Get the free 401(k) Loans: Reasons to Borrow, Plus Rules and ...

Show details

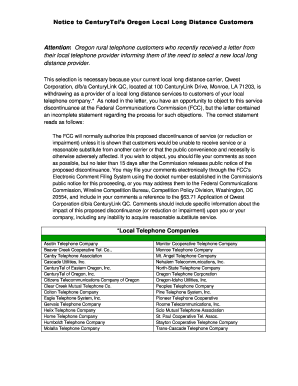

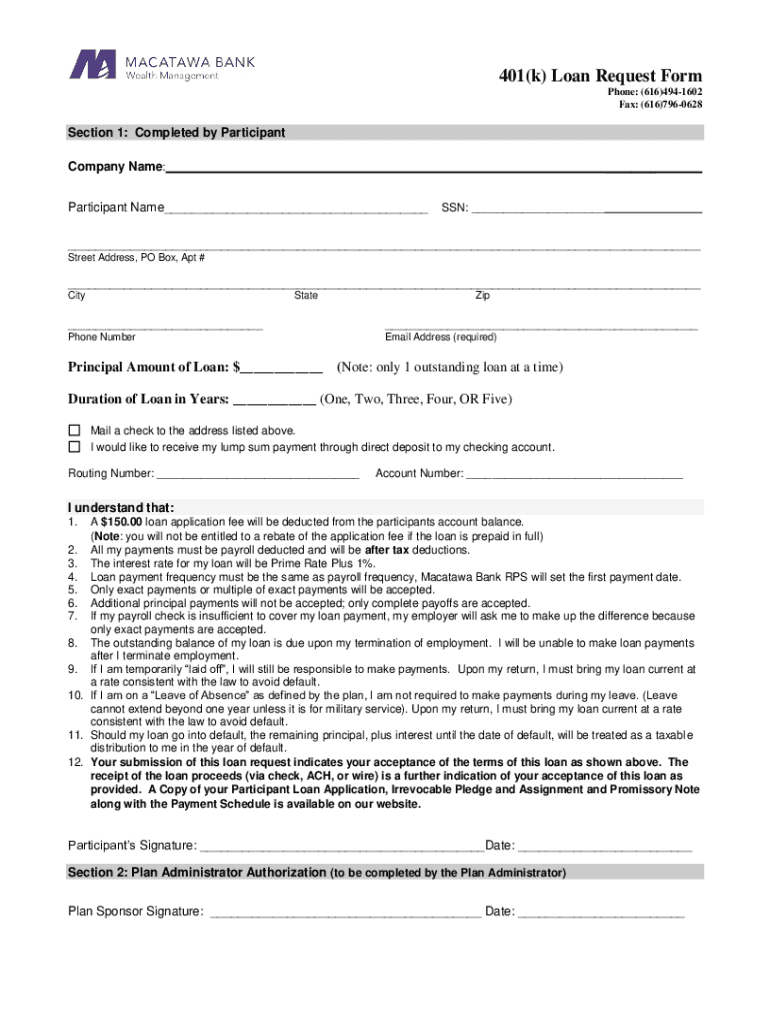

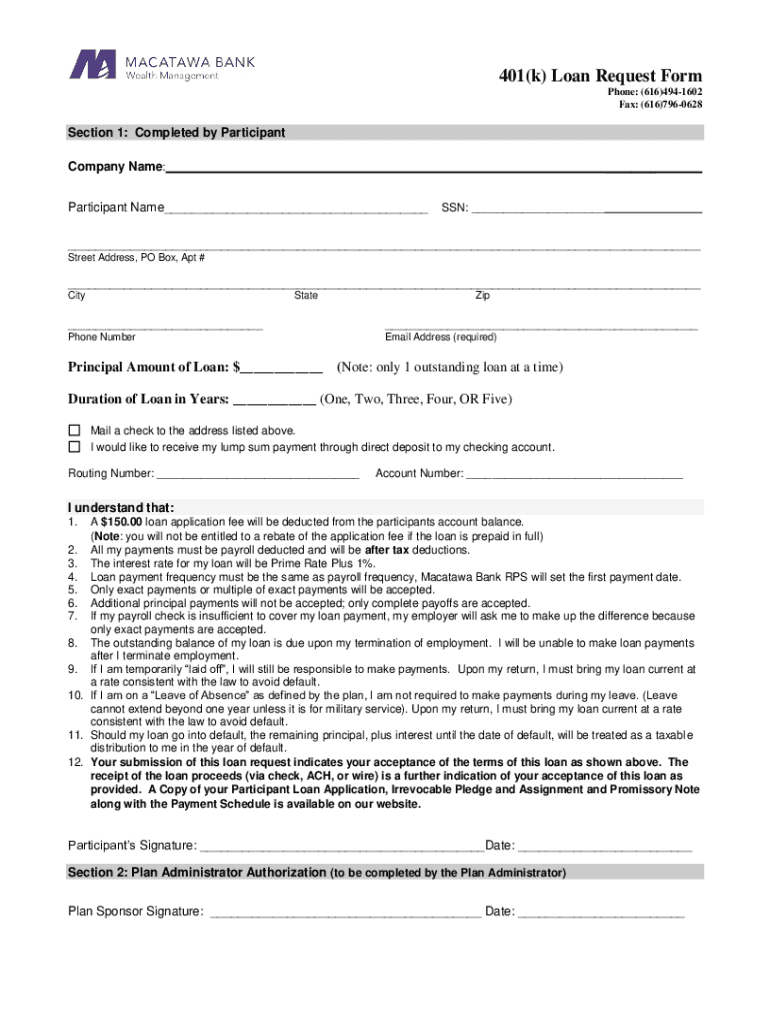

401(k) Loan Request Form Phone: (616)4941602 Fax: (616)7960628Section 1: Completed by Participant Company Name:___Participant Name___SSN: ______ Street Address, PO Box, Apt #___ CityStateZip______Phone

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401k loans reasons to

Edit your 401k loans reasons to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k loans reasons to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 401k loans reasons to online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 401k loans reasons to. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401k loans reasons to

How to fill out 401k loans reasons to

01

To fill out 401k loans reasons to, follow these steps:

02

Review the terms and conditions of your 401k plan to ensure that loans are allowed.

03

Determine the maximum amount you can borrow from your 401k account.

04

Understand the loan repayment terms, interest rates, and any fees associated with the loan.

05

Evaluate your financial situation and determine if borrowing from your 401k is the right decision for you.

06

Gather the necessary documentation required by your employer or plan administrator to process the loan application.

07

Fill out the loan application form accurately and provide all necessary information.

08

Submit the completed loan application along with the required documents to your employer or plan administrator.

09

Wait for the loan approval and review any additional instructions provided by your employer or plan administrator.

10

If approved, review the loan agreement and ensure you understand the terms and conditions.

11

Sign the loan agreement and follow any instructions provided to receive the funds.

12

Repay the loan according to the agreed-upon schedule, considering any interest and fees involved.

13

Keep track of your loan repayments and make sure to stay in compliance with the repayment terms.

14

Note: It is recommended to consult with a financial advisor or tax professional before taking a loan from your 401k.

Who needs 401k loans reasons to?

01

401k loans reasons to may be suitable for the following individuals:

