Get the free State Fundraising Notices

Show details

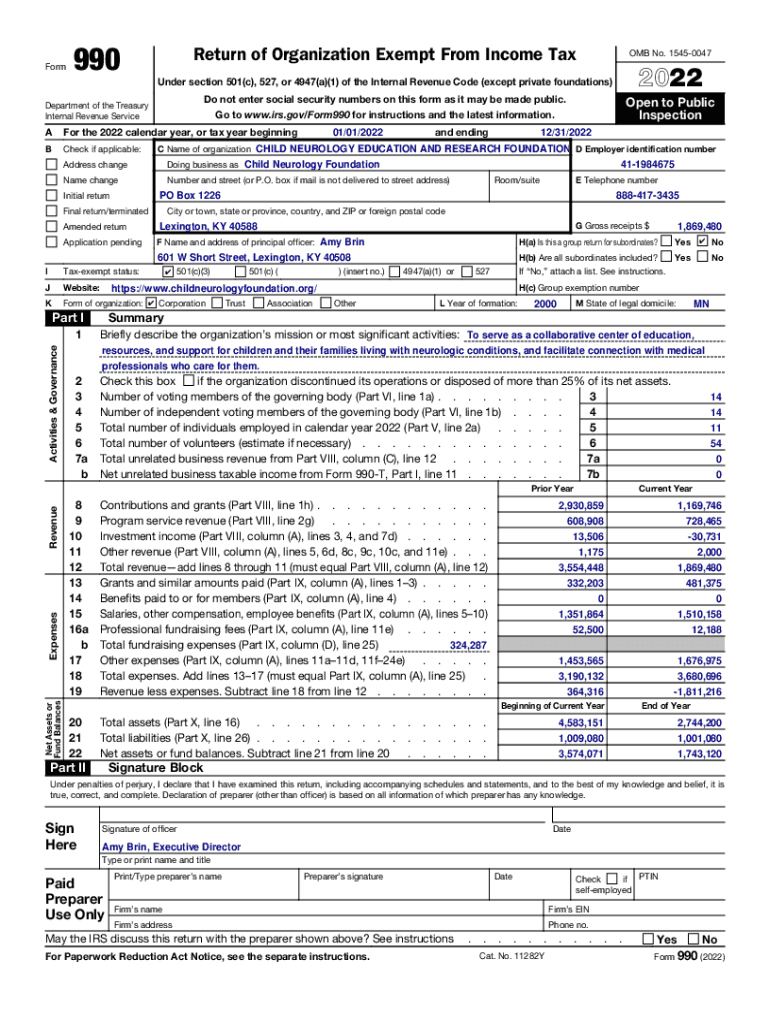

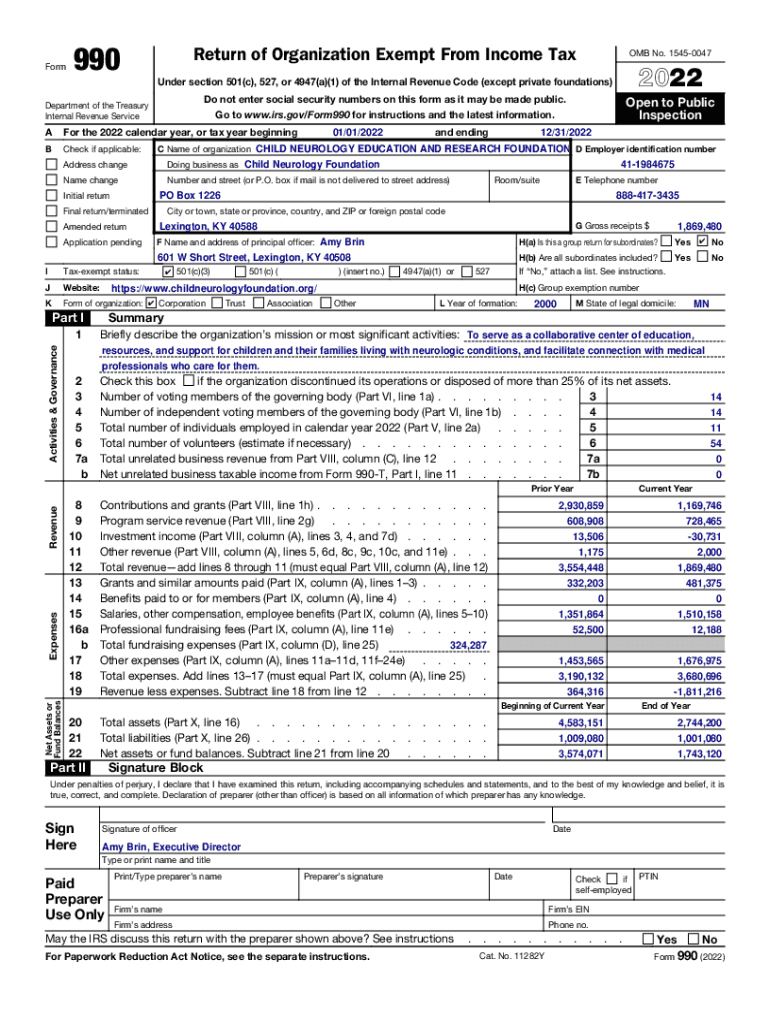

Form990Return of Organization Exempt From Income Tax2022Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)

Do not enter social security numbers on this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state fundraising notices

Edit your state fundraising notices form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state fundraising notices form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state fundraising notices online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit state fundraising notices. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state fundraising notices

How to fill out state fundraising notices

01

Read the instructions: Start by reading the instructions provided with the fundraising notice form. This will give you a clear understanding of the requirements and how to proceed.

02

Gather necessary information: Collect all the pertinent information required for the state fundraising notice, such as the organization's name, address, purpose of the fundraising, financial information, and any supporting documentation.

03

Research state laws: Familiarize yourself with the specific state laws and regulations regarding fundraising notices. Each state may have different requirements, so it's essential to be aware of the rules that apply to your organization.

04

Complete the form: Fill out the state fundraising notice form accurately and completely. Double-check all the information provided to ensure its accuracy.

05

Attach supporting documents: If required, attach any supporting documents, such as financial statements or other relevant information, to the fundraising notice form.

06

Submit the notice: Once the form is completed and all necessary documents are attached, submit the state fundraising notice according to the instructions provided. This may involve mailing it to a specific address or submitting it electronically.

07

Keep copies and records: Make sure to keep copies of the completed fundraising notice and any supporting documents for your records. This will be helpful in case of any future inquiries or audits.

08

Stay updated: Stay informed about any updates or changes to state fundraising notice requirements. Be proactive in maintaining compliance with the latest regulations.

Who needs state fundraising notices?

01

Non-profit organizations: Non-profit organizations that engage in fundraising activities may need to file state fundraising notices to comply with state laws and regulations.

02

Charities: Charitable organizations, both large and small, often require state fundraising notices to ensure transparency and accountability in their fundraising efforts.

03

Professional fundraisers: Individuals or firms offering fundraising services on behalf of non-profit organizations may need to file state fundraising notices as part of their contractual obligations.

