Get the free Credit card rejected because of an "address mismatch"?

Show details

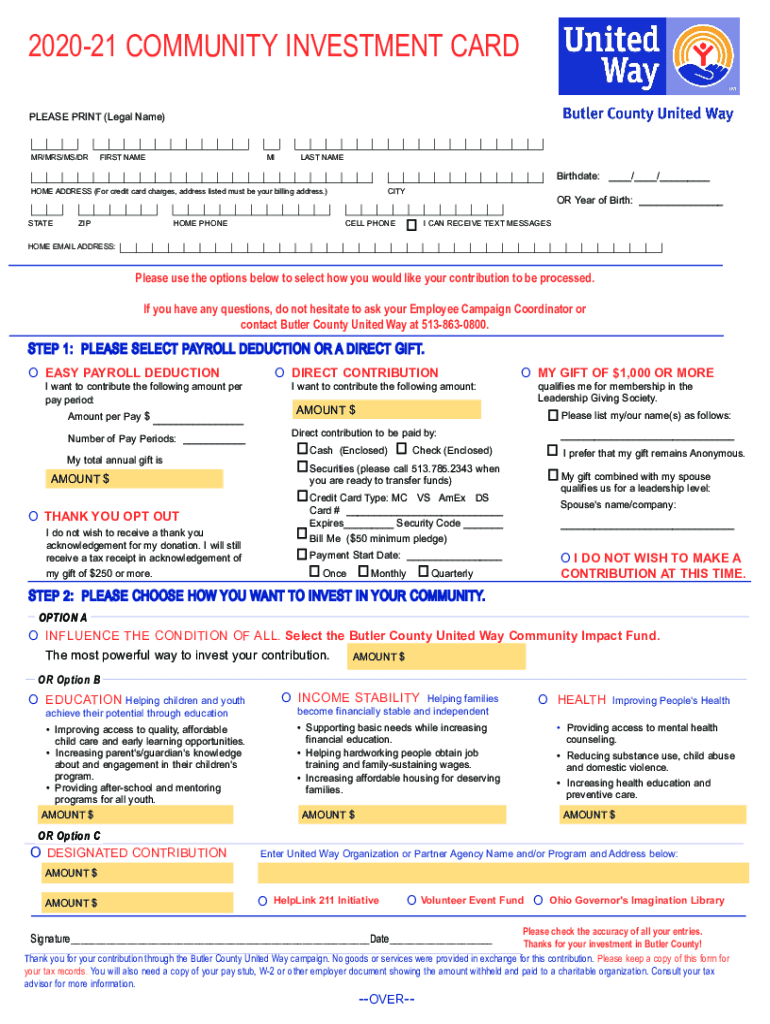

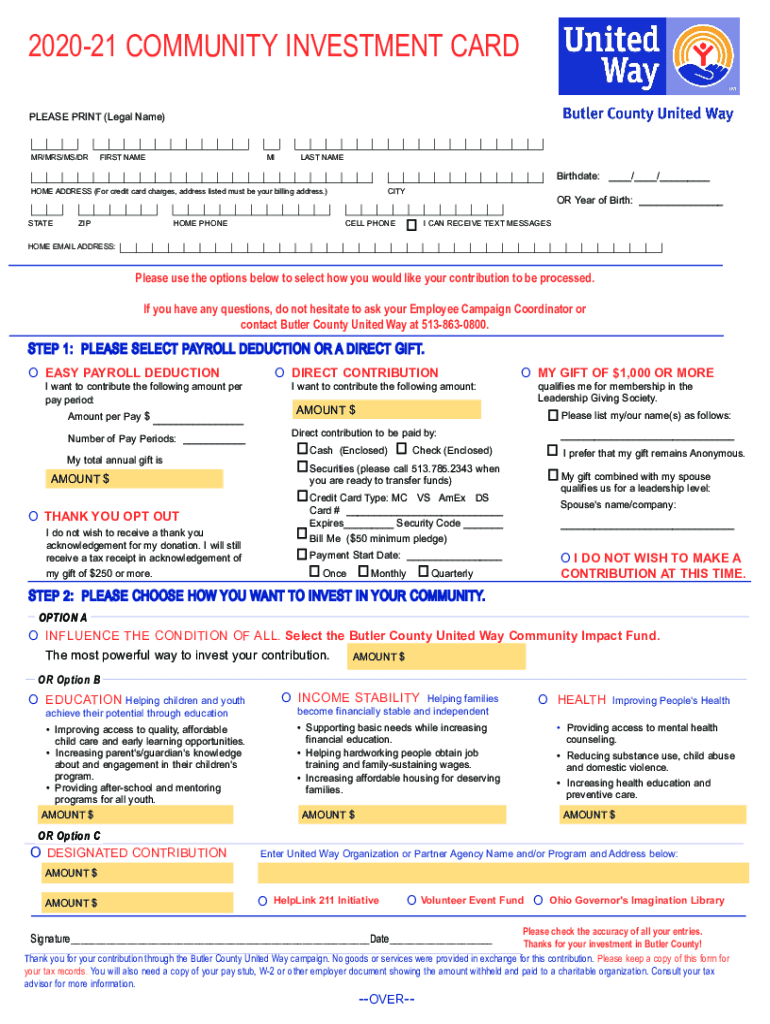

202021 COMMUNITY INVESTMENT CARD

PLEASE PRINT (Legal Name)MR/MRS/MS/FIRST NAMEMILAST NAMEBirthdate: ___/___/___

HOME ADDRESS (For credit card charges, address listed must be your billing address.)STATEZIPHOME

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card rejected because

Edit your credit card rejected because form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card rejected because form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit card rejected because online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit card rejected because. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card rejected because

How to fill out credit card rejected because

01

Check the reason for the rejection. Contact your credit card issuer to understand why your credit card was rejected. They will provide you with specific information.

02

Verify your credit card information. Make sure that you have entered all the required information correctly, including the card number, expiration date, CVV, and billing address.

03

Ensure sufficient funds are available. Confirm that you have enough available credit or funds in your bank account to cover the transaction.

04

Check for any outstanding balances or overdue payments. Pay off any pending dues or outstanding balances on your credit card to improve your chances of approval.

05

Review your credit history. If you have a poor credit score or a history of late payments, it can impact your credit card application. Work on improving your credit score before reapplying.

06

Consider alternative payment methods. If your credit card continues to be rejected, explore other payment options such as using a different credit card, debit card, or online payment platforms.

07

Contact merchant support. If the rejection occurs during an online transaction, reach out to the merchant's customer support for assistance. They may provide insight into the issue.

08

Seek professional help. If you are consistently facing credit card rejections, consult with a financial advisor or credit counselor who can offer guidance based on your specific situation.

Who needs credit card rejected because?

01

Individuals who have experienced a temporary financial setback and need to secure alternative payment options.

02

People with low credit scores or a history of late payments who struggle to get approved for traditional credit cards.

03

Individuals who want to avoid the temptation of overspending or accruing debt.

04

