Get the free State Board of Accountancy Extends Credit Periods for ...

Show details

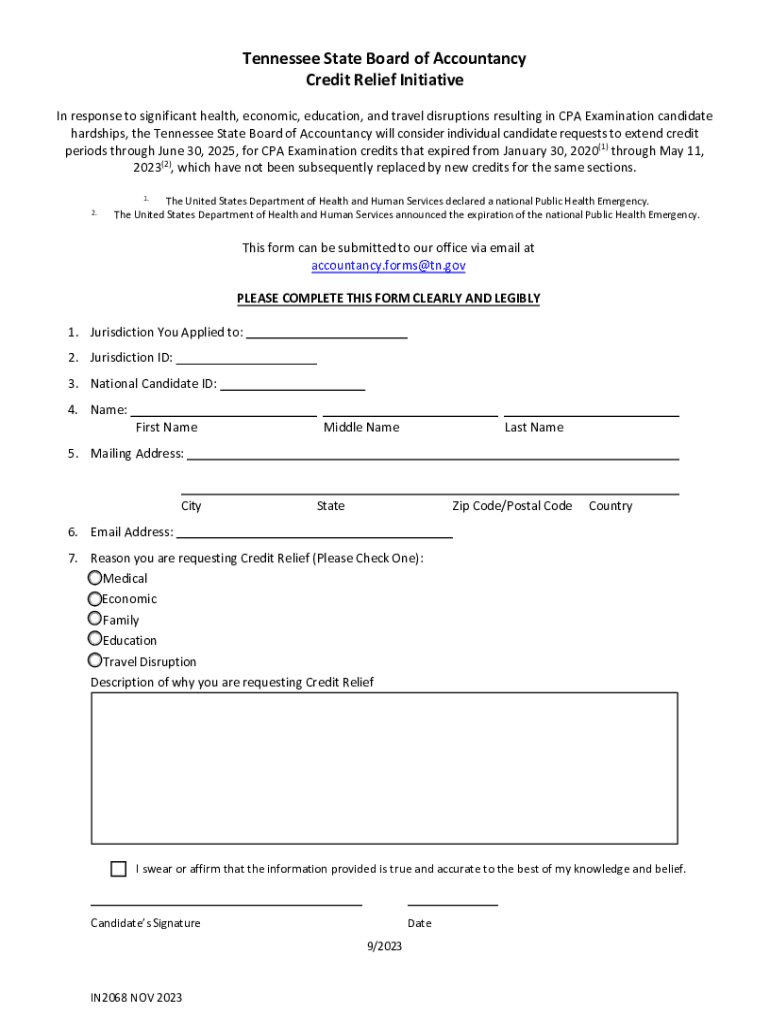

Tennessee State Board of Accountancy Credit Relief Initiative In response to significant health, economic, education, and travel disruptions resulting in CPA Examination candidate hardships, the Tennessee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state board of accountancy

Edit your state board of accountancy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state board of accountancy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state board of accountancy online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit state board of accountancy. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state board of accountancy

How to fill out state board of accountancy

01

Step 1: Gather the necessary documents and information. This may include personal identification, educational qualifications, work experience, and any other required documentation.

02

Step 2: Research the specific requirements of your state board of accountancy. Each state may have slightly different requirements, so it's important to familiarize yourself with the guidelines and instructions provided by your state board.

03

Step 3: Complete the application form. Fill out all the required fields accurately and legibly. Double-check for any errors or missing information.

04

Step 4: Attach all the necessary documents to the application. This may include transcripts, certificates, letters of reference, or any other supporting documentation as required by your state board.

05

Step 5: Pay the application fee. Most state boards of accountancy require a fee to process your application. This fee can vary by state, so be sure to check the current fee schedule.

06

Step 6: Submit your completed application and supporting documents to the state board. This can typically be done online or through mail as per the instructions provided by your state board.

07

Step 7: Wait for the board's response. The state board will review your application and supporting documents to determine if you meet the requirements for licensure. This process may take some time, so be patient and wait for their decision.

08

Step 8: If approved, you will receive your licensure from the state board of accountancy. Congratulations! You can now legally practice accounting within your state.

09

Step 9: If not approved, carefully review the reasons for denial provided by the state board. Address any deficiencies or issues mentioned and consider reapplying if applicable.

Who needs state board of accountancy?

01

Individuals aspiring to become certified public accountants (CPAs) typically need to go through the state board of accountancy. Most states require individuals to obtain licensure from the state board in order to practice accounting professionally.

02

Accounting professionals who want to offer services that require a CPA license, such as auditing, tax preparation, or financial advisory, must go through the state board of accountancy to demonstrate their competency and adherence to professional standards.

03

Employers in the accounting industry often prefer or require candidates with a state board of accountancy license. Having a CPA license can improve job prospects and open up opportunities for career advancement.

04

Students pursuing a career in accounting may need to fulfill the requirements of the state board of accountancy to obtain their CPA license. This typically involves completing the necessary educational qualifications, passing the CPA exam, and fulfilling any additional experience requirements set by the state board.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit state board of accountancy online?

The editing procedure is simple with pdfFiller. Open your state board of accountancy in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out the state board of accountancy form on my smartphone?

Use the pdfFiller mobile app to fill out and sign state board of accountancy on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete state board of accountancy on an Android device?

On Android, use the pdfFiller mobile app to finish your state board of accountancy. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is state board of accountancy?

The state board of accountancy is a regulatory agency responsible for overseeing the licensing and regulation of accountants and accounting firms within a state.

Who is required to file state board of accountancy?

Individuals and firms that provide accounting services and wish to obtain or maintain their license to practice accountancy in the state must file with the state board of accountancy.

How to fill out state board of accountancy?

To fill out the state board of accountancy, you typically need to complete a designated application form, provide necessary documentation such as proof of education and experience, and pay applicable fees.

What is the purpose of state board of accountancy?

The purpose of the state board of accountancy is to protect the public by ensuring that only qualified individuals and firms are licensed to provide accounting services.

What information must be reported on state board of accountancy?

Required information typically includes personal identification, educational background, experience, and any disciplinary actions or criminal history.

Fill out your state board of accountancy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Board Of Accountancy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.