04

Community groups: Local community groups or associations that conduct fundraising events or campaigns may be required to file state fundraising notices, depending on the state's regulations.

05

Political campaigns: Political campaigns, whether at the local, state, or national level, often need to file state fundraising notices to disclose their fundraising activities and comply with campaign finance laws.

06

Educational institutions: Universities, colleges, and schools that engage in fundraising activities may need to submit state fundraising notices to ensure compliance with state regulations.

07

Religious organizations: Religious institutions that raise funds for various purposes may be required to file state fundraising notices to maintain transparency and comply with state fundraising laws.

08

Others: Depending on the state's specific laws, other types of organizations, such as social clubs, sports teams, or advocacy groups, may also need to file state fundraising notices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in state fundraising notices without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your state fundraising notices, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit state fundraising notices straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit state fundraising notices.

How can I fill out state fundraising notices on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your state fundraising notices. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is state fundraising notices?

State fundraising notices are official documents required by state authorities that inform them about the fundraising activities conducted by organizations or individuals.

Who is required to file state fundraising notices?

Typically, non-profit organizations, charities, and certain individuals who conduct fundraising activities on behalf of a cause or organization are required to file state fundraising notices.

How to fill out state fundraising notices?

State fundraising notices generally require the completion of specific forms provided by state regulatory agencies, which may include details about the organization, the purpose of fundraising, and expected financial outcomes.

What is the purpose of state fundraising notices?

The purpose of state fundraising notices is to ensure transparency in fundraising activities, to protect the public from fraud, and to help regulate the fundraising practices of organizations.

What information must be reported on state fundraising notices?

Information that must be reported typically includes the name and contact details of the organization, the purpose of the fundraising, dates of the fundraising activities, and an estimate of the funds to be raised.

Fill out your state fundraising notices online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Fundraising Notices is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.