Get the free Lender Certification for Individual Condominium Unit Financing

Show details

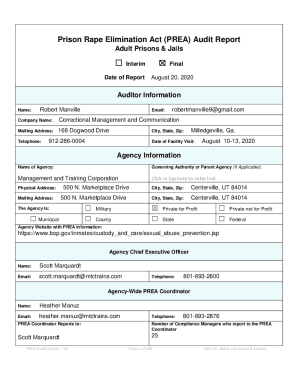

A certification form where the lender verifies the eligibility of a condominium unit for FHA financing, confirming that the project is approved and meets specific criteria.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lender certification for individual

Edit your lender certification for individual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lender certification for individual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lender certification for individual online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit lender certification for individual. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

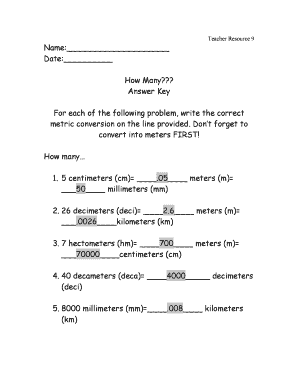

How to fill out lender certification for individual

How to fill out Lender Certification for Individual Condominium Unit Financing

01

Gather all necessary documentation for the condominