Get the free Ohio Municipal Tax Reform - tax ohio

Show details

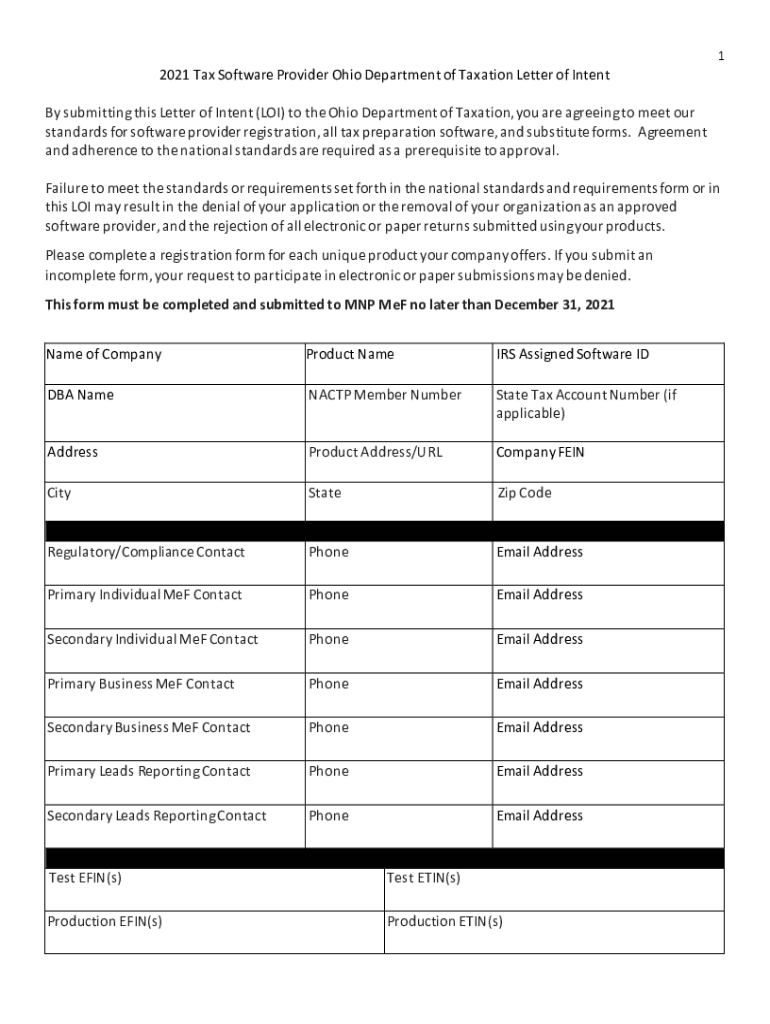

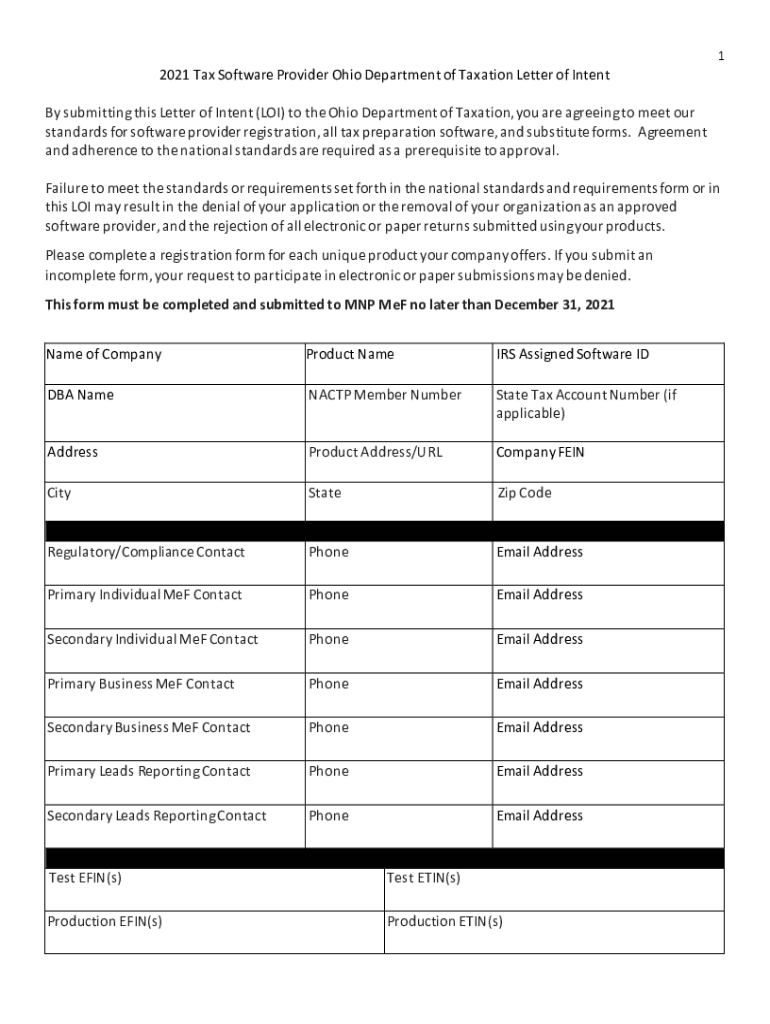

Ohio Department of Taxation Letter of Intent Year 2021 Municipal Net Profit Tax Return MNP MEF group MNPTax@tax.state.oh.us 6147283750Ohio Department of Taxation due date December 31, 20212021 Tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ohio municipal tax reform

Edit your ohio municipal tax reform form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio municipal tax reform form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ohio municipal tax reform online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ohio municipal tax reform. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ohio municipal tax reform

How to fill out ohio municipal tax reform

01

Gather all the necessary documents and information such as your income records, deductions, and credits.

02

Visit the official website of the Ohio Department of Taxation to download the Ohio municipal tax reform form.

03

Carefully read the instructions provided with the form to ensure you understand the requirements and procedures.

04

Fill out the form accurately and completely, providing all the requested information.

05

Double-check your entries and make sure there are no errors or missing information.

06

Attach any additional supporting documents required, such as W-2 forms or receipts for deductions claimed.

07

Calculate your tax liability or refund based on the information provided.

08

Sign and date the form.

09

Send the completed form and any supporting documents to the designated address mentioned in the instructions.

10

Keep a copy of the filled-out form and supporting documents for your records.

11

Await notification or confirmation from the Ohio Department of Taxation regarding the status of your municipal tax reform application.

Who needs ohio municipal tax reform?

01

Individuals who reside or work in Ohio and are subject to municipal taxes may need Ohio municipal tax reform.

02

Businesses operating within Ohio municipalities may require tax reform to ensure compliance with local tax regulations.

03

Taxpayers who believe that the current tax system is unfair or burdensome may advocate for Ohio municipal tax reform.

