Get the free Personal Finance Literacy (Madura/Casey/Roberts)

Show details

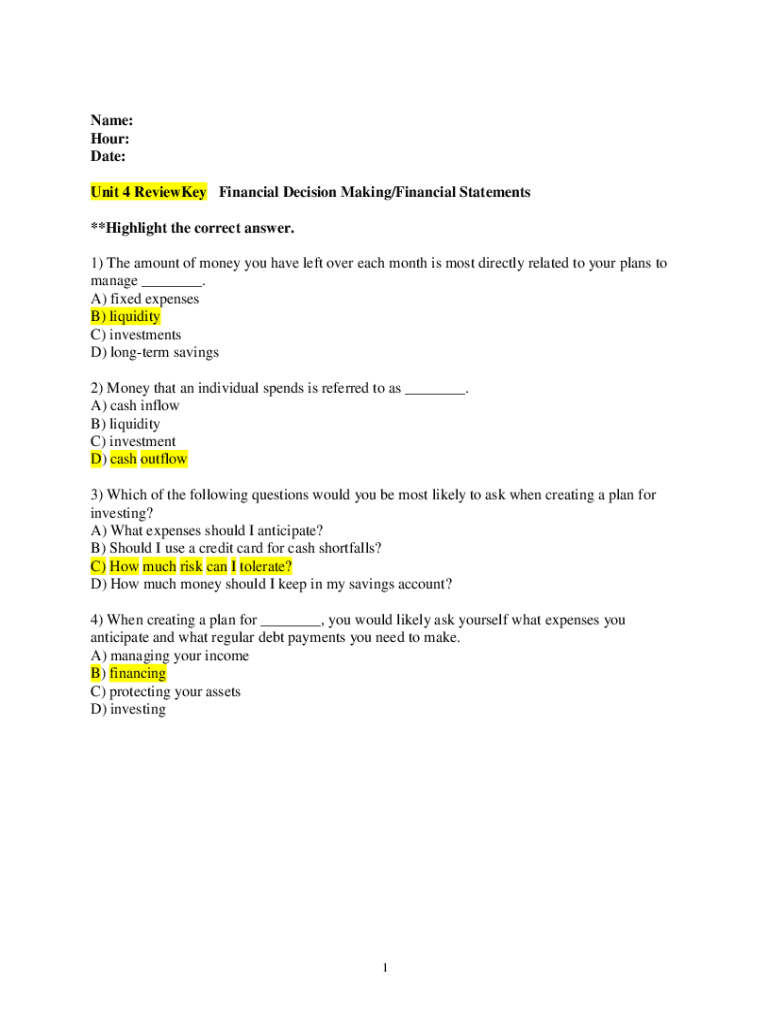

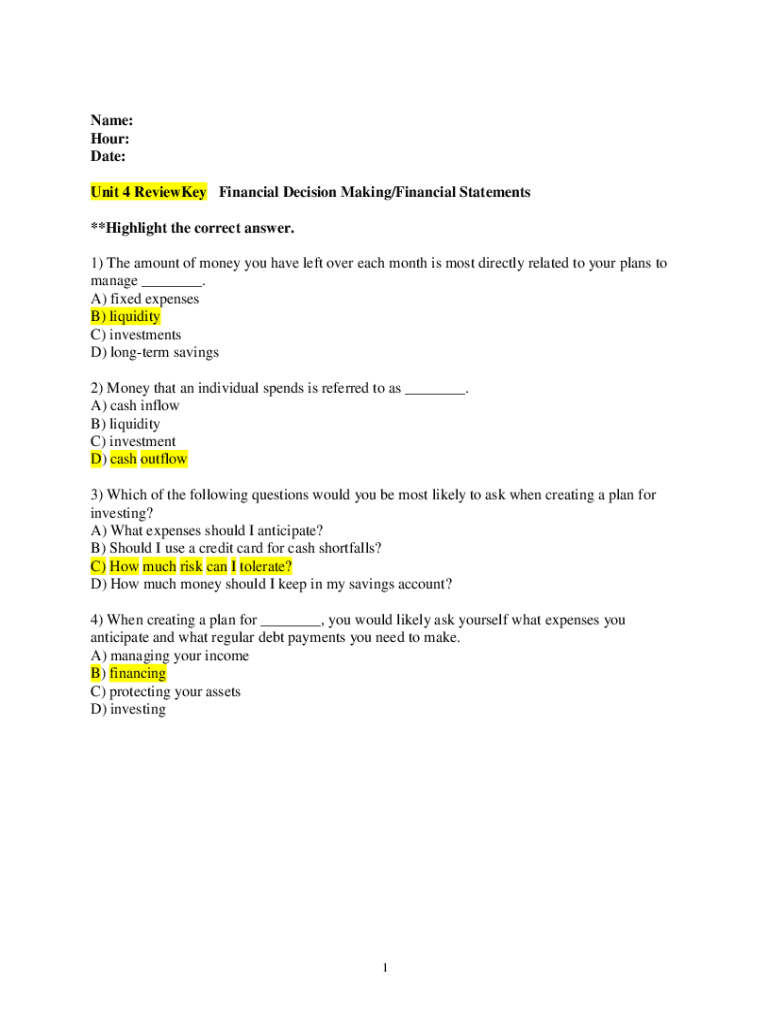

Name: Hour: Date: Unit 4 Review Key Financial Decision Making/Financial Statements **Highlight the correct answer. 1) The amount of money you have left over each month is most directly related to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal finance literacy maduracaseyroberts

Edit your personal finance literacy maduracaseyroberts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal finance literacy maduracaseyroberts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal finance literacy maduracaseyroberts online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal finance literacy maduracaseyroberts. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal finance literacy maduracaseyroberts

How to fill out personal finance literacy maduracaseyroberts

01

Start by organizing your financial documents, such as bank statements, bills, and tax information.

02

Create a budget to track your income and expenses. Determine your monthly income and allocate funds for essential expenses like housing, utilities, and groceries.

03

Set financial goals for short-term and long-term objectives. This can include saving for emergencies, retirement, or a specific purchase.

04

Educate yourself about personal finance through books, online resources, or courses. Understand concepts like investing, debt management, and credit scores.

05

Monitor your spending and track your progress towards your financial goals. Use tools like spreadsheets or personal finance apps to stay organized.

06

Reduce unnecessary expenses and find ways to save money. This can include cutting back on dining out, entertainment, or finding cheaper alternatives for everyday needs.

07

Build an emergency fund to cover unexpected expenses. Aim for at least three to six months' worth of living expenses.

08

Consider investing for long-term wealth accumulation. Learn about different investment options like stocks, bonds, mutual funds, or real estate.

09

Manage and reduce debt by paying off high-interest loans or credit card balances first. Create a repayment plan and prioritize debt reduction.

10

Regularly review and adjust your financial plan as your circumstances change. Stay informed about updates in personal finance and adapt strategies accordingly.

Who needs personal finance literacy maduracaseyroberts?

01

Anyone who wants to gain control over their financial situation can benefit from personal finance literacy.

02

Young adults starting their careers can benefit from learning how to manage their income, expenses, and investments.

03

