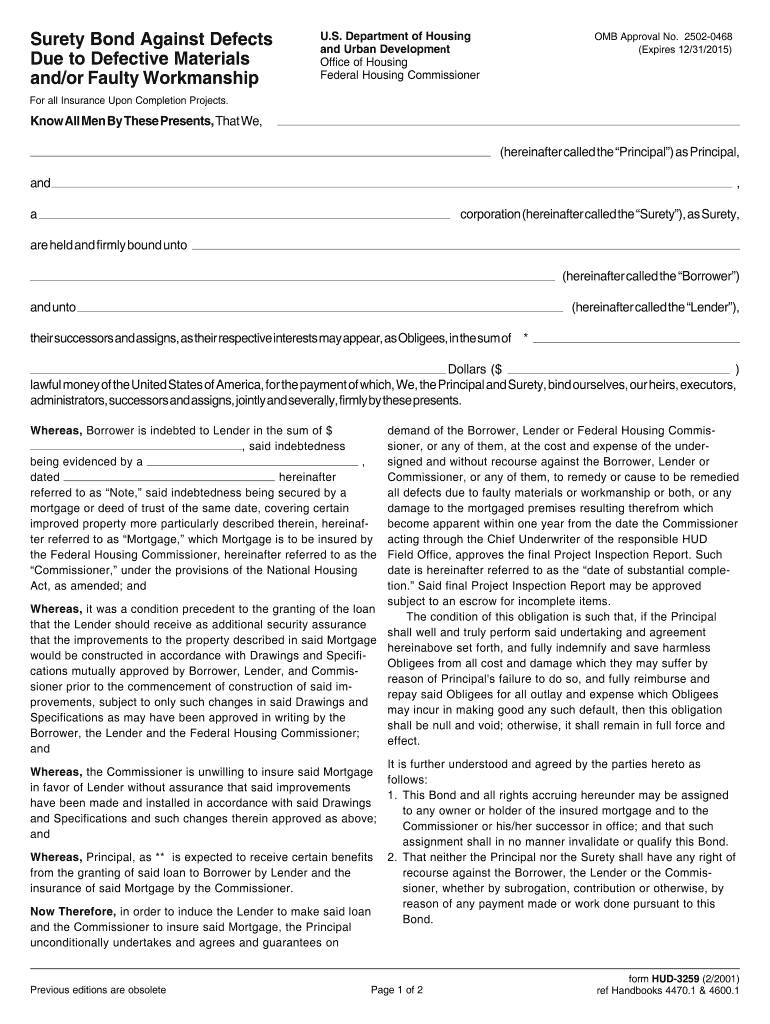

Get the free Surety Bond Against Defects Due to Defective Materials and/or Faulty Workmanship - p...

Show details

This document serves as a surety bond ensuring that defects due to faulty materials or workmanship in construction projects are remedied without recourse against the borrower, lender, or federal housing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond against defects

Edit your surety bond against defects form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond against defects form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit surety bond against defects online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit surety bond against defects. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out surety bond against defects

How to fill out Surety Bond Against Defects Due to Defective Materials and/or Faulty Workmanship

01

Obtain the Surety Bond application form from your bonding company or agent.

02

Fill in your personal or business information, including name, address, and contact details.

03

Provide information about the project for which the bond is needed, including project specifics and location.

04

Detail the scope of work and timeline for completion.

05

Include any required financial information, such as balance sheets or income statements, to demonstrate financial stability.

06

Review the terms of the bond, including the coverage limits and duration.

07

Sign the application and include any necessary documentation, such as proof of insurance.

08

Submit the completed application to the bonding company or agent for processing.

09

Pay any required fees associated with the bond application.

10

Once approved, ensure you receive a copy of the bond for your records.

Who needs Surety Bond Against Defects Due to Defective Materials and/or Faulty Workmanship?

01

Contractors and subcontractors working on construction projects.

02

Business owners involved in renovation or repair work.

03

Individuals seeking financial protection against defects in materials or poor workmanship.

04

Companies that need to comply with legal or contractual requirements for bonding.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean to be bonded under a surety bond?

A contractor surety bond is an agreement between three parties. You, the contractor, pay a fee to have a surety bond provider guarantee your contract with your customer. This means that if you don't complete the project, the guarantor will find someone who can or will pay your customer a pre-determined amount.

Who typically pays for a performance bond?

Being ``bonded'' on a job application typically means that an employer can obtain a bond to protect against potential losses caused by an employee's actions, such as theft or fraud. This is often relevant in jobs that involve handling money or valuable items.

What is the purpose of a construction bond?

Who Pays For a Performance Bond? The bond principal pays for a performance bond. This is the person or company hired to perform the contracted work. If you would like the project developer to cover the costs of your construction performance bond, you can include your bond costs within your bid.

How much does a $25,000 contractor's bond cost?

$25,000 surety bonds typically cost 0.5–10% of the bond amount, or $125–$2,500. Highly qualified applicants with strong credit might pay just $125 to $250, while an individual with poor credit will receive a higher rate.

What is a workmanship bond?

A surety bond for jail serves as a guarantee for the court that the defendant will fulfill their obligations. Unlike a cash bond where you pay the court directly, a surety bond is one in which you enlist the help of a bail bond company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Surety Bond Against Defects Due to Defective Materials and/or Faulty Workmanship?

A Surety Bond Against Defects Due to Defective Materials and/or Faulty Workmanship is a financial guarantee that ensures the contractor will repair or replace defective materials or workmanship in construction projects within a specified time frame.

Who is required to file Surety Bond Against Defects Due to Defective Materials and/or Faulty Workmanship?

Typically, contractors or subcontractors involved in construction projects are required to file this type of surety bond as a condition of their contract with project owners or general contractors.

How to fill out Surety Bond Against Defects Due to Defective Materials and/or Faulty Workmanship?

To fill out the bond, the contractor must provide details such as the project name, the parties involved, the bond amount, and any specific terms regarding the defects covered and the time frame for repairs. It is important to ensure accuracy and compliance with the requirements set forth by the project owner.

What is the purpose of Surety Bond Against Defects Due to Defective Materials and/or Faulty Workmanship?

The purpose of this surety bond is to protect project owners from financial losses due to poor workmanship or defective materials, ensuring that the contractor is held accountable for their work and obligated to fix any issues that arise during the warranty period.

What information must be reported on Surety Bond Against Defects Due to Defective Materials and/or Faulty Workmanship?

The information that must be reported includes the names and addresses of the parties involved, the bond amount, a description of the project, the duration of the bond's coverage, and specific conditions under which the bond may be claimed.

Fill out your surety bond against defects online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond Against Defects is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.