04

Local government officials and policymakers may recognize the need for tax reform to attract businesses and stimulate economic growth.

05

Non-profit organizations and charities operating in Ohio municipalities may seek tax reform to simplify their tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ohio municipal tax reform to be eSigned by others?

Once your ohio municipal tax reform is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit ohio municipal tax reform online?

With pdfFiller, the editing process is straightforward. Open your ohio municipal tax reform in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit ohio municipal tax reform on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share ohio municipal tax reform from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is ohio municipal tax reform?

Ohio municipal tax reform refers to the changes and updates in the tax code that govern how municipalities in Ohio can levy and collect income taxes from individuals and businesses.

Who is required to file ohio municipal tax reform?

Any individual or business earning income within a municipality in Ohio is required to file under the Ohio municipal tax reform, particularly those who are subject to local income taxes.

How to fill out ohio municipal tax reform?

To fill out Ohio municipal tax reform, taxpayers must complete the appropriate municipal tax return forms, report their income, deductions, and credits, and ensure they comply with the specific municipal guidelines.

What is the purpose of ohio municipal tax reform?

The purpose of Ohio municipal tax reform is to standardize the tax collection process across municipalities, improve compliance, and reduce the burden on taxpayers while ensuring municipalities have the necessary revenue for services.

What information must be reported on ohio municipal tax reform?

Taxpayers must report personal information, income earned, deductions claimed, and any credits that may apply as part of the Ohio municipal tax reform requirements.

Fill out your ohio municipal tax reform online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ohio Municipal Tax Reform is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.