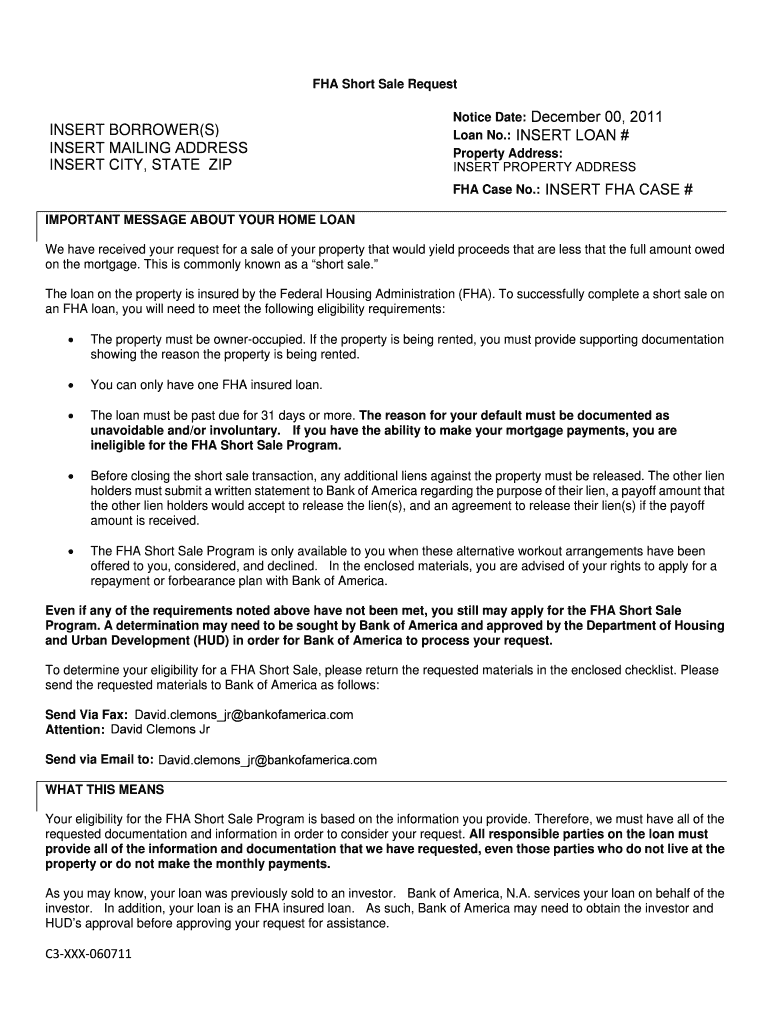

Get the free FHA Short Sale Request

Show details

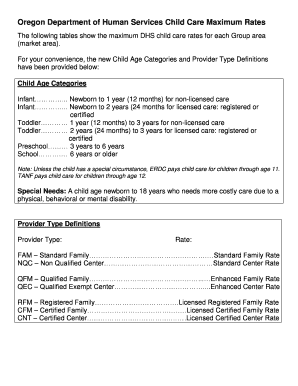

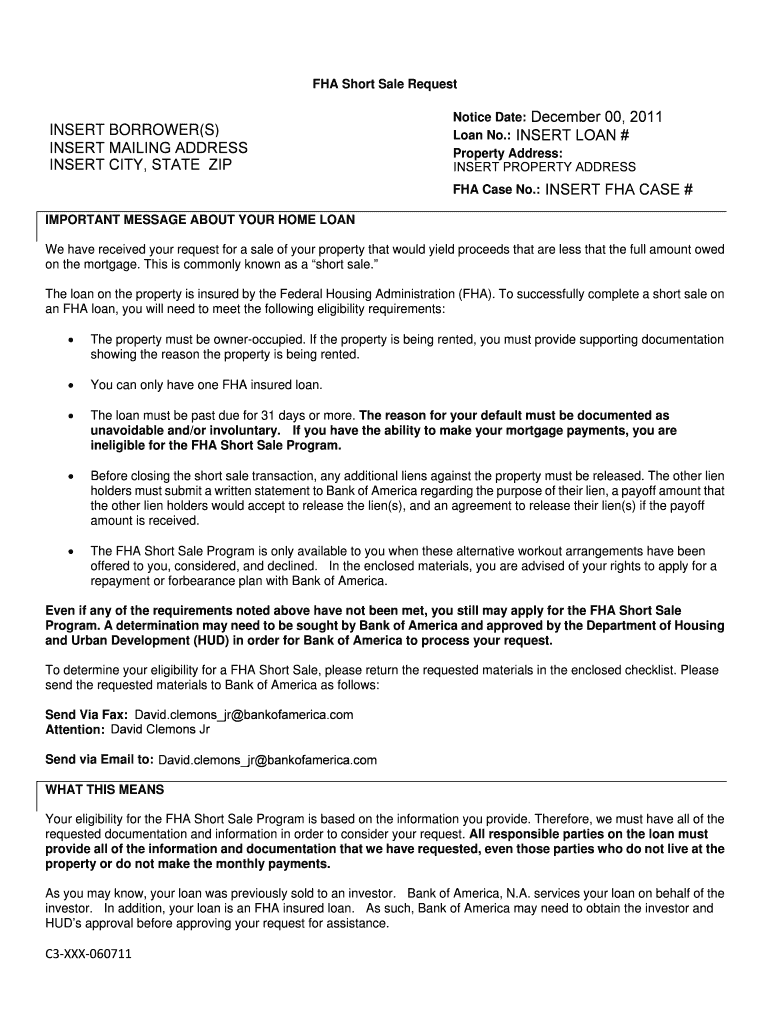

A document detailing the process and requirements for homeowners seeking to initiate a short sale on their FHA-insured property to avoid foreclosure.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha short sale request

Edit your fha short sale request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha short sale request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha short sale request online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fha short sale request. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha short sale request

How to fill out FHA Short Sale Request

01

Gather all necessary documentation, including financial statements and hardship letters.

02

Complete the FHA Short Sale Request form with accurate information about the property and your financial situation.

03

Provide a detailed explanation of your financial hardship, including any relevant circumstances that affect your ability to pay.

04

Attach required documents such as bank statements, tax returns, and proof of income.

05

Submit the completed Short Sale Request form and all supporting documents to your lender.

06

Follow up with your lender for confirmation and address any additional requests for information in a timely manner.

Who needs FHA Short Sale Request?

01

Homeowners who are financially distressed and unable to keep up with their mortgage payments.

02

Individuals facing foreclosure or who need to sell their property for less than the outstanding mortgage amount.

03

Borrowers eligible for FHA loans looking to pursue a short sale option.

Fill

form

: Try Risk Free

People Also Ask about

How to get financing for a short sale?

Financing a short sale purchase is not much different from financing a traditional home purchase. Sometimes, the property's lien holder may require that you get preapproved or prequalified for a mortgage with it before approving your offer. This is because it wants to be sure that you can complete the purchase.

Can you get financing on a short sale?

The seller has to qualify for the short sale and negotiate a deal with the lender to get the ball rolling. Let's say you receive approval from the current homeowner's lender. You would then take the final agreement back to your lender to secure financing.

What is the FHA 85% rule?

What is the FHA 85% rule? The FHA 85% rule states that you can't borrow more than 85% of your home's value, and only applied to FHA cash-out refinance loans. However, the 85% rule no longer applies; the current LTV ratio limit for FHA cash-out refinances is 80%.

How do you get approved for short selling?

