Get the free Morocco - Tax Treaty DocumentsInternal Revenue Service

Show details

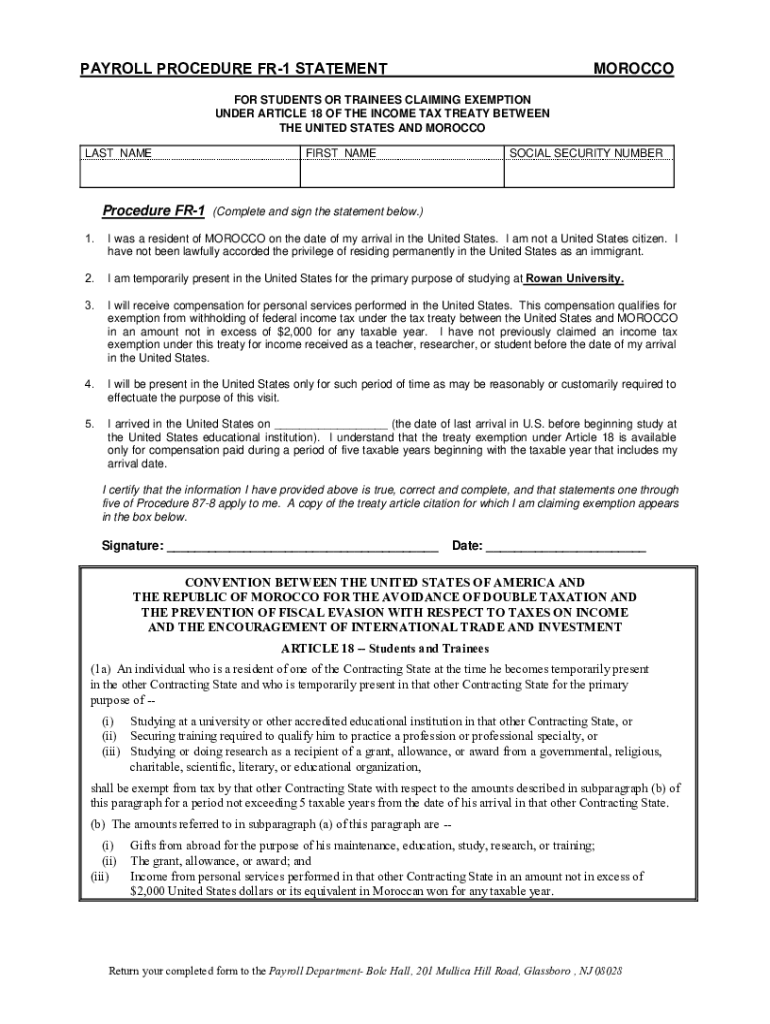

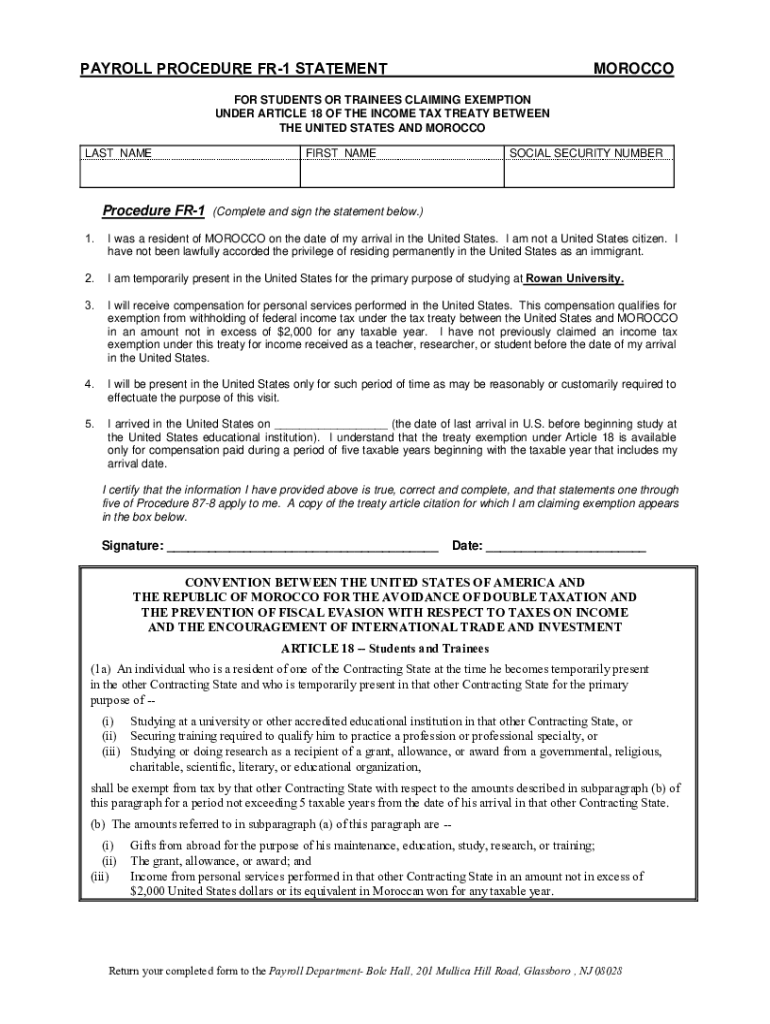

PAYROLL PROCEDURE FR1 STATEMENTMOROCCOFOR STUDENTS OR TRAINEES CLAIMING EXEMPTION

UNDER ARTICLE 18 OF THE INCOME TAX TREATY BETWEEN

THE UNITED STATES AND MOROCCO

LAST NAMEFIRST ASOCIAL SECURITY NUMBERProcedure

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign morocco - tax treaty

Edit your morocco - tax treaty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your morocco - tax treaty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing morocco - tax treaty online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit morocco - tax treaty. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out morocco - tax treaty

How to fill out morocco - tax treaty

01

Begin by gathering all necessary documents and information, such as your personal information, tax identification number, and details about your income and assets.

02

Understand the tax treaty between your country and Morocco. Familiarize yourself with the specific provisions and rules mentioned in the treaty.

03

Fill out the tax treaty form. Make sure to complete all required sections accurately and provide necessary details, such as the tax year, applicable articles of the treaty, and income types.

04

Attach any supporting documents as required. This may include proof of residency, employment details, or any other relevant documentation.

05

Double-check all the information provided in the form and ensure its accuracy.

06

Submit the completed tax treaty form along with the supporting documents to the relevant tax authority in your country.

07

Await confirmation or response from the tax authority. They will review the form and supporting documents to determine its validity and eligibility.

08

If approved, you may enjoy the benefits and provisions outlined in the Morocco-tax treaty. If any discrepancies or issues arise, follow up with the tax authority for further clarification or resolution.

Who needs morocco - tax treaty?

01

Individuals or businesses residing or operating in Morocco who have cross-border income or assets.

02

Individuals or businesses residing or operating in a country that has a tax treaty with Morocco.

03

