Get the free Private Flood Insurance Claims Process - Aon Edge

Show details

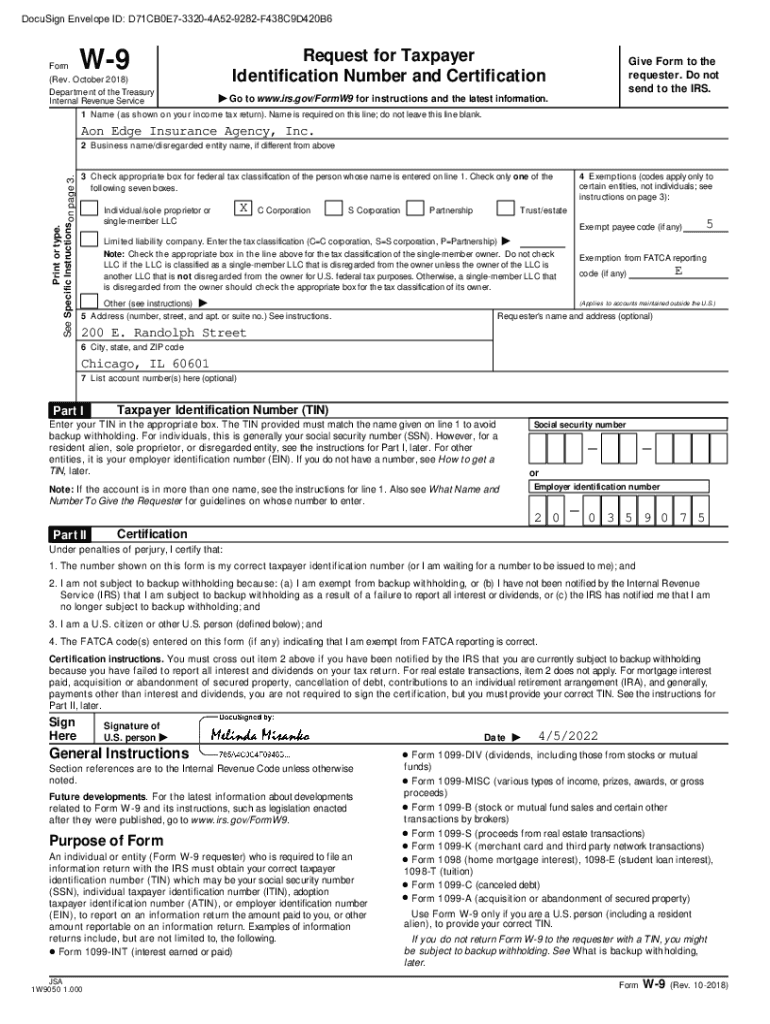

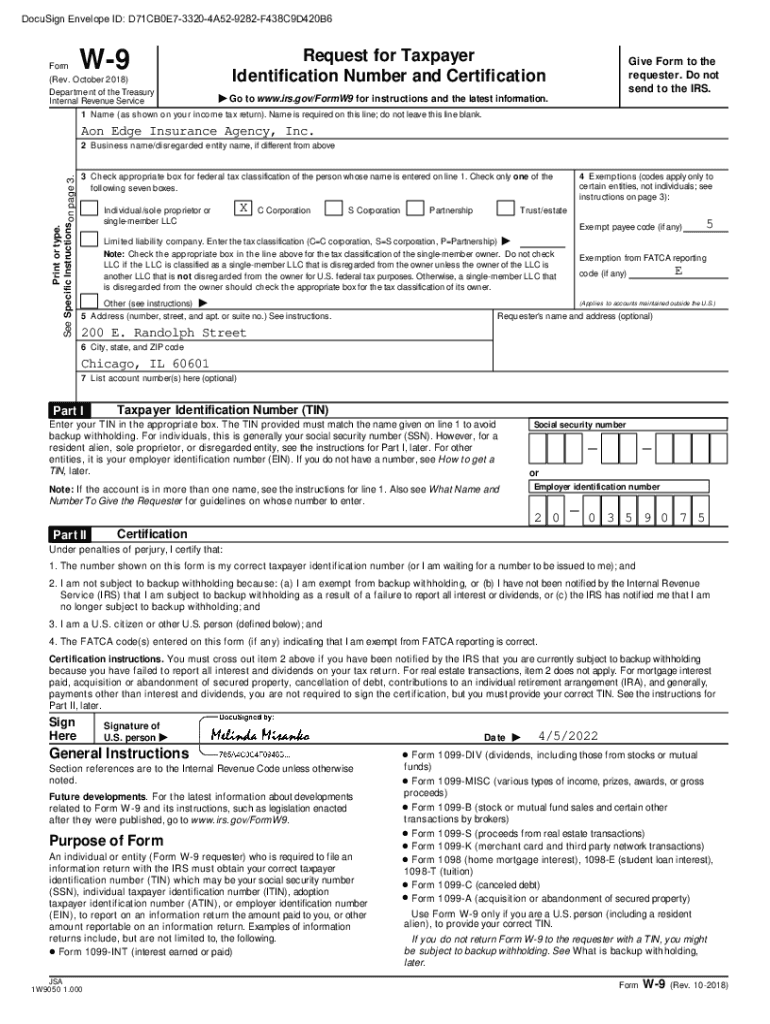

DocuSign Envelope ID: D71CB0E733204A529282F438C9D420B6FormW9(Rev. October 2018) Department of the Treasury Internal Revenue ServiceIRequest for Taxpayer Identification Number and CertificationGive

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private flood insurance claims

Edit your private flood insurance claims form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private flood insurance claims form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private flood insurance claims online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit private flood insurance claims. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private flood insurance claims

How to fill out private flood insurance claims

01

Step 1: Gather all necessary documents, such as the insurance policy, proof of loss form, and any supporting documentation.

02

Step 2: Document all damages by taking photographs and videos of affected areas.

03

Step 3: Contact your private flood insurance provider and report the claim as soon as possible.

04

Step 4: Complete the proof of loss form, providing details of the damages and estimated repair costs.

05

Step 5: Submit the completed proof of loss form and all supporting documentation to your insurance provider.

06

Step 6: Cooperate with any inspections or investigations conducted by the insurance company.

07

Step 7: Keep a record of all communication with the insurance company, including the date, time, and details of each interaction.

08

Step 8: Follow up regularly on the status of your claim and provide any additional information requested by the insurance company.

09

Step 9: Once your claim is approved, review the settlement offer carefully and negotiate if necessary.

10

Step 10: If you believe the claim has been unfairly denied or underpaid, consult with a legal professional specializing in insurance claims.

Who needs private flood insurance claims?

01

Homeowners who live in flood-prone areas and do not have access to government-backed flood insurance may need private flood insurance claims.

02

Business owners with properties located in flood zones might also require private flood insurance claims.

03