Individuals with existing debt can benefit from understanding strategies to reduce and manage their liabilities effectively.

04

Families and individuals who want to save for future goals, such as buying a house, starting a business, or funding education, can benefit from personal finance literacy.

05

Retirees and individuals approaching retirement can benefit from understanding how to maximize their savings and make appropriate financial decisions.

06

Entrepreneurs and small business owners can benefit from personal finance literacy to effectively manage their company's finances.

07

Anyone who wants to make informed decisions about their financial well-being and build long-term wealth can benefit from personal finance literacy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my personal finance literacy maduracaseyroberts directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your personal finance literacy maduracaseyroberts and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find personal finance literacy maduracaseyroberts?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the personal finance literacy maduracaseyroberts. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out the personal finance literacy maduracaseyroberts form on my smartphone?

Use the pdfFiller mobile app to fill out and sign personal finance literacy maduracaseyroberts on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is personal finance literacy maduracaseyroberts?

Personal finance literacy maduracaseyroberts refers to the knowledge and skills needed to make informed financial decisions.

Who is required to file personal finance literacy maduracaseyroberts?

Anyone who wants to improve their understanding of personal finance and make better financial choices can benefit from personal finance literacy maduracaseyroberts.

How to fill out personal finance literacy maduracaseyroberts?

Personal finance literacy maduracaseyroberts can be filled out by taking courses, reading books, attending workshops, or working with financial professionals.

What is the purpose of personal finance literacy maduracaseyroberts?

The purpose of personal finance literacy maduracaseyroberts is to empower individuals to make informed financial decisions, manage their money effectively, and plan for their future.

What information must be reported on personal finance literacy maduracaseyroberts?

Personal finance literacy maduracaseyroberts may include details about income, expenses, savings, investments, debt, insurance, and financial goals.

Fill out your personal finance literacy maduracaseyroberts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Finance Literacy Maduracaseyroberts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.