Get the free Personal Finance Tracker for Beginners (template included)!

Show details

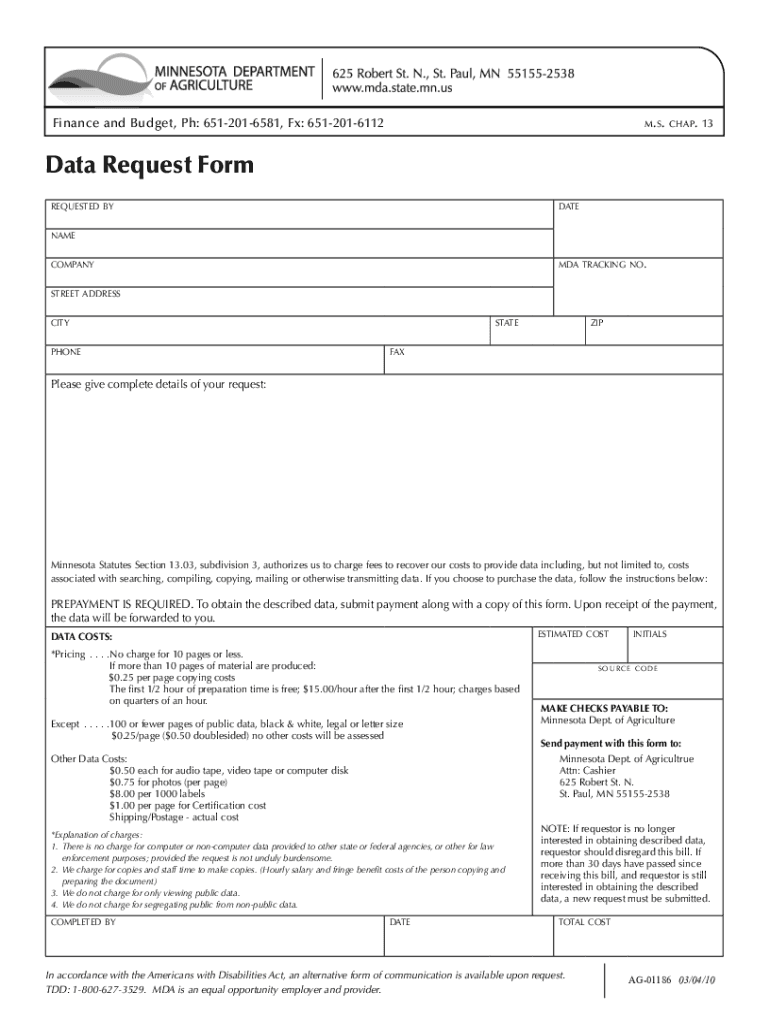

Finance and Budget, pH: 6512016581, FX: 6512016112 m. s. Chap .13Data Request Form

requested bydatename

MDA tracking no. Company

street address

city

phonestatezipfaxPlease give complete details of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal finance tracker for

Edit your personal finance tracker for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal finance tracker for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal finance tracker for online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit personal finance tracker for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal finance tracker for

How to fill out personal finance tracker for

01

Open the personal finance tracker spreadsheet on your computer or mobile device.

02

Start by entering your income for the month in the designated field. This can include your salary, freelance earnings, or any other source of income you receive.

03

Next, input your fixed expenses such as rent/mortgage, utility bills, insurance, and loan payments. These are the expenses that stay the same each month.

04

After that, add your variable expenses like groceries, dining out, entertainment, and transportation. These expenses may vary from month to month.

05

Include any additional expenses or savings goals you have in separate categories.

06

Calculate your total income by summing up all the income sources you entered.

07

Calculate your total expenses by summing up all the expenses you inputted.

08

Determine your net income by subtracting your total expenses from your total income.

09

Track your financial progress by updating your income and expenses regularly. Make adjustments to your spending habits as needed to achieve your financial goals.

10

You can also make use of graphs and charts available in the personal finance tracker to visually analyze your financial data over time.

Who needs personal finance tracker for?

01

Anyone who wants to have better control over their finances and track their spending habits can benefit from a personal finance tracker.

02

Individuals who struggle with budgeting or have difficulty managing their expenses can use a personal finance tracker to gain insights and make more informed financial decisions.

03

Entrepreneurs and freelancers can use a personal finance tracker to keep track of their income and expenses for tax purposes and to ensure they are meeting their financial goals.

04

People who are saving for specific financial goals, such as buying a house or going on a vacation, can use a personal finance tracker to stay organized and monitor their progress.

05

Families or couples who want to manage their finances together can utilize a personal finance tracker to collaborate and coordinate their spending and savings.

06

Even individuals with a good handle on their finances can benefit from using a personal finance tracker to maintain financial discipline and have a clear overview of their financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my personal finance tracker for in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign personal finance tracker for and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send personal finance tracker for for eSignature?

To distribute your personal finance tracker for, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete personal finance tracker for online?

pdfFiller has made it simple to fill out and eSign personal finance tracker for. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

What is personal finance tracker for?

A personal finance tracker is used to monitor and manage an individual's financial activities, including income, expenses, savings, and investments.

Who is required to file personal finance tracker for?

Anyone who wants to manage their finances effectively, including individuals and households, can benefit from using a personal finance tracker.

How to fill out personal finance tracker for?

To fill out a personal finance tracker, list your sources of income, categorize your expenses, record your savings and investments, and calculate your net worth on a regular basis.

What is the purpose of personal finance tracker for?

The purpose of a personal finance tracker is to help individuals gain control over their finances, track their financial goals, and make informed financial decisions.

What information must be reported on personal finance tracker for?

Information that must be reported includes income sources, fixed and variable expenses, savings amounts, investment details, and debt levels.

Fill out your personal finance tracker for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Finance Tracker For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.