Get the free ANCHOR Property Tax Relief Q&A - YouTube

Show details

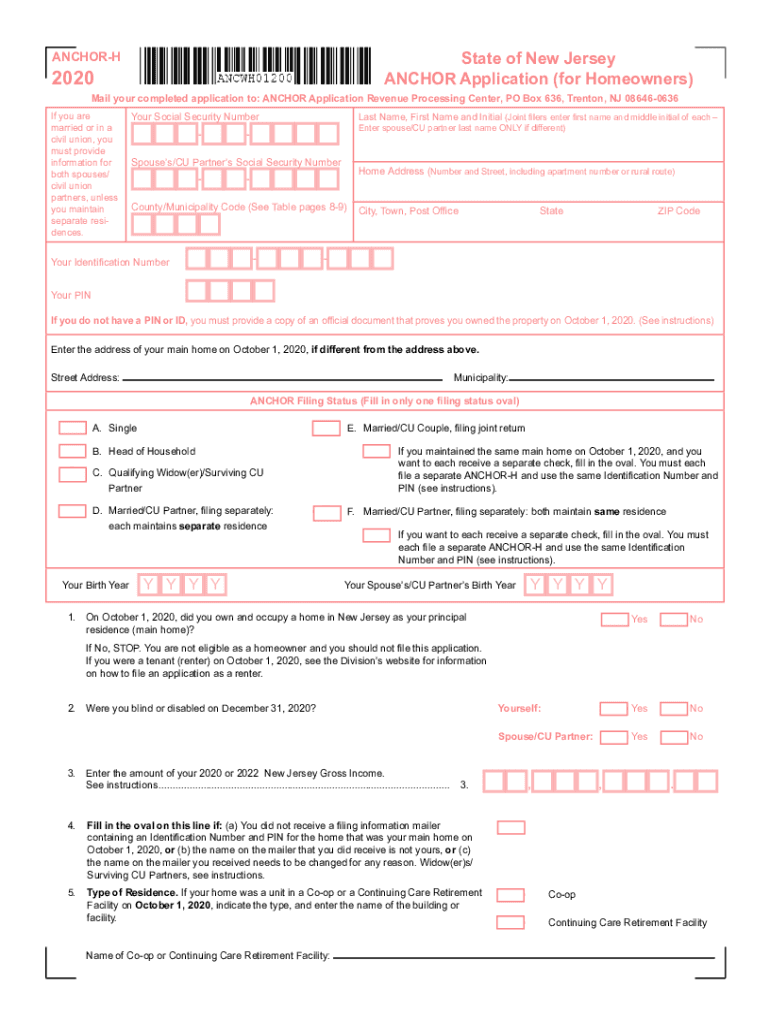

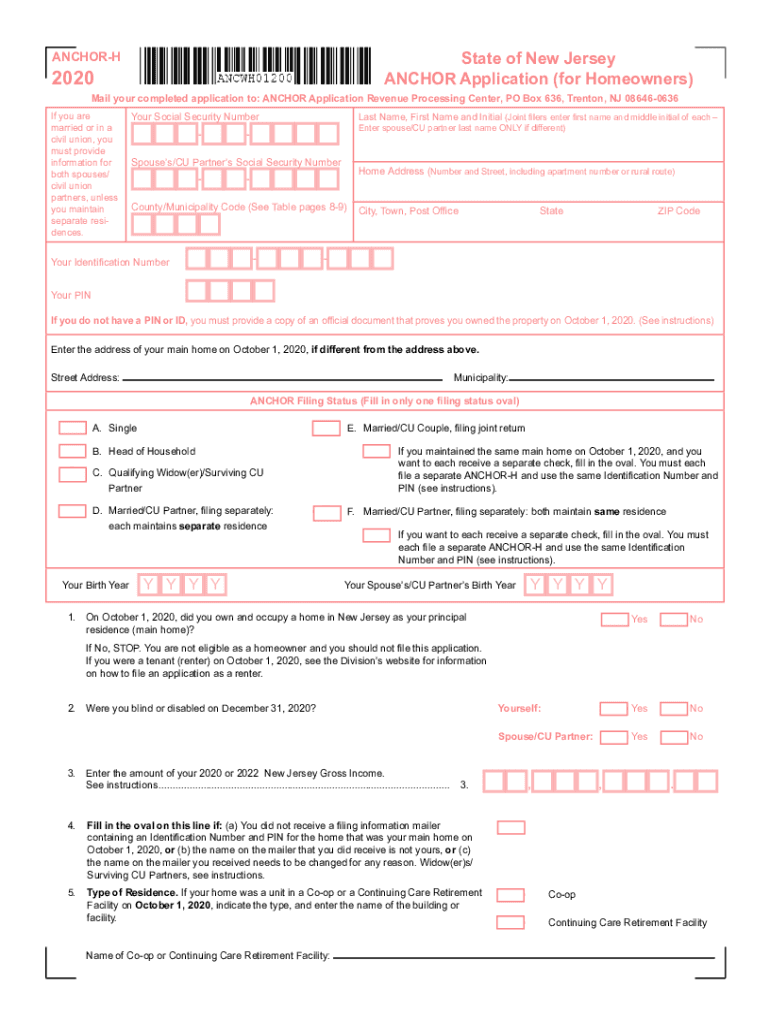

State of New Jersey ANCHOR Application (for Homeowners)ANCHORH2020Mail your completed application to: ANCHOR Application Revenue Processing Center, PO Box 636, Trenton, NJ 086460636If you are married

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign anchor property tax relief

Edit your anchor property tax relief form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your anchor property tax relief form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing anchor property tax relief online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit anchor property tax relief. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out anchor property tax relief

How to fill out anchor property tax relief

01

Step 1: Obtain the necessary forms from the local tax assessor's office or download them from their website.

02

Step 2: Fill out the personal information section of the form, including your name, address, and contact details.

03

Step 3: Provide information about the property for which you are seeking anchor property tax relief. This may include the property address, assessment details, and any relevant supporting documents.

04

Step 4: Complete the income section of the form, providing details of your annual income and any applicable deductions or exemptions.

05

Step 5: Attach any required documentation, such as income proofs, property ownership documents, or tax statements.

06

Step 6: Review the completed form for accuracy and make any necessary corrections.

07

Step 7: Submit the filled-out form to the local tax assessor's office either in-person or by mail, following their specified instructions.

08

Step 8: Wait for the tax assessor's office to process your application and notify you of any additional steps or requirements.

09

Step 9: Follow up with the tax assessor's office if you haven't received a response within the designated timeframe.

10

Step 10: If approved, enjoy the benefits of anchor property tax relief as provided by the local tax authorities.

Who needs anchor property tax relief?

01

Homeowners who are experiencing financial hardship and struggling to pay their property taxes may need anchor property tax relief.

02

Individuals with limited income or fixed incomes, such as retirees, may benefit from anchor property tax relief.

