Get the free How to submit gift aid for sponsorship or small collections

Show details

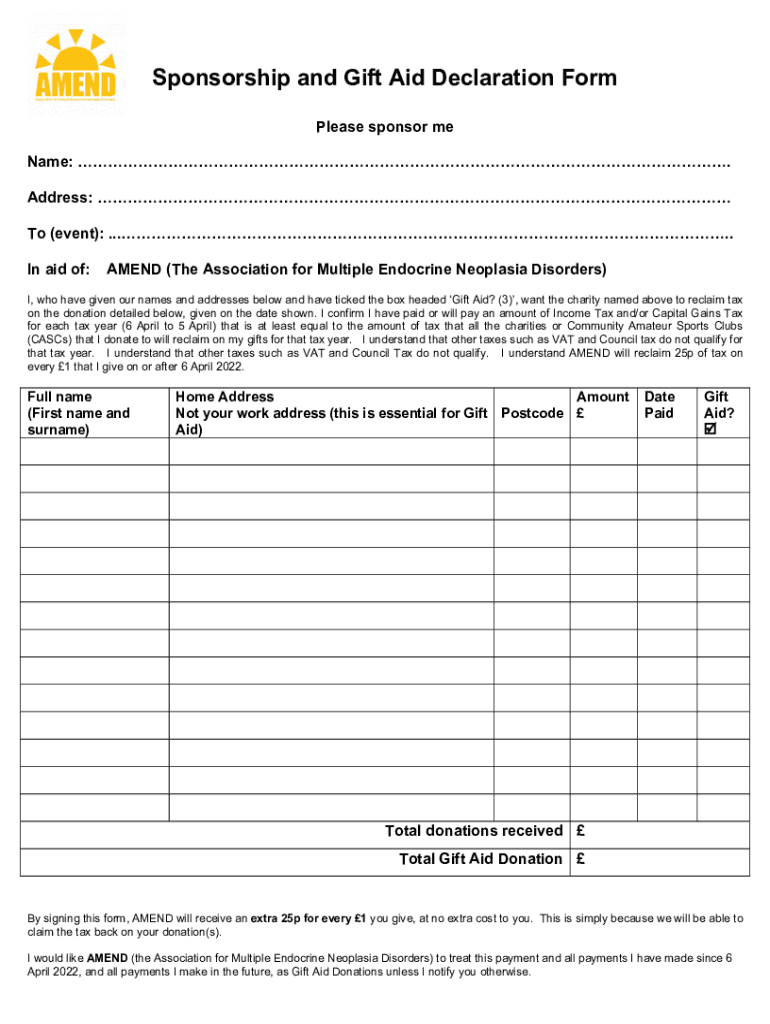

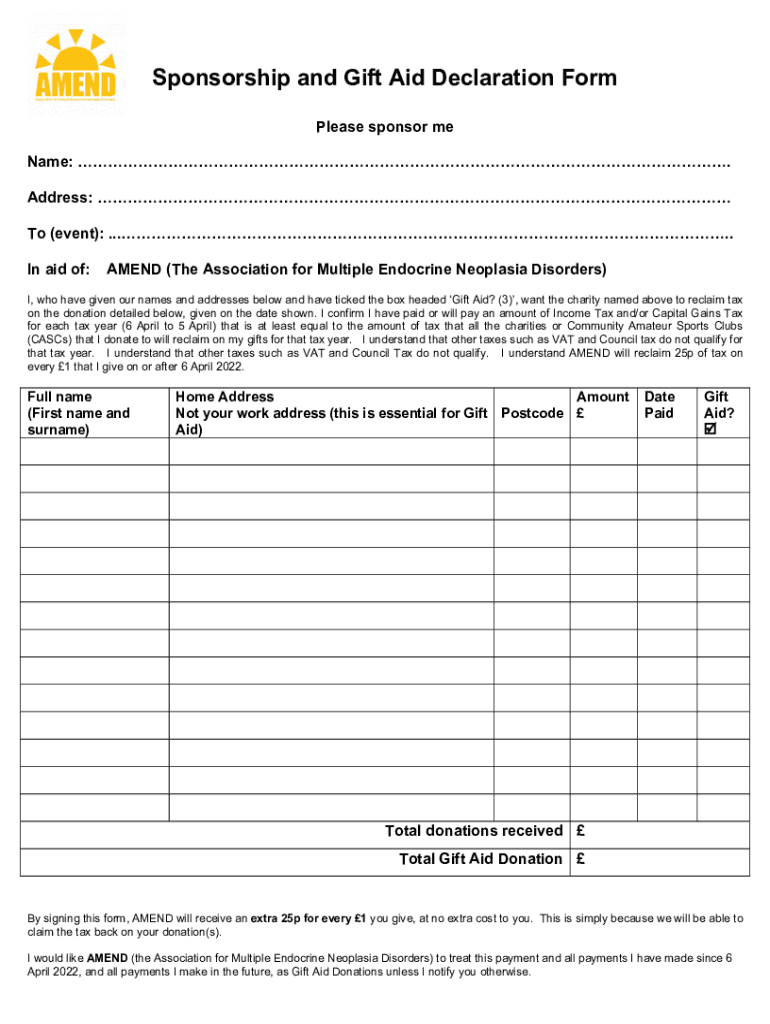

Sponsorship and Gift Aid Declaration Form Please sponsor me Name:. Address: To (event): ..... In aid of:AMEND (The Association.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to submit gift

Edit your how to submit gift form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to submit gift form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to submit gift online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit how to submit gift. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to submit gift

How to fill out how to submit gift

01

Start by gathering all the necessary information about the gift you want to submit. This may include details like the recipient's name, address, and contact information.

02

Next, find out the submission process of the specific platform or organization you wish to submit the gift to. This could be a website, an email address, or a physical address.

03

Prepare the gift according to the guidelines provided by the platform or organization. This may involve packaging it securely, adding any required documentation or forms, and ensuring it meets any size or weight restrictions.

04

Fill out any required forms or paperwork accompanying the gift. This could include a submission form, a letter explaining the purpose of the gift, or any other documentation requested.

05

Double-check all the information you have provided to ensure accuracy. Mistakes or missing details may delay or hinder the submission process.

06

Submit the gift by following the specified submission method. If it is an online submission, attach any necessary files or documents as instructed. If it is a physical submission, make sure to send it to the correct address using a reliable shipping method.

07

Keep a record of the submission for your own reference. This may include noting the date of submission, any tracking or reference numbers provided, and any correspondence with the platform or organization regarding the gift.

08

Follow up on the submission if necessary. If you don't receive any confirmation or acknowledgment of the gift within a reasonable timeframe, consider reaching out to the platform or organization to inquire about the status.

Who needs how to submit gift?

01