International travelers who face difficulties using their credit cards in certain countries or need a backup payment method.

05

Those who prefer to rely on cash or prepaid cards for budgeting purposes and want to limit their reliance on credit cards.

06

People who have concerns about identity theft or fraud and want to minimize the risk by not using credit cards.

07

Individuals who want to establish or rebuild their credit history and are willing to take the necessary steps to improve their creditworthiness.

08

Those who prefer using alternative payment methods like mobile wallets or online payment platforms instead of traditional credit cards.

09

Individuals who have a limited credit history and want to start building credit through responsible credit card usage.

10

Businesses or organizations that need to provide employees with company credit cards but want to set spending limits or closely monitor expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the credit card rejected because in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your credit card rejected because in seconds.

How can I edit credit card rejected because on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing credit card rejected because, you can start right away.

Can I edit credit card rejected because on an iOS device?

You certainly can. You can quickly edit, distribute, and sign credit card rejected because on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is credit card rejected because?

Credit card transactions may be rejected due to insufficient funds, expiration of the card, incorrect card details, or suspected fraudulent activity.

Who is required to file credit card rejected because?

Merchants and financial institutions that process credit card transactions are generally required to document and manage cases of rejected credit card payments.

How to fill out credit card rejected because?

To fill out a report on credit card rejections, include the cardholder's details, transaction amount, date of transaction, reason for rejection, and any relevant supporting documentation.

What is the purpose of credit card rejected because?

The purpose of documenting credit card rejections is to maintain accurate financial records, identify issues in transaction processing, and comply with financial regulations.

What information must be reported on credit card rejected because?

Information that must be reported includes the transaction date, attempt amount, reason for rejection, cardholder identification, and merchant details.

Fill out your credit card rejected because online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Rejected Because is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.