03

Families or individuals living in areas with high property taxes may seek anchor property tax relief to alleviate the financial burden.

04

Senior citizens who wish to age in place and stay in their homes despite rising property taxes can benefit from anchor property tax relief.

05

Individuals with disabilities or those facing medical expenses may find anchor property tax relief helpful in managing their financial situation.

06

Low-income homeowners or families facing foreclosure due to property tax delinquency may need anchor property tax relief.

07

Certain veterans or active military personnel may be eligible for anchor property tax relief under specific programs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my anchor property tax relief directly from Gmail?

anchor property tax relief and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send anchor property tax relief to be eSigned by others?

To distribute your anchor property tax relief, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in anchor property tax relief?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your anchor property tax relief to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is anchor property tax relief?

Anchor property tax relief is a program designed to provide property tax relief to eligible homeowners, typically aimed at reducing the financial burden of property taxes.

Who is required to file anchor property tax relief?

Homeowners who meet certain income and residency requirements are required to file for anchor property tax relief.

How to fill out anchor property tax relief?

To fill out anchor property tax relief, homeowners need to complete the designated application form, providing necessary information about their property and income.

What is the purpose of anchor property tax relief?

The purpose of anchor property tax relief is to alleviate financial pressure on homeowners by lowering their property tax bills and helping them afford their homes.

What information must be reported on anchor property tax relief?

Homeowners must report information including their property address, income, and any other relevant financial data as required by the application form.

Fill out your anchor property tax relief online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Anchor Property Tax Relief is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.