Get the free Tax Deferred SolutionsCalifornia-based full-service plan ...

Show details

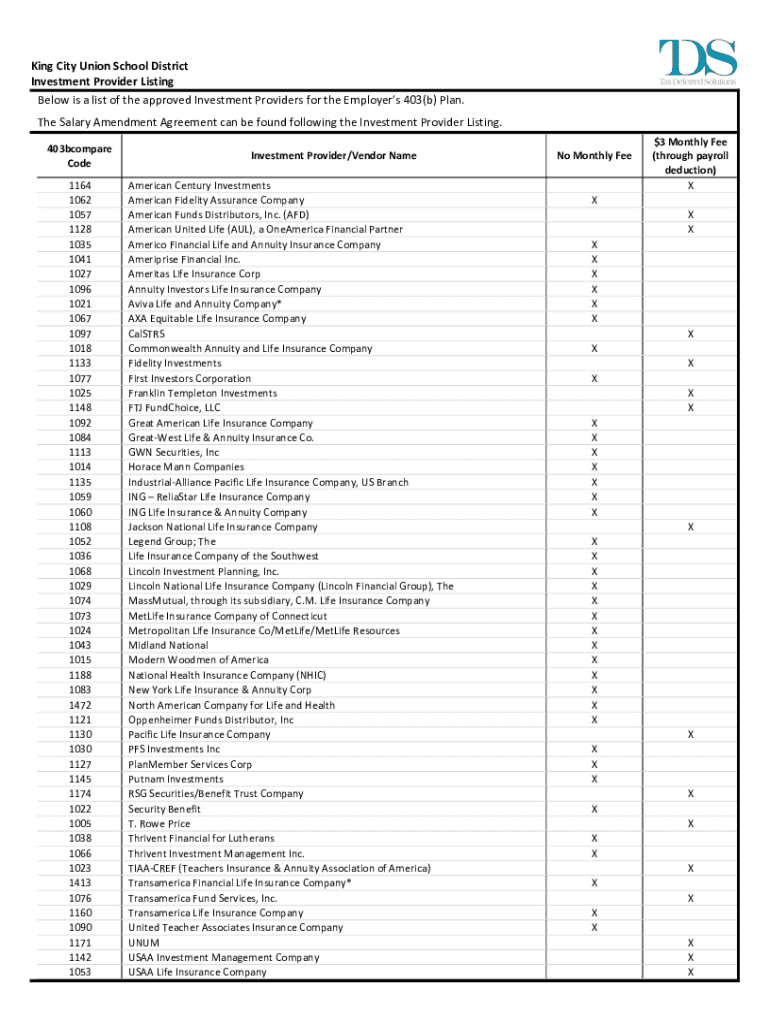

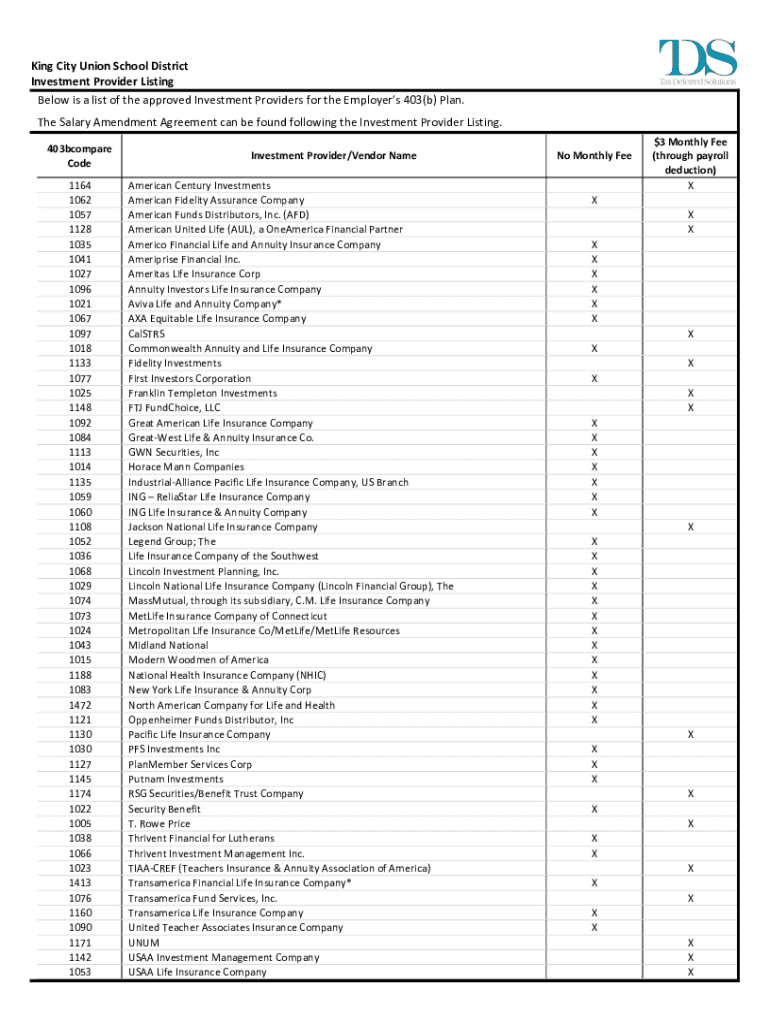

KingCityUnionSchoolDistrict

InvestmentProviderListing

BelowisalistoftheapprovedInvestmentProvidersfortheEmployers403(b)Plan. TheSalaryAmendmentAgreementcanbefoundfollowingtheInvestmentProviderListing.

403bcompare

Code

1164

1062

1057

1128

1035

1041

1027

1096

1021

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax deferred solutionscalifornia-based full-service

Edit your tax deferred solutionscalifornia-based full-service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax deferred solutionscalifornia-based full-service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax deferred solutionscalifornia-based full-service online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax deferred solutionscalifornia-based full-service. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax deferred solutionscalifornia-based full-service

How to fill out tax deferred solutionscalifornia-based full-service

01

Gather all necessary documents such as income statements, W-2 forms, and investment statements.

02

Determine your taxable income by subtracting any deductions or exemptions.

03

Research tax deferred solutions that are available in your area, specifically focusing on California-based full-service options.

04

Consult with a tax advisor or financial planner to understand the specific requirements and benefits of tax deferred solutions.

05

Decide on the appropriate tax deferred solution that suits your needs and goals.

06

Fill out the necessary application or enrollment forms for the chosen tax deferred solution.

07

Provide accurate and complete information while filling out the forms.

08

Attach any supporting documents required by the tax deferred solution provider.

09

Double-check all the information provided before submitting the forms.

10

Submit the completed forms and any required documentation to the tax deferred solution provider.

11

Follow up with the provider to ensure that your application has been received and processed.

12

Keep track of any relevant deadlines or additional steps required to maintain the tax deferred solution.

13

Regularly review and update your tax deferred solution as needed to optimize its benefits.

14

Seek professional advice if you encounter any issues or have questions regarding your tax deferred solution.

15

Stay informed about changes in tax laws or regulations that may affect your tax deferred solution.

Who needs tax deferred solutionscalifornia-based full-service?

01

Individuals who have a higher tax liability and want to legally reduce their tax burden.

02

Small business owners or self-employed individuals who need tax planning strategies to defer taxes on their income or investments.

03

High-income earners who are subject to higher tax rates and want to minimize their tax obligations.