Anyone who wants to send a gift to a specific platform or organization needs to know how to submit the gift.

02

Individuals who wish to support a cause, contribute to a charity, or participate in a gift exchange program may need to submit a gift according to the specific guidelines set by the platform or organization.

03

Companies or businesses looking to promote their products or services through gifting may also need to know how to submit the gift to the intended recipients.

04

Fundraising initiatives, community drives, and donation campaigns often require individuals to submit gifts as a way of contributing to the cause.

05

It is essential for those who want to ensure their gift reaches the intended recipient and follows the necessary procedures to understand how to submit a gift.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my how to submit gift directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your how to submit gift and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit how to submit gift straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing how to submit gift, you need to install and log in to the app.

How do I fill out how to submit gift using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign how to submit gift. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is how to submit gift?

How to submit a gift refers to the process of reporting gifts to the IRS that exceed a certain annual threshold, usually through Form 709.

Who is required to file how to submit gift?

Anyone who gifts amounts over the annual exclusion limit, which is $17,000 per recipient for 2023, needs to file Form 709.

How to fill out how to submit gift?

To fill out Form 709, you need to provide details about the donor, the recipient, the value of the gift, and any applicable deductions or exemptions.

What is the purpose of how to submit gift?

The purpose is to ensure that gifts above a certain value are reported for tax purposes and to track the use of the lifetime estate and gift tax exemption.

What information must be reported on how to submit gift?

You must report the donor's details, recipient's details, description of the gift, fair market value, and any deductions or exclusions being claimed.

Fill out your how to submit gift online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Submit Gift is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.