02

- Individuals who are facing a financial emergency or need immediate access to funds.

03

- People who are unable to qualify for traditional loans due to poor credit history.

04

- Individuals who want to consolidate higher-interest debt into a lower-interest loan.

05

- Employees who have a stable income and feel confident in their ability to repay the loan.

06

- Individuals who are willing to accept the potential impacts on their retirement savings.

07

Note: It's important to carefully consider the implications before borrowing from a 401k, as it may affect your long-term retirement goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 401k loans reasons to from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your 401k loans reasons to into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit 401k loans reasons to straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 401k loans reasons to.

How do I complete 401k loans reasons to on an Android device?

Use the pdfFiller Android app to finish your 401k loans reasons to and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is 401k loans reasons to?

401k loans can be taken for various reasons such as purchasing a home, covering medical expenses, managing debt, or funding education.

Who is required to file 401k loans reasons to?

Typically, participants of a 401k plan who wish to take out a loan must comply with the plan's provisions and any documentation requirements set by the plan administrator.

How to fill out 401k loans reasons to?

To fill out a 401k loan request, you generally need to complete a loan application form provided by your plan administrator, detailing the amount requested and the reason for the loan.

What is the purpose of 401k loans reasons to?

The purpose of 401k loans is to provide individuals access to funds for immediate financial needs while allowing them to pay themselves back with interest.

What information must be reported on 401k loans reasons to?

When reporting on 401k loans, you typically need to provide the loan amount, the reason for the loan, the repayment terms, and recipient details in accordance with IRS regulations and plan rules.

Fill out your 401k loans reasons to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401k Loans Reasons To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.