Individuals who want additional coverage or higher limits than what is provided by the National Flood Insurance Program (NFIP) may choose private flood insurance claims.

04

Property owners with valuable assets or high-risk properties may opt for private flood insurance claims to ensure adequate protection.

05

Anyone who wants more flexibility and customization in their flood insurance coverage may consider private policies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute private flood insurance claims online?

Easy online private flood insurance claims completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the private flood insurance claims in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your private flood insurance claims in seconds.

How do I edit private flood insurance claims straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit private flood insurance claims.

What is private flood insurance claims?

Private flood insurance claims are requests for compensation filed by policyholders under a private flood insurance policy, which provides coverage for damages caused by flooding.

Who is required to file private flood insurance claims?

Property owners who hold a private flood insurance policy and have experienced flood damage are required to file private flood insurance claims.

How to fill out private flood insurance claims?

To fill out private flood insurance claims, policyholders need to complete the claim form provided by their insurer, providing details about the flood damage, dates of the incident, and supporting documentation such as photographs and repair estimates.

What is the purpose of private flood insurance claims?

The purpose of private flood insurance claims is to enable policyholders to seek financial reimbursement for losses incurred due to flooding, thereby helping them recover and rebuild after an event.

What information must be reported on private flood insurance claims?

Information that must be reported on private flood insurance claims includes the policyholder's details, the date and location of the flood, a description of the damage, the estimated repair costs, and supporting evidence such as photos or receipts.

Fill out your private flood insurance claims online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Flood Insurance Claims is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.