Get the free SBA PPP Loan Submission Customer Checklist (1)

Show details

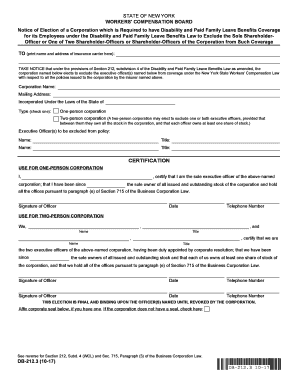

SBA PPP LOAN SUBMISSION CHECKLIST Borrowers Full Legal Business Name Loan Officer Port Number Completed and signed PPP application https://home.treasury.gov/system/files/136/PaycheckProtectionProgramApplication3302020v3.pdf

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba ppp loan submission

Edit your sba ppp loan submission form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba ppp loan submission form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sba ppp loan submission online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sba ppp loan submission. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba ppp loan submission

How to fill out sba ppp loan submission

01

Gather all the necessary documents and information required for the SBA PPP loan submission.

02

Visit the official Small Business Administration (SBA) website to access the loan application form.

03

Fill out the application form accurately, providing all the required details about your business and loan request.

04

Ensure you have all the necessary supporting documents ready, such as payroll records, tax filings, and financial statements.

05

Double-check the completed application form and review the provided information for any errors or missing information.

06

Submit the completed application form and supporting documents through the approved channels, which may include online platforms or designated lenders.

07

Keep track of your application status and any additional requests for information from the SBA or lenders.

08

Once your SBA PPP loan submission is reviewed and approved, carefully review the loan terms, including interest rates and repayment options.

09

If satisfied with the loan terms, accept the loan offer and make sure to use the funds for eligible expenses as outlined by the SBA.

10

Maintain accurate records of how the funds are used and comply with any reporting requirements specified by the SBA.

11

Repay the loan according to the agreed-upon terms to fulfill the SBA PPP loan submission process.

Who needs sba ppp loan submission?

01

Small business owners who have been negatively impacted by the COVID-19 pandemic and require financial assistance to maintain their business operations.

02

Entrepreneurs who are struggling to pay employee wages and maintain payroll obligations.

03

Companies experiencing reduced revenue and cash flow due to mandatory business closures or economic downturn caused by the pandemic.

04

Self-employed individuals, independent contractors, and sole proprietors who need financial support to sustain their business during this challenging time.

05

Startups and new businesses that face difficulties accessing traditional credit options and need funding for operational expenses.

06

Businesses in industries severely affected by COVID-19, such as hospitality, tourism, retail, and food services.

07

Small business owners who meet the eligibility criteria set by the SBA for the Paycheck Protection Program (PPP) and require financial assistance to retain their workforce.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sba ppp loan submission directly from Gmail?

sba ppp loan submission and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make changes in sba ppp loan submission?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your sba ppp loan submission to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit sba ppp loan submission on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share sba ppp loan submission from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is sba ppp loan submission?

The SBA PPP loan submission refers to the application process for the Paycheck Protection Program (PPP) loans, which were designed to provide financial assistance to small businesses affected by the COVID-19 pandemic.

Who is required to file sba ppp loan submission?

Any small business, nonprofit organization, veteran organization, or Tribal business that has been impacted by the COVID-19 pandemic and seeks financial assistance through the Paycheck Protection Program is required to file for an SBA PPP loan submission.

How to fill out sba ppp loan submission?

To fill out the SBA PPP loan submission, applicants need to complete the PPP Loan Application form, gather necessary documentation such as payroll records, taxes, and other financial information, and submit the completed application along with the required documents to an approved lender.

What is the purpose of sba ppp loan submission?

The purpose of the SBA PPP loan submission is to provide financial support to small businesses so they can maintain their workforce and continue operations during economic disruptions caused by the COVID-19 pandemic.

What information must be reported on sba ppp loan submission?

The SBA PPP loan submission must report information including the number of employees, payroll costs, business type, details about the ownership structure, and estimated loan amount requested.

Fill out your sba ppp loan submission online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Ppp Loan Submission is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.