04

Individuals with large investments or high net worth looking for wealth management solutions that provide tax advantages.

05

California residents who want to take advantage of California-based full-service tax deferred solutions.

06

Individuals or families planning for retirement and seeking long-term tax savings.

07

Investors looking for ways to grow their investments without incurring immediate taxable gains.

08

Individuals or businesses with significant capital gains seeking strategies to defer taxes on those gains.

09

Parents or guardians who want to save for their children's education while enjoying tax benefits.

10

Individuals who want to optimize their overall financial plan by incorporating tax deferred solutions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax deferred solutionscalifornia-based full-service directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your tax deferred solutionscalifornia-based full-service and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit tax deferred solutionscalifornia-based full-service online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your tax deferred solutionscalifornia-based full-service to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete tax deferred solutionscalifornia-based full-service on an Android device?

Use the pdfFiller mobile app and complete your tax deferred solutionscalifornia-based full-service and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is tax deferred solutionscalifornia-based full-service?

Tax Deferred Solutions is a California-based full-service provider that offers financial planning and tax strategies aimed at deferring taxes to maximize savings and investment potential.

Who is required to file tax deferred solutionscalifornia-based full-service?

Individuals and businesses seeking to take advantage of tax-deferred investment options or those who have specific tax-related transactions that qualify for tax deferral may be required to file.

How to fill out tax deferred solutionscalifornia-based full-service?

To fill out the tax deferred solutions form, gather relevant financial documents, provide accurate income and expense information, and follow the instructions on the form to ensure all sections are completed correctly.

What is the purpose of tax deferred solutionscalifornia-based full-service?

The purpose is to allow clients to defer taxes through strategic financial planning, aiming to reduce current tax liabilities and enhance long-term wealth accumulation.

What information must be reported on tax deferred solutionscalifornia-based full-service?

Clients must report income sources, investment details, deductions, and any previous tax filings relevant to their tax-deferred strategy.

Fill out your tax deferred solutionscalifornia-based full-service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Deferred Solutionscalifornia-Based Full-Service is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.