Get the free FHA Maximum Mortgage Calculation Worksheet

Show details

A calculation worksheet designed for streamline refinancing of FHA loans without requiring an appraisal, detailing the maximum mortgage amount based on existing indebtedness.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fha maximum mortgage calculation

Edit your fha maximum mortgage calculation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fha maximum mortgage calculation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fha maximum mortgage calculation online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fha maximum mortgage calculation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fha maximum mortgage calculation

How to fill out FHA Maximum Mortgage Calculation Worksheet

01

Start with your personal information at the top of the worksheet.

02

Write down your gross monthly income from all sources.

03

Document any other income sources that can be considered when calculating mortgage eligibility.

04

List your total monthly debts, including credit card payments, car loans, and any other liabilities.

05

Calculate your total monthly housing expense, including the projected mortgage payment, property taxes, and homeowners insurance.

06

Enter the appropriate FHA loan limits based on your location and the type of property.

07

Calculate the Maximum Mortgage Amount by considering the debt-to-income ratios outlined by FHA guidelines.

08

Finalize your calculations and ensure all values are correctly filled out.

Who needs FHA Maximum Mortgage Calculation Worksheet?

01

Homebuyers looking to finance their purchase through FHA-insured loans.

02

Real estate agents assisting clients in understanding their mortgage capabilities.

03

Lenders evaluating potential borrowers for FHA loans.

04

Financial advisors helping clients plan for home ownership under FHA guidelines.

Fill

form

: Try Risk Free

People Also Ask about

What is the FHA 85% rule?

What is the FHA 85% rule? The FHA 85% rule states that you can't borrow more than 85% of your home's value, and only applied to FHA cash-out refinance loans. However, the 85% rule no longer applies; the current LTV ratio limit for FHA cash-out refinances is 80%.

How is the FHA maximum loan amount calculated?

These median prices only directly determine the actual (1-unit) loan limits when the calculated limit (115% of the median price) is between the national ceiling and floor values for the loan limits. Limits for multiple-unit properties are fixed multiples of the 1-unit limits.

How to calculate max loan amount on FHA Streamline?

For owner-occupied Principal Residences the “maximum Base Loan Amount” for Streamline Refinances is the lesser of the outstanding principal balance of the existing Mortgage as of the month prior to mortgage Disbursement; or the original principal balance of the existing Mortgage.

What is the maximum loan to value for FHA?

Loan-to-value ratio requirements by loan type Loan typeLTV maximum FHA loan 96.5% VA loan 100% USDA loan 100% Refinance* 80%2 more rows • Mar 14, 2025

How to calculate FHA max loan amount?

FHA determines loan limits using the national conforming loan limit — 115% of local median home prices — as a baseline. For 2025, the “floor” in California is set at $524,255, or 65% of the conforming loan limit, and the “ceiling” is set at $1,209,750, or 150% of the conforming loan limit.

How much of an FHA loan can I get?

The Federal Housing Administration (FHA) increased the maximum claim amount on the Home Equity Conversion Mortgage (HECM), the only type of reverse mortgage loan it insures, from $1,149,825 (2024) to $1,209,750 (2025). Not sure what all that means? We'll explain down below.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

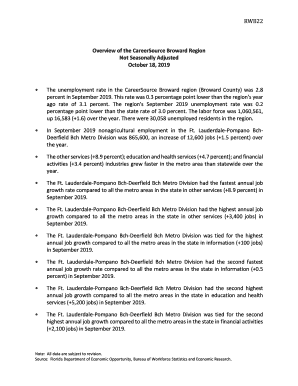

What is FHA Maximum Mortgage Calculation Worksheet?

The FHA Maximum Mortgage Calculation Worksheet is a form used to calculate the maximum mortgage allowable under FHA guidelines, taking into account various factors such as income, debts, and the appraised value of the property.

Who is required to file FHA Maximum Mortgage Calculation Worksheet?

Lenders are required to file the FHA Maximum Mortgage Calculation Worksheet when originating FHA-insured loans to determine the maximum loan amount for a borrower based on their financial capacity.

How to fill out FHA Maximum Mortgage Calculation Worksheet?

To fill out the FHA Maximum Mortgage Calculation Worksheet, you must provide information on the borrower's income, debts, property value, and the applicable FHA loan limits, ensuring all calculations reflect the borrower's financial situation accurately.

What is the purpose of FHA Maximum Mortgage Calculation Worksheet?

The purpose of the FHA Maximum Mortgage Calculation Worksheet is to ensure that loans are structured within the FHA guidelines and to protect both the lender and borrower by accurately assessing affordability and risk.

What information must be reported on FHA Maximum Mortgage Calculation Worksheet?

The FHA Maximum Mortgage Calculation Worksheet must report information such as the borrower's gross monthly income, monthly debts, property value, loan term, and current FHA loan limits applicable to the area.

Fill out your fha maximum mortgage calculation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fha Maximum Mortgage Calculation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.