Get the free Corporate Banking - Overview, Business Banking Spectrum

Show details

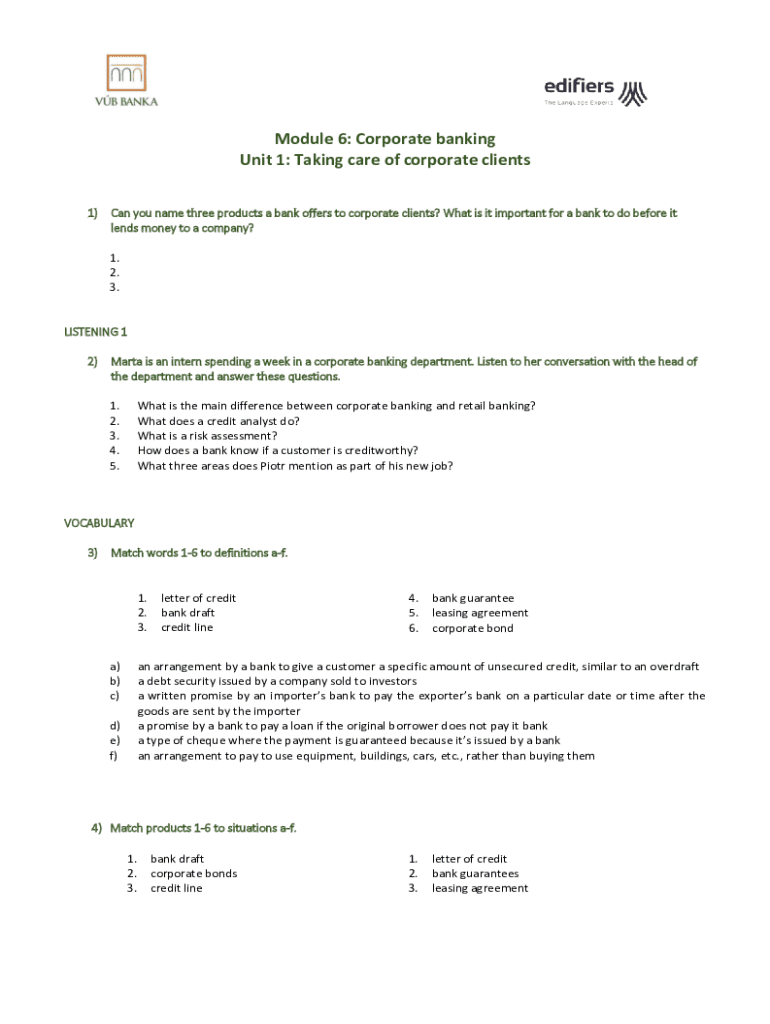

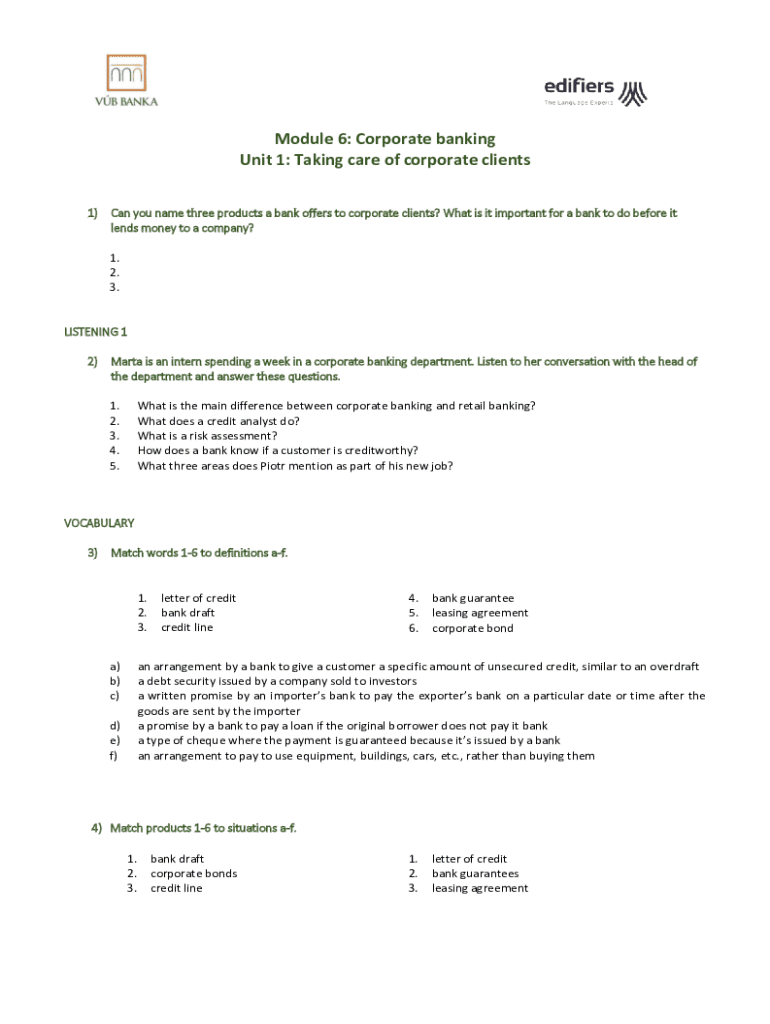

Module 6: Corporate banking Unit 1: Taking care of corporate clients 1)Can you name three products a bank offers to corporate clients? What is it important for a bank to do before it lends money to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate banking - overview

Edit your corporate banking - overview form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate banking - overview form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate banking - overview online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit corporate banking - overview. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate banking - overview

How to fill out corporate banking - overview

01

To fill out corporate banking - overview, follow these steps:

02

Gather all the necessary information about your company, such as its name, address, registration number, and tax identification number.

03

Contact the corporate banking department of your chosen bank to inquire about the specific requirements and documentation needed.

04

Prepare the necessary documents, which may include identification proofs, copies of registration certificates, financial statements, and business plan.

05

Fill out the application form provided by the bank, ensuring that all the required fields are completed accurately.

06

Review the completed form and double-check for any mistakes or missing information.

07

Attach all the required documents securely with the application form.

08

Submit the completed form and documents to the corporate banking department either physically or through an online platform.

09

Await the bank's review and approval process, which may involve verification of the provided documents and conducting background checks.

10

If approved, you will receive further instructions regarding account opening, signatories, and other banking services.

11

Ensure to comply with any additional requirements or follow-up actions communicated by the bank.

12

Start enjoying the benefits of corporate banking, such as enhanced financial management, access to specialized services, and improved credibility for your company.

Who needs corporate banking - overview?

01

Corporate banking - overview is beneficial for various entities, including:

02

- Established companies looking for efficient cash management solutions

03

- Businesses with complex financial needs, such as managing multiple accounts, international transactions, and payroll services

04

- Companies planning to expand their operations and require financial support for investments or acquisitions

05

- Startups and new businesses seeking professional banking services to establish a robust financial foundation

06

