Get the free FHA 203(k) LOAN DRAW REQUEST DISCLOSURE

Show details

This document outlines the procedure for contractors to request draw payments during the renovation process of a 203(k) loan, detailing the roles of the consultant and lender in reviewing and disbursing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha 203k loan draw

Edit your fha 203k loan draw form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha 203k loan draw form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fha 203k loan draw online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fha 203k loan draw. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

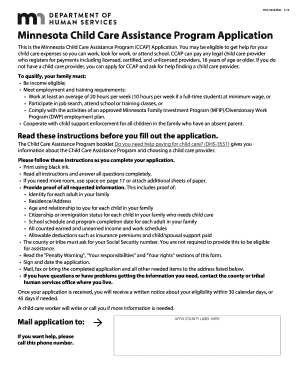

How to fill out fha 203k loan draw

How to fill out FHA 203(k) LOAN DRAW REQUEST DISCLOSURE

01

Obtain the FHA 203(k) Loan Draw Request Disclosure form from your lender or the FHA website.

02

Fill out your personal information at the top of the form, including your name, address, and loan number.

03

Indicate the amount of funds you are requesting to withdraw for the renovation.

04

Provide details about the contractor and the work completed to date.

05

Attach any required documents, such as invoices, proof of work completed, and any necessary approvals.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to your lender along with any additional requested documentation.

Who needs FHA 203(k) LOAN DRAW REQUEST DISCLOSURE?

01

Homeowners who are using an FHA 203(k) loan to fund renovation projects.

02

Borrowers who have completed renovation work and are ready to request disbursement of funds.

03

Contractors who are involved in the renovation process and need acknowledgment of work completed.

Fill

form

: Try Risk Free

People Also Ask about

What is not allowed on a 203k loan?

Things that are not allowed under the California FHA 203(k) program are basic landscaping, “luxury” items like a swimming pool or something that will take more than six months to complete (once the work has started).

Can I do the repairs myself with a 203k loan?

Self-help is allowed on the 203k if the borrower is a licensed contractor. If not, then a Certified 203k Contractor is required because the lender has to ensure the work is done properly and to code.

What are the downsides of a 203k loan?

Cons of 203k Loans - Higher costs. 203k loans typically come with higher upfront fees, interest rates, and closing costs due to their more complicated structure. - More time consuming. The 203k lending process also takes substantially more time than a standard mortgage due to the additional steps.

Can appliances be included in a 203k loan?

Types of 203k Loans: Standard vs Limited The Limited 203k is designed for less extensive improvements and for projects not exceeding a total of $35,000. It is ideal for non-structural related property conditions, including painting, appliances, or other minor remodeling.

Which of the following would not be an eligible use of 203k funds?

You cannot include improvements for commercial use or luxury items, such as tennis courts, gazebos, or new swimming pools. You may use a 203(k) loan to finance the rehabilita- tion of the following types of properties. Cooperative units and investment properties are not eligible. for at least one year.

What is not eligible under a 203 k rehabilitation home loan?

Limited and standard 203(k) loans have different rules about how much you can borrow for renovations and what you can do with the money. Improvements the FHA deems luxuries, like a swimming pool or an outdoor kitchen, generally aren't eligible for either one.

How hard is it to get an FHA 203k loan?

The FHA 203(k) loan requirements are flexible, which makes qualifying easier than a typical renovation loan. Minimum credit score of 580, though some lenders may require 620–640. Lower threshold than the typical 720+ for conventional construction loans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FHA 203(k) LOAN DRAW REQUEST DISCLOSURE?

The FHA 203(k) Loan Draw Request Disclosure is a document that outlines the procedures and stipulations for withdrawing funds from an FHA-backed renovation loan. It is used to ensure transparency and to monitor the progress of rehabilitation projects funded under the 203(k) program.

Who is required to file FHA 203(k) LOAN DRAW REQUEST DISCLOSURE?

The borrower or the contractor working on the renovation project is required to file the FHA 203(k) Loan Draw Request Disclosure. This is necessary to request disbursement of loan funds for completed work.

How to fill out FHA 203(k) LOAN DRAW REQUEST DISCLOSURE?

To fill out the FHA 203(k) Loan Draw Request Disclosure, the applicant must provide accurate information about the project, including details about the completed work, the requested amount, and relevant contract information. Supporting documents such as invoices and a project status update may also be required.

What is the purpose of FHA 203(k) LOAN DRAW REQUEST DISCLOSURE?

The purpose of the FHA 203(k) Loan Draw Request Disclosure is to facilitate the process of withdrawing funds for renovations while ensuring compliance with program regulations. It helps lenders track the progress of the project and ensure that funds are released based on completed work.

What information must be reported on FHA 203(k) LOAN DRAW REQUEST DISCLOSURE?

The FHA 203(k) Loan Draw Request Disclosure must include information about the borrower, the property address, details of the work completed, the amount of funds requested, and any relevant documentation that supports the request, such as contractor invoices or inspection reports.

Fill out your fha 203k loan draw online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha 203k Loan Draw is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.