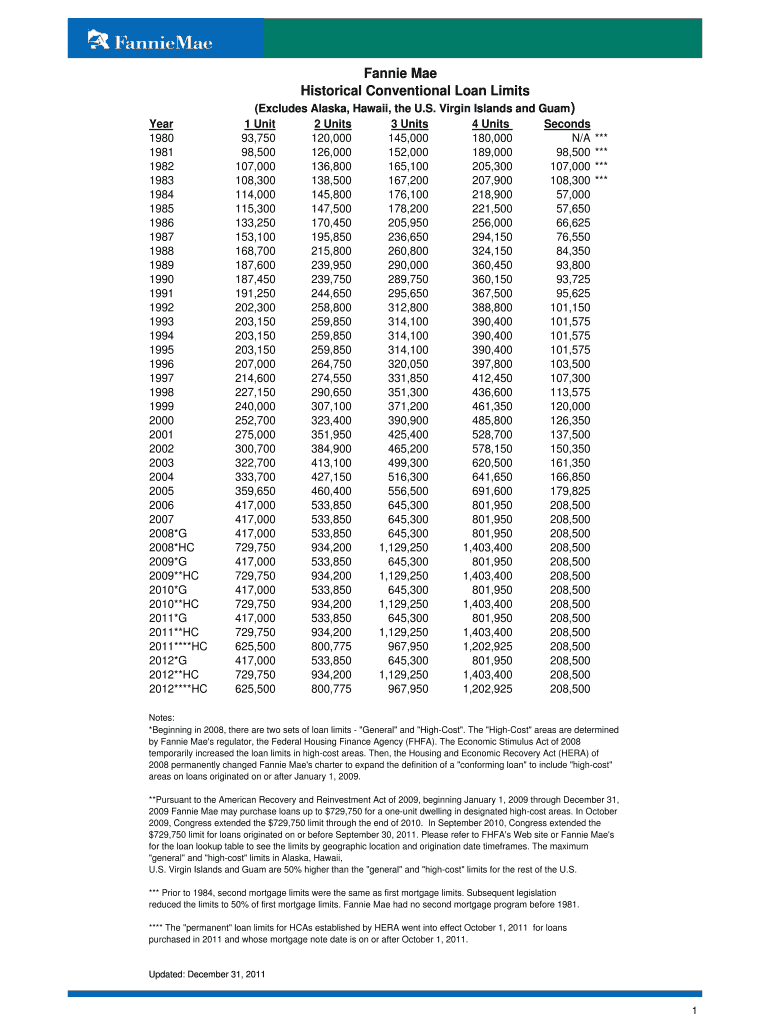

Get the free Historical Conventional Loan Limits

Show details

Fannie Mae

Historical Conventional Loan Limits

Year

1980

1981

1982

1983

1984

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008×G

2008×HC

2009×G

2009**HC

2010×G

2010**HC

2011×G

2011**HC

2011****HC

2012×G

2012**HC

2012****HC(Excludes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign historical conventional loan limits

Edit your historical conventional loan limits form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your historical conventional loan limits form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing historical conventional loan limits online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit historical conventional loan limits. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out historical conventional loan limits

01

To fill out historical conventional loan limits, you will need access to historical data on loan limits for conventional loans. This information can usually be obtained from government agencies or professional organizations in the mortgage industry.

02

Begin by researching the specific time period for which you need historical conventional loan limits. This could be a specific year or a range of years.

03

Once you have identified the time period, gather the relevant loan limit information for that period. This data may include maximum loan amounts for different types of properties (such as single-family homes, multi-unit properties, or high-cost areas) as well as any applicable adjustments or exceptions.

04

Organize the loan limit information in a clear and concise manner. This could involve creating a spreadsheet or table to easily compare the limits for different years or property types. Consider grouping the information by region or state if applicable.

05

Double-check the accuracy of the historical loan limit data and ensure that it is up-to-date. Loan limits can change over time due to various factors such as inflation, market conditions, or legislative changes. It's important to have the most accurate and current information available.

Who needs historical conventional loan limits?

01

Lenders and mortgage professionals rely on historical conventional loan limits to determine the maximum loan amount they can offer to borrowers. These limits help ensure that loans are within the acceptable risk guidelines set by lenders and government regulators.

02

Homebuyers and homeowners may also need to be familiar with historical conventional loan limits. Understanding these limits can help them determine the maximum mortgage amount they can potentially qualify for or refinance into.

03

Real estate professionals, including real estate agents and appraisers, may also benefit from knowing historical loan limits. This knowledge can assist them in accurately pricing and valuing properties, especially when dealing with multi-unit properties or properties located in high-cost areas.

In summary, filling out historical conventional loan limits involves researching and organizing loan limit data for a specific time period, ensuring the accuracy of the information, and making it accessible to relevant parties such as lenders, homebuyers, homeowners, and real estate professionals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my historical conventional loan limits directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your historical conventional loan limits and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I modify historical conventional loan limits without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your historical conventional loan limits into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit historical conventional loan limits on an Android device?

You can make any changes to PDF files, like historical conventional loan limits, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is historical conventional loan limits?

Historical conventional loan limits are the maximum loan amount that can be borrowed through a conventional loan for a given year. These limits are set by regulatory authorities and are based on various factors such as the location and the type of property.

Who is required to file historical conventional loan limits?

Lenders and financial institutions who offer conventional loans are required to file historical conventional loan limits. This is to ensure compliance with regulatory guidelines and to track lending practices over time.

How to fill out historical conventional loan limits?

Filling out historical conventional loan limits requires gathering information on the loan amounts disbursed for each year and comparing them to the maximum loan limits set for those respective years. This information is then reported to the regulatory authorities as per their prescribed format.

What is the purpose of historical conventional loan limits?

The purpose of historical conventional loan limits is to regulate the lending practices in the mortgage market and ensure that loans are within reasonable limits. These limits help to prevent excessive borrowing and promote stability in the housing market.

What information must be reported on historical conventional loan limits?

The information that must be reported on historical conventional loan limits includes the loan amounts disbursed for each year, the applicable loan limits for those years, and any other details required by the regulatory authorities for accurate reporting.

Fill out your historical conventional loan limits online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Historical Conventional Loan Limits is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.