Get the free Guidelines for Cash Dividend Distribution

Show details

This document outlines the guidelines for cash dividend distribution for Semirara Mining Corporation, detailing the cash dividend amount, record date, payment date, and tax treatment regarding withholding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guidelines for cash dividend

Edit your guidelines for cash dividend form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guidelines for cash dividend form via URL. You can also download, print, or export forms to your preferred cloud storage service.

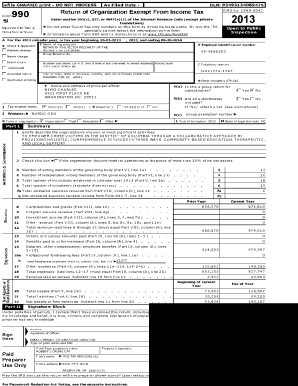

Editing guidelines for cash dividend online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit guidelines for cash dividend. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

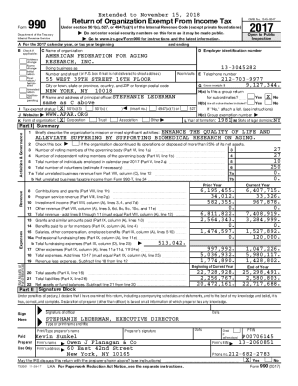

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guidelines for cash dividend

How to fill out Guidelines for Cash Dividend Distribution

01

Begin with the company name and relevant financial year.

02

Outline the criteria for dividend eligibility, including shareholder requirements.

03

Specify the method of dividend calculation based on company profits.

04

Determine the payment schedule, including dates for declaration and distribution.

05

Include any legal requirements and compliance with regulatory authorities.

06

Detail the communication plan to inform shareholders about the dividends.

07

Provide instructions for record-keeping and documentation regarding the dividend distribution.

Who needs Guidelines for Cash Dividend Distribution?

01

Company management teams responsible for financial decisions.

02

Shareholders seeking clarity on dividend distributions.

03

Financial analysts evaluating the company's profitability and payout strategy.

04

Regulatory bodies overseeing compliance with financial regulations.

Fill

form

: Try Risk Free

People Also Ask about

What are the requirements for the declaration of a cash dividend?

When declaring a cash dividend, the board of directors generally must: calculate the cash amount to be paid to the shareholders, both individually and in the aggregate. fix a record date for determining the stockholders who will be entitled to receive the dividend (based on the laws of your state)

What are the requirements when declaring dividends?

(1) The company may by ordinary resolution declare dividends, and the directors may decide to pay interim dividends. (2) A dividend must not be declared unless the directors have made a recommendation as to its amount. Such a dividend must not exceed the amount recommended by the directors.

How is cash dividend distributed?

Cash dividend - This is the most common type of dividend. Shareholders receive a cash payment for each share of a company they own. Cash dividends are usually paid on a regular basis, such as half-yearly or annually.

What is the requirement for the declaration of a cash dividends?

There are three prerequisites to paying a cash dividend: a decision by the board of directors, sufficient cash, and sufficient retained earnings. Four dates are associated with a cash dividend.

What are the rules for dividend payout?

(a) The final dividend, if any, is paid once in a financial year after the preparation of the annual financial statements. (b) The Board of Directors shall recommend the final dividend to the Shareholders for their approval in the Annual General Meeting of the Company.

What is the requirement to declare a dividend?

Conditions for Dividend Payment A company may only make a distribution of profits to its shareholders if the company is solvent. The company is regarded as solvent if it is able to pay its debts as and when the debts become due within 12 months immediately after the distribution is made.

What are the rules for declaring dividends?

Dividend The company's assets exceed its liabilities immediately before the dividend is declared and the excess is sufficient for the payment of the dividend. The payment of the dividend is fair and reasonable to the company's shareholders as a whole.

What 3 conditions must be met before a cash dividend is paid?

They are payouts of retained earnings, which is accumulated profit. Therefore, cash dividends reduce both the Retained Earnings and Cash account balances. There are three prerequisites to paying a cash dividend: a decision by the board of directors, sufficient cash, and sufficient retained earnings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Guidelines for Cash Dividend Distribution?

Guidelines for Cash Dividend Distribution outline the procedures and criteria that a company must follow when declaring and distributing cash dividends to its shareholders.

Who is required to file Guidelines for Cash Dividend Distribution?

Publicly traded companies and those that are subject to regulatory oversight are typically required to file guidelines for cash dividend distribution.

How to fill out Guidelines for Cash Dividend Distribution?

To fill out the Guidelines for Cash Dividend Distribution, companies should provide accurate financial data, ensure compliance with relevant laws and regulations, and include their dividend policy and criteria for distribution.

What is the purpose of Guidelines for Cash Dividend Distribution?

The purpose of Guidelines for Cash Dividend Distribution is to ensure transparency, fairness, and compliance in the process of distributing dividends among shareholders.

What information must be reported on Guidelines for Cash Dividend Distribution?

Information that must be reported includes the company's dividend policy, financial performance, the amount of dividends declared, the method of payment, and any relevant dates associated with the dividend distribution.

Fill out your guidelines for cash dividend online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guidelines For Cash Dividend is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.