Get the free Microfinance Institutions/Rural Credit Reporting - www1 ifc

Show details

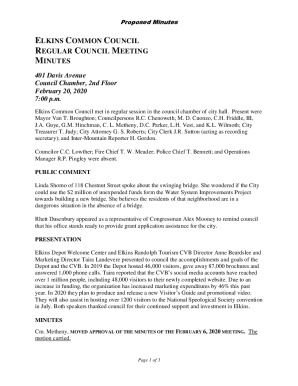

This presentation provides insights into microfinance institutions, focusing on credit reporting practices within the sector, challenges faced, and case studies showcasing the impact of effective

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign microfinance institutionsrural credit reporting

Edit your microfinance institutionsrural credit reporting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your microfinance institutionsrural credit reporting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit microfinance institutionsrural credit reporting online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit microfinance institutionsrural credit reporting. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out microfinance institutionsrural credit reporting

How to fill out Microfinance Institutions/Rural Credit Reporting

01

Gather all necessary financial data of the clients, including income statements and loan information.

02

Obtain consent from clients to share their data with the microfinance institution.

03

Access the reporting format or platform specified by the microfinance institution or regulatory body.

04

Fill in the client details accurately, including personal identification information and loan specifics.

05

Verify the data to ensure it is correct and complete before submission.

06

Submit the filled report by the given deadline through the required method (online portal, physical submission, etc.).

Who needs Microfinance Institutions/Rural Credit Reporting?

01

Microfinance institutions seeking to assess creditworthiness of borrowers.

02

Regulatory bodies monitoring the lending practices of microfinance institutions.

03

Researchers studying the impact of microfinance on rural communities.

04

Rural clients seeking access to credit and financial services.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5c of microfinance?

Lenders also use these five Cs—character, capacity, capital, collateral, and conditions—to set your loan rates and loan terms.

What is the difference between micro credit and microfinance?

Microcredit is considered as a poverty reduction tool, whereas Microfinance is considered as a tool for poverty alleviation, it aims to provide financial inclusion to the unbanked population.

What are the 5 Cs explained?

Examines five key areas: Company, Customers, Competitors, Collaborators, and Climate. It serves as a roadmap that illuminates the critical factors impacting an organization, offering insights that can be harnessed to drive growth and profitability.

What are the 5 C's of microfinance?

The 5 Cs of Credit analysis are – Character, Capacity, Capital, Collateral, and Conditions. They are used by lenders to evaluate a borrower's creditworthiness and include factors such as the borrower's reputation, income, assets, collateral, and the economic conditions impacting repayment.

What are the five principles of microfinance?

These are Principle 1 (Objectives, independence, powers, transparency and cooperation), Principle 4 (Transfer of significant ownership), and Principle 5 (Major acquisitions).

What are the 5 C's of microfinance?

Called the five Cs of credit, they include capacity, capital, conditions, character, and collateral.

What is the difference between microfinance and regular stream bank in English?

Microfinance caters to the financial services needs of the poor and micro enterprises and is normally collateral-free short term facility whereas the commercial banks generally deal with corporate clients, SMEs and individuals with larger income levels and extend financing facilities primarily based on collaterals and

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Microfinance Institutions/Rural Credit Reporting?

Microfinance Institutions/Rural Credit Reporting refers to the process by which microfinance institutions track and report financial transactions related to lending, borrowing, and other financial services provided to underserved populations, particularly in rural areas.

Who is required to file Microfinance Institutions/Rural Credit Reporting?

Entities that are classified as microfinance institutions, which provide financial services to low-income individuals or groups, are required to file Microfinance Institutions/Rural Credit Reporting.

How to fill out Microfinance Institutions/Rural Credit Reporting?

To fill out Microfinance Institutions/Rural Credit Reporting, institutions must gather relevant financial data, complete the specified forms accurately by providing required details, and submit them according to the regulatory guidelines set by the appropriate authority.

What is the purpose of Microfinance Institutions/Rural Credit Reporting?

The purpose of Microfinance Institutions/Rural Credit Reporting is to enhance transparency in microfinance operations, monitor the financial health of microfinance institutions, and ensure compliance with regulatory requirements to promote sustainable development in rural areas.

What information must be reported on Microfinance Institutions/Rural Credit Reporting?

Required information includes details about loans issued, repayment status, borrower demographics, total assets, liabilities, income, expenditures, and any other financial indicators relevant to the institution's operations.

Fill out your microfinance institutionsrural credit reporting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Microfinance Institutionsrural Credit Reporting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.