To sell stocks short, you need to open a margin account To qualify for a margin trading account, you need to apply, and you must have at least $2,000 in cash equity or eligible securities. When you use margin, you must maintain at least 30% of the total value of your position as equity at all times.

Is it difficult to buy a short sale?

When you buy a home through a short sale, you need to negotiate with the seller, their lender, your lender and any other lienholders on the property. This can complicate the short sale process and add to the time it takes to complete the sale.

Why would a lender deny a short sale?

Unrealistic Buyer Expectations Also, because the lender might reject the first offer—especially if it's substantially lower than the listing price or below fair market value—uninformed buyers and sellers who expect a quick turnaround can get frustrated and bail on the deal before the sale is approved.

What is the waiting period for a short sale on a FHA loan?

For borrowers who have completed a short sale, the FHA typically requires a waiting period of three years before they can qualify for a new FHA-insured mortgage loan.

Can an FHA loan be used for a short sale?

If the borrower does not qualify for any of the FHA Home Retention Options and the property sales value is not enough to pay the loan in full, the servicer may be able to accept less than the full amount owed by approving eligible borrowers for a Pre-Foreclosure Sale, also known as a short sale.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FHA Short Sale Request?

An FHA Short Sale Request is a formal application process for homeowners with FHA-insured loans who are seeking to sell their property for less than the amount owed on the mortgage, allowing them to avoid foreclosure.

Who is required to file FHA Short Sale Request?

The homeowner or borrower who holds the FHA-insured mortgage must file the FHA Short Sale Request.

How to fill out FHA Short Sale Request?

To fill out an FHA Short Sale Request, complete the required application forms, provide necessary supporting documents such as financial statements, hardship letters, and submit them to the lender for evaluation.

What is the purpose of FHA Short Sale Request?

The purpose of the FHA Short Sale Request is to facilitate a sale of the property at a price lower than the outstanding mortgage balance, helping the borrower avoid foreclosure while allowing the lender to recover some losses.

What information must be reported on FHA Short Sale Request?

The information that must be reported on the FHA Short Sale Request includes the property details, borrower financial information, the reason for the short sale, and any supporting documentation that outlines the borrower's financial hardship.

Fill out your fha short sale request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Short Sale Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.