Get the free Taxation of e-Commerce - cle or

Show details

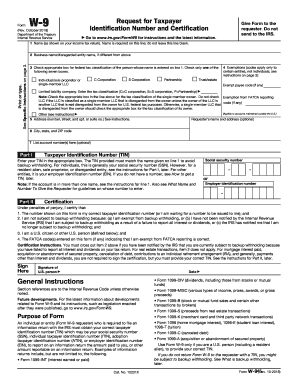

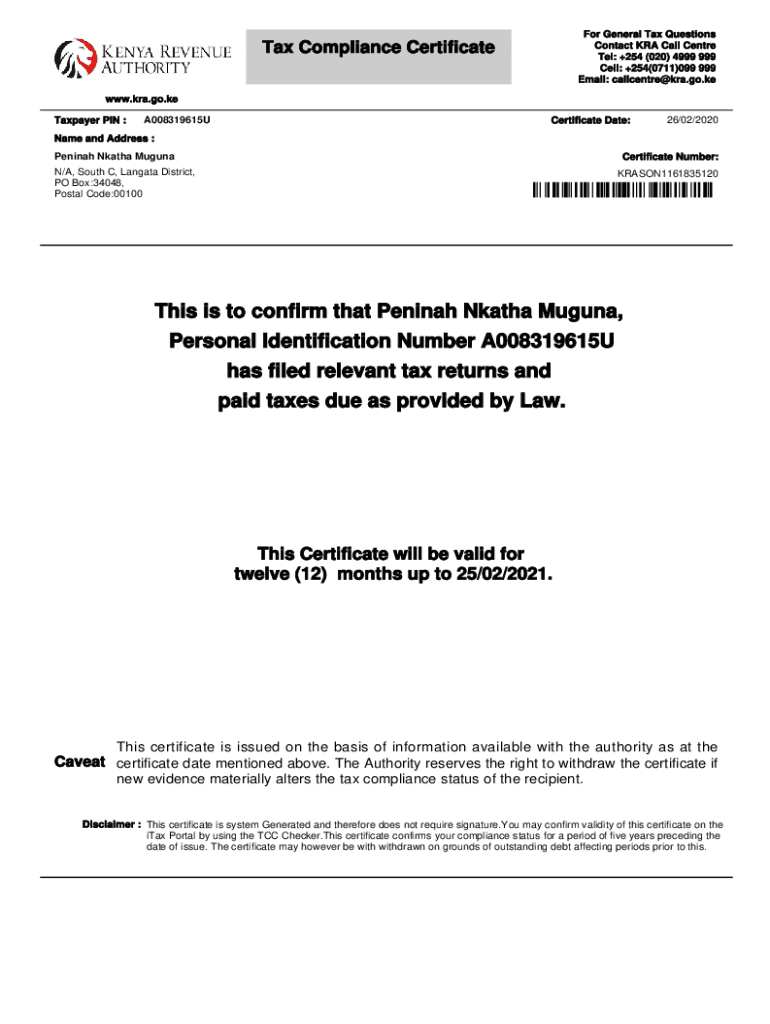

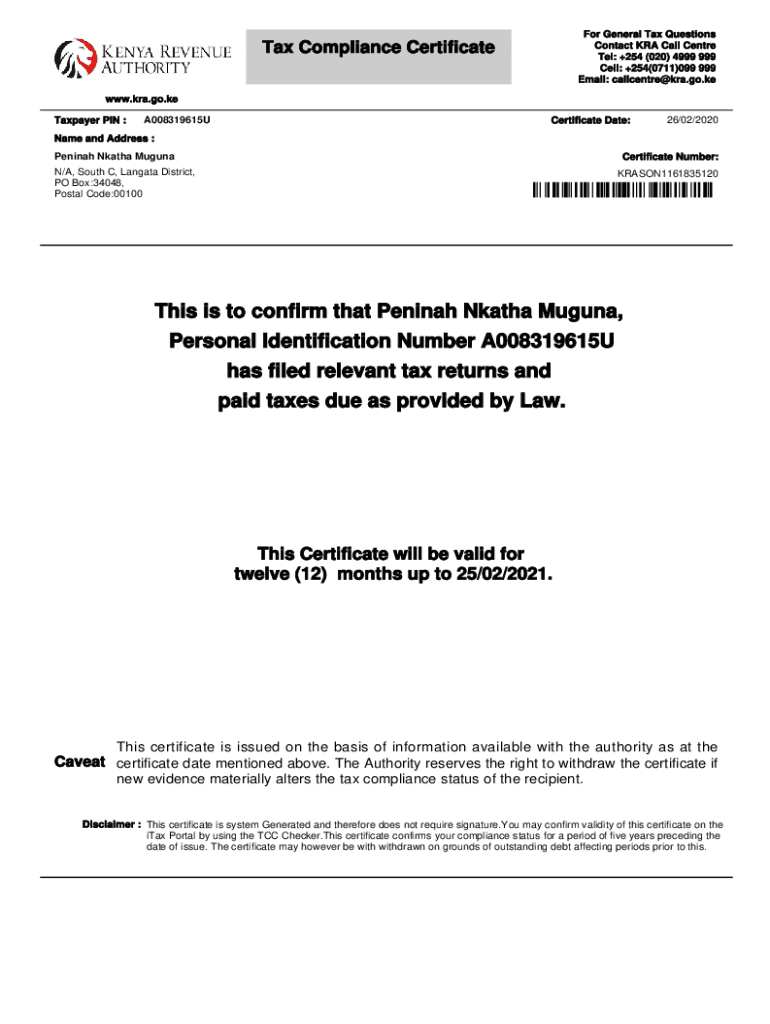

For General Tax Questions Contact ERA Call Center Tel: +254 (020) 4999 999 Cells: +254(0711)099 999 Email: callcentre@kra.go.keTax Compliance Certificate www.kra.go.ke Taxpayer PIN :A008319615UCertificate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxation of e-commerce

Edit your taxation of e-commerce form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxation of e-commerce form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxation of e-commerce online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit taxation of e-commerce. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxation of e-commerce

How to fill out taxation of e-commerce

01

First, gather all relevant financial records pertaining to your e-commerce business, including sales records, expenses, and receipts.

02

Next, determine your tax obligations based on the tax laws and regulations specific to your jurisdiction.

03

Ensure that you have a proper accounting system in place to accurately track and record all transactions related to your e-commerce business.

04

Complete the necessary forms or online filings required for reporting your e-commerce income and expenses to the tax authorities.

05

Don't forget to include any applicable deductions or credits that you may be eligible for to minimize your tax liability.

06

Double-check all the information provided in your tax return to ensure accuracy and completeness.

07

Submit your completed tax return and any required payments to the designated tax authority before the specified deadline.

08

Keep a copy of all the documentation related to your e-commerce taxation for future reference or potential audits.

09

Consider consulting with a tax professional or accountant who specializes in e-commerce taxation to ensure compliance and maximize tax efficiency.

Who needs taxation of e-commerce?

01

Any individual or business engaged in e-commerce activities and generating income through online sales needs to consider taxation of e-commerce.

02

E-commerce platforms and online marketplaces also need to navigate the complexities of taxation to facilitate compliance for their sellers.

03