Individuals or businesses needing to benefit from the tax provisions and benefits outlined in the Morocco-tax treaty.

04

Tax professionals or advisors who assist individuals or businesses with international tax matters involving Morocco.

05

Any individual or business seeking to ensure proper tax treatment and avoidance of double taxation between Morocco and their country of residence or operation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find morocco - tax treaty?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the morocco - tax treaty. Open it immediately and start altering it with sophisticated capabilities.

How do I execute morocco - tax treaty online?

pdfFiller has made filling out and eSigning morocco - tax treaty easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the morocco - tax treaty in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your morocco - tax treaty and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is morocco - tax treaty?

The Morocco tax treaty is an agreement between Morocco and another country designed to avoid double taxation and prevent fiscal evasion with respect to taxes on income and capital.

Who is required to file morocco - tax treaty?

Individuals or entities that receive income from Morocco or have financial interests in Morocco may be required to file under the Morocco tax treaty, particularly if they wish to benefit from reduced tax rates or exemptions.

How to fill out morocco - tax treaty?

To fill out the Morocco tax treaty forms, one must provide personal or business information, details of income received, and residency status, along with any necessary supporting documentation to claim benefits under the treaty.

What is the purpose of morocco - tax treaty?

The purpose of the Morocco tax treaty is to eliminate double taxation on income, facilitate cross-border trade and investment, and enhance cooperation between tax authorities.

What information must be reported on morocco - tax treaty?

Information required includes the taxpayer's identity, residency status, details of the income earned, applicable tax rates, and any claims for exemptions or reductions under the treaty.

Fill out your morocco - tax treaty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Morocco - Tax Treaty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.