Get the free EMPLOYEE DEFERRED PAYMENT AGREEMENT

Show details

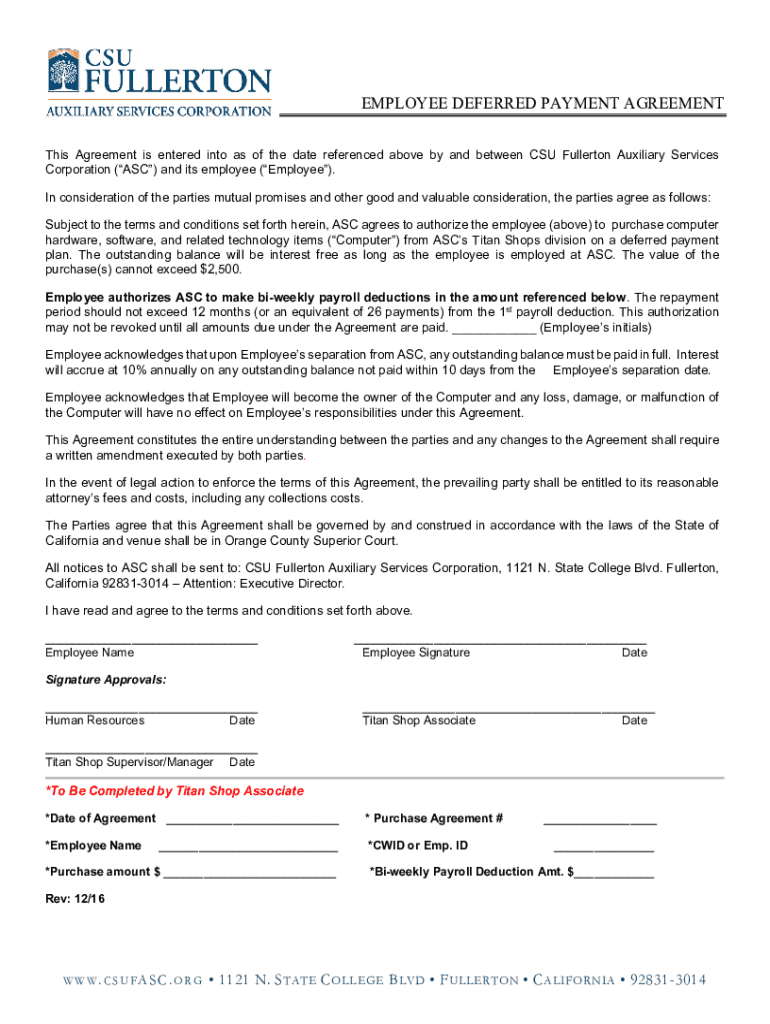

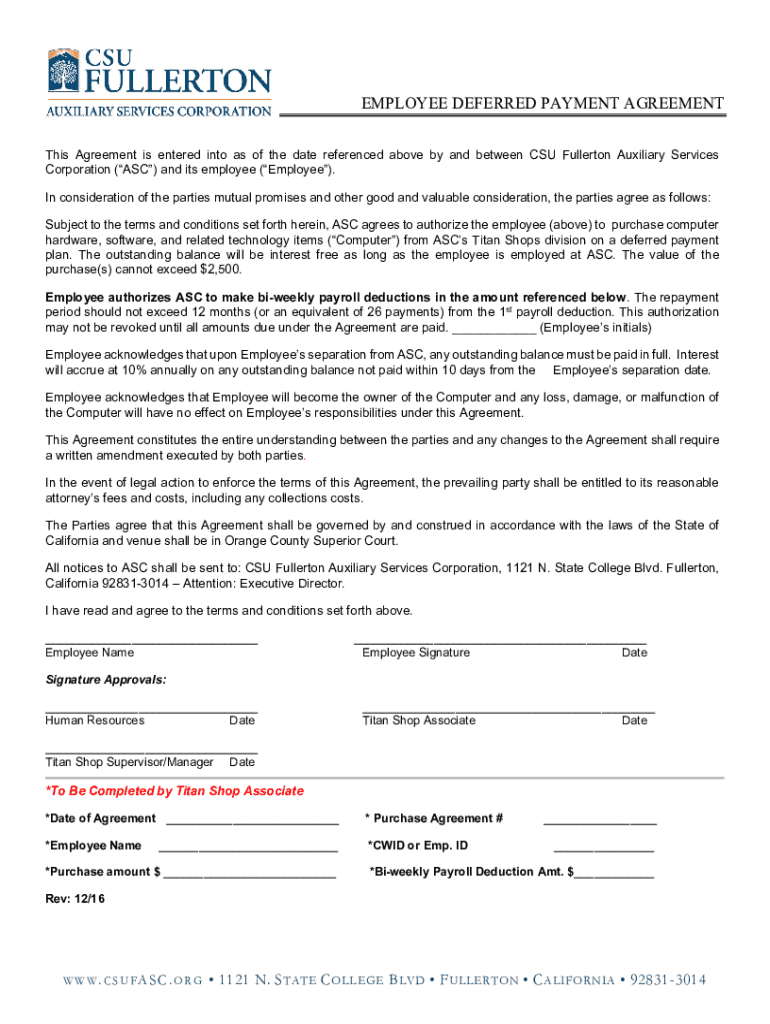

EMPLOYEE DEFERRED PAYMENT AGREEMENT This Agreement is entered into as of the date referenced above by and between CSU Fullerton Auxiliary Services Corporation (ASC) and its employee (Employee). In

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee deferred payment agreement

Edit your employee deferred payment agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee deferred payment agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employee deferred payment agreement online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit employee deferred payment agreement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee deferred payment agreement

How to fill out employee deferred payment agreement

01

Gather all necessary information and documents related to the deferred payment agreement.

02

Start by identifying the parties involved in the agreement, including the employer and the employee.

03

Clearly define the terms and conditions of the deferred payment, such as the amount to be deferred, the repayment schedule, and any applicable interest rates.

04

Specify the reason for deferring payment, such as temporary financial hardships or restructuring of the company.

05

Include any relevant clauses or provisions regarding the termination or modification of the agreement.

06

Make sure both parties read and understand the agreement thoroughly before signing.

07

Execute the agreement by obtaining signatures from both the employer and the employee.

08

Keep a copy of the signed agreement for future reference and documentation purposes.

Who needs employee deferred payment agreement?

01

Employers who are facing temporary financial difficulties and need to defer payment to their employees.

02

Employees who are willing to accept deferred payment options to support their employer during challenging times.

03

Companies undergoing restructuring or changes in their financial structure.

04

Small businesses or startups that may experience cash flow issues and need to defer payments to employees temporarily.

05

Organizations that have a formal deferred payment program in place for employee compensation.

06

Employers and employees who want a legally binding agreement that outlines the terms and conditions of deferred payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit employee deferred payment agreement online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your employee deferred payment agreement to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I edit employee deferred payment agreement on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing employee deferred payment agreement.

How do I complete employee deferred payment agreement on an Android device?

Use the pdfFiller mobile app to complete your employee deferred payment agreement on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is employee deferred payment agreement?

An employee deferred payment agreement is a formal arrangement between an employer and employee that allows the employee to defer a portion of their earnings or compensation to a later date, often for tax benefits or retirement savings.

Who is required to file employee deferred payment agreement?

Employers who have entered into a deferred payment agreement with their employees are required to file the appropriate documentation related to the agreement.

How to fill out employee deferred payment agreement?

To fill out an employee deferred payment agreement, both the employer and employee should provide necessary personal and financial information, specify the amounts being deferred, outline the terms and conditions, and both parties should sign the agreement.

What is the purpose of employee deferred payment agreement?

The purpose of an employee deferred payment agreement is to provide a way for employees to defer income to future periods, thereby potentially lowering their current tax liabilities and aiding in long-term financial planning.

What information must be reported on employee deferred payment agreement?

The information that must be reported includes the employee's personal details, the deferred payment amount, the dates of deferral, and specific terms of the agreement.

Fill out your employee deferred payment agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Deferred Payment Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.