Tax authorities require e-commerce businesses to report and pay taxes on their online sales to ensure fairness and equal treatment with traditional brick-and-mortar businesses.

04

Entrepreneurs, freelancers, and small business owners who sell products or services online are among those who have a taxation obligation.

05

Governments worldwide have recognized the growth of e-commerce and its significant impact on the economy, making taxation necessary to fund public services and infrastructure.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send taxation of e-commerce for eSignature?

taxation of e-commerce is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I sign the taxation of e-commerce electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out taxation of e-commerce on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your taxation of e-commerce. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is taxation of e-commerce?

Taxation of e-commerce refers to the process of taxing online sales and transactions conducted over the internet. This includes sales tax, income tax, and other applicable taxes on digital goods and services.

Who is required to file taxation of e-commerce?

Businesses and individuals engaged in e-commerce activities, including online retailers, service providers, and digital entrepreneurs, are required to file taxation of e-commerce, depending on their revenue and jurisdiction.

How to fill out taxation of e-commerce?

To fill out taxation of e-commerce, taxpayers need to gather relevant sales and income data, calculate applicable taxes, complete the appropriate tax forms for their jurisdiction, and submit them electronically or by mail, following the guidelines provided by tax authorities.

What is the purpose of taxation of e-commerce?

The purpose of taxation of e-commerce is to ensure that online businesses contribute to public revenue in a manner similar to traditional brick-and-mortar establishments, promote fair competition, and avoid tax evasion.

What information must be reported on taxation of e-commerce?

Information that must be reported includes total sales revenue, taxable sales, exemptions, state and local sales tax collected, and any other relevant financial data as required by tax authorities.

Fill out your taxation of e-commerce online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxation Of E-Commerce is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.