Get the free Student Funding, Taxes & Payroll for Thesis Students

Show details

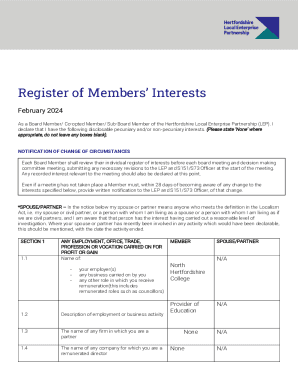

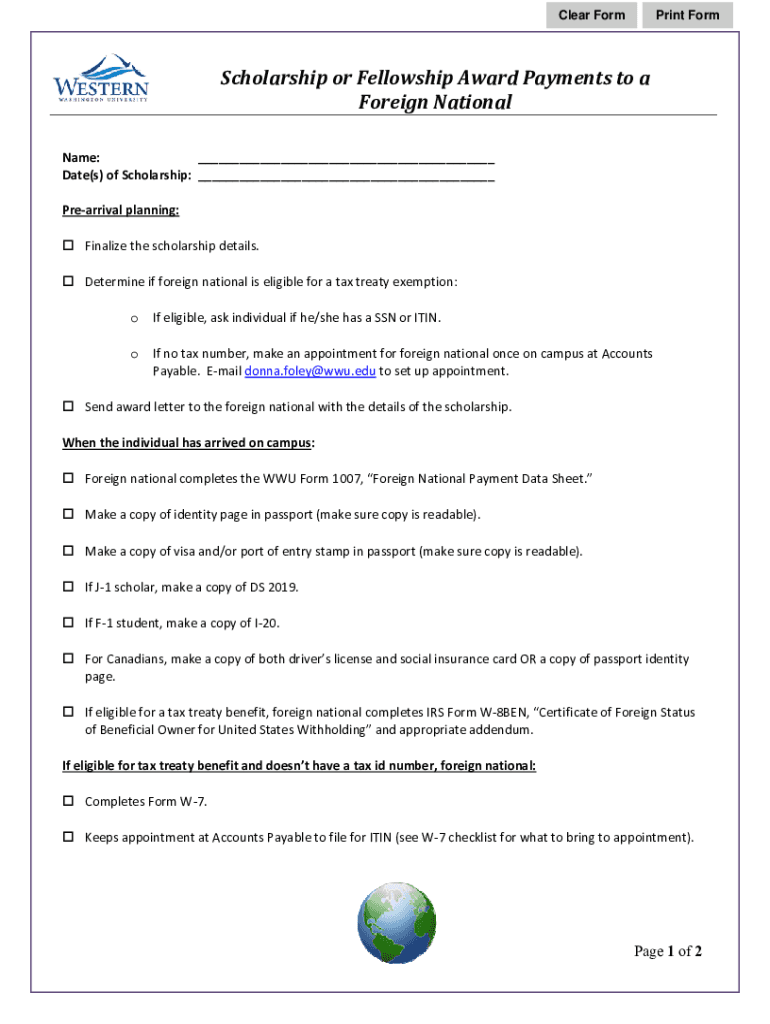

Clear FormPrint FormScholarship or Fellowship Award Payments to aForeign National Name: ___ Date(s)ofScholarship: ___ Prearrivalplanning: Finalizethescholarshipdetails. Determineifforeignnationaliseligibleforataxtreatyexemption:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign student funding taxes amp

Edit your student funding taxes amp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your student funding taxes amp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing student funding taxes amp online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit student funding taxes amp. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out student funding taxes amp

How to fill out student funding taxes amp

01

Gather all your necessary documents, such as your T2202A form and any other relevant tax forms.

02

Ensure you have any supporting documents, such as receipts or proof of payment for tuition fees or textbooks.

03

Start by logging into the online tax filing platform provided by the government or download the necessary software.

04

Enter your personal information accurately, including your name, address, and Social Insurance Number.

05

Look for the section specifically related to student funding taxes and select it.

06

Fill out the required fields regarding your student funding, such as the amount received and any grants or scholarships.

07

Provide details about the type of student funding you received, whether it was a student loan, bursary, or any other form of financial assistance.

08

Double-check all the information you entered and ensure it is accurate.

09

Submit your completed tax return and await any notifications or requests for further documents from the tax authorities.

10

Keep a copy of your submitted tax return and all supporting documents for future reference.

Who needs student funding taxes amp?

01

Students who received any form of student funding, such as student loans, grants, scholarships, or bursaries, need to fill out student funding taxes.

02

Individuals who are enrolled in an eligible educational institution and have received financial assistance for their studies should complete this tax form.

03

It is especially important for students who want to claim eligible tax credits or deductions related to their education expenses.

04

If you have doubts about whether you need to fill out student funding taxes, it is advised to consult with a tax professional or check the guidelines provided by the tax authorities in your country.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit student funding taxes amp from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your student funding taxes amp into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for the student funding taxes amp in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your student funding taxes amp in seconds.

How do I edit student funding taxes amp on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share student funding taxes amp on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is student funding taxes amp?

Student funding taxes amp refers to specific tax regulations and obligations related to financial support received by students, which may include grants, scholarships, or other forms of funding.

Who is required to file student funding taxes amp?

Students who receive taxable financial aid, scholarships, or grants that exceed their qualified education expenses are required to file student funding taxes amp.

How to fill out student funding taxes amp?

To fill out student funding taxes amp, gather all relevant documents regarding your funding, complete the required tax forms accurately, report any taxable income, and submit your forms to the relevant tax authority.

What is the purpose of student funding taxes amp?

The purpose of student funding taxes amp is to ensure that students accurately report taxable financial aid and comply with tax regulations, potentially impacting their tax obligations and benefits.

What information must be reported on student funding taxes amp?

Information that must be reported includes the total amount of financial aid received, the type of funding, and any qualified education expenses incurred during the tax year.

Fill out your student funding taxes amp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Student Funding Taxes Amp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.