- Companies dealing with large-scale corporate transactions or regular business activities involving significant funds

07

- Entities looking for personalized financial advice and tailored banking solutions based on their specific industry and requirements

08

- Businesses aiming to streamline their financial operations and improve transparency through digital banking platforms and corporate tools

09

- Organizations requiring specialized services like trade finance, foreign exchange, liquidity management, and risk management.

10

Ultimately, corporate banking - overview is suitable for companies of all sizes and industries that aim to optimize their financial management, gain access to diverse banking services, and strengthen their overall business foundations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the corporate banking - overview in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your corporate banking - overview in seconds.

Can I create an eSignature for the corporate banking - overview in Gmail?

Create your eSignature using pdfFiller and then eSign your corporate banking - overview immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit corporate banking - overview straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing corporate banking - overview.

What is corporate banking - overview?

Corporate banking refers to the suite of financial services provided by banks to corporations, businesses, and other large institutions. This includes services such as financing, treasury and cash management, commercial loans, leasing, and investment banking.

Who is required to file corporate banking - overview?

Typically, large corporations, businesses seeking commercial loans, and institutions utilizing corporate banking services are required to file relevant information and documents with their banks or regulatory authorities.

How to fill out corporate banking - overview?

Filling out corporate banking documents generally involves providing company details, financial information, projected cash flows, loan requests, and specific terms related to banking services. It's important to follow the bank's specific guidelines and requirements.

What is the purpose of corporate banking - overview?

The purpose of corporate banking is to meet the financial needs of businesses through structured financial products and services that facilitate growth, manage cash flows, and optimize financial performance.

What information must be reported on corporate banking - overview?

Information that must be reported typically includes company financial statements, tax documents, business plans, projections, and any other relevant financial data deemed necessary by the banking institution.

Fill out your corporate banking - overview online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Banking - Overview is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.