Get the free all profits go to akc's junior eo team

Show details

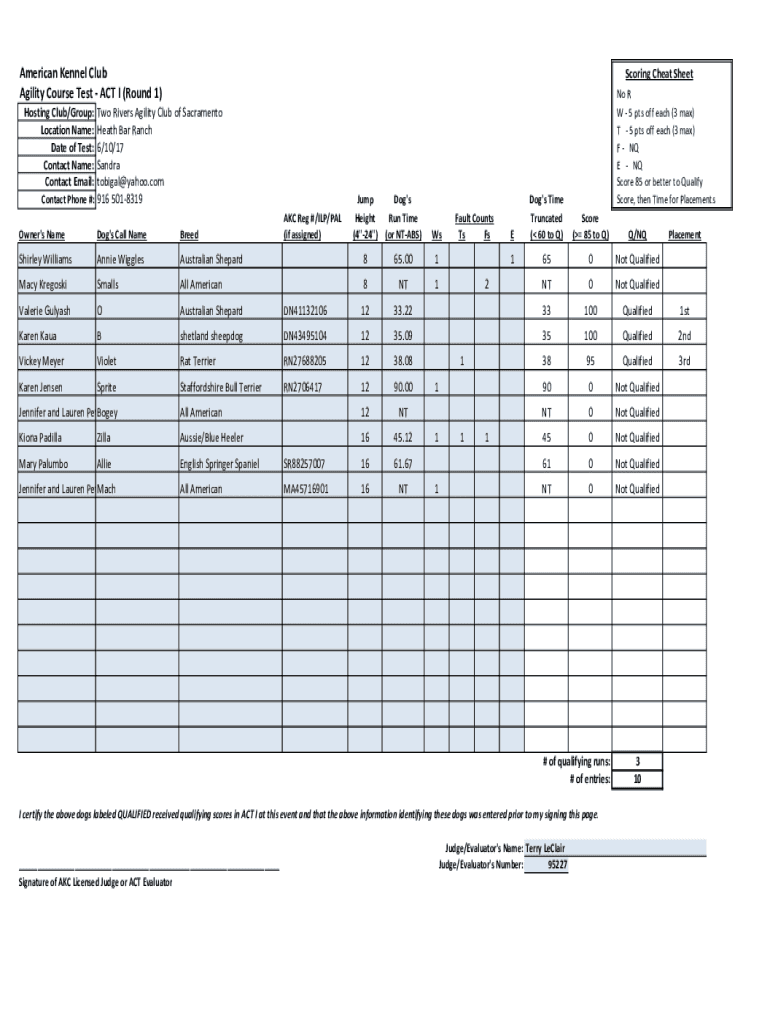

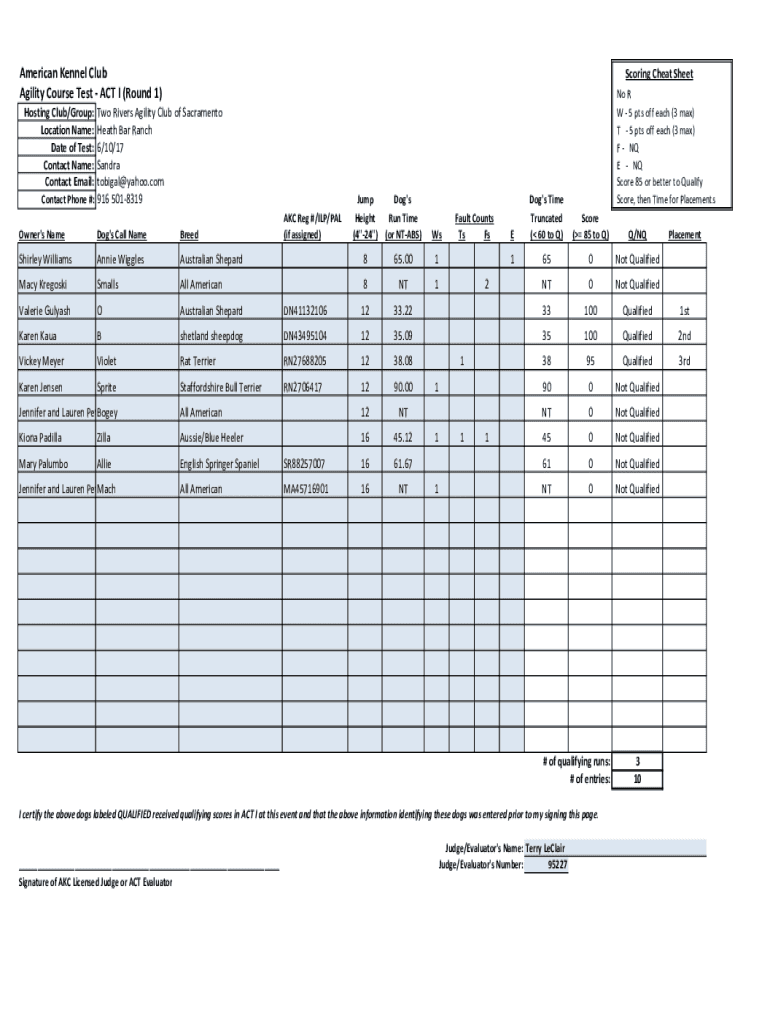

AmericanKennelClub

AgilityCourseTestACTI(Round1)ScoringCheatSheetTwoRiversAgilityClubofSacramento

HeathBarRanch

6/10/17

Sandra

tobigal@yahoo.com

ContactPhone#: 9165018319NoR

W5ptsoffeach(3max)

T5ptsoffeach(3max)

FNQ

END

Score85orbettertoQualify

Score,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign all profits go to

Edit your all profits go to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your all profits go to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing all profits go to online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit all profits go to. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out all profits go to

How to fill out all profits go to

01

First, gather all necessary financial information such as revenue and expenses.

02

Identify any deductions or expenses that can be claimed against the profits.

03

Calculate the total profit by subtracting the expenses from the revenue.

04

Ensure that all profits are accounted for and properly recorded in the financial statements.

05

Allocate the profits to the designated recipients or beneficiaries.

06

Review and verify the accuracy of the financial records to eliminate any errors.

07

File the necessary tax returns, ensuring that the allocation of profits is reported correctly.

08

Monitor and track the financial performance to ensure that all profits go to the intended recipients.

Who needs all profits go to?

01

Non-profit organizations typically need all profits to go towards their designated cause or mission.

02

Charitable organizations that rely on funding from profits may also require all profits to be allocated towards their philanthropic efforts.

03

Some corporate entities or business partnerships may have agreements in place to distribute all profits to specific individuals or groups.

04

Investors or shareholders who are entitled to a portion of the profits may expect all profits to be allocated according to their ownership shares.

05

In certain legal frameworks or jurisdictions, there may be legal requirements or regulations that mandate all profits go to specific beneficiaries or purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit all profits go to on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing all profits go to right away.

How do I edit all profits go to on an iOS device?

Create, edit, and share all profits go to from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete all profits go to on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your all profits go to, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is all profits go to?

All profits go to the shareholders of the company as dividends or are reinvested back into the business for growth and expansion.

Who is required to file all profits go to?

Typically, corporations and businesses are required to report their profits to tax authorities and may be required to file specific profit-related documents.

How to fill out all profits go to?

To fill out profit reporting forms, businesses need to compile their financial statements, including income statements and balance sheets, and follow the specific instructions provided by the relevant tax authority.

What is the purpose of all profits go to?

The purpose is to provide transparency on a company's financial performance, ensuring that stakeholders, including investors and tax authorities, understand how profits are generated and allocated.

What information must be reported on all profits go to?

Businesses must report their total revenue, deductions, operating expenses, net profit or loss, and any distributions made to shareholders.

Fill out your all profits go to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

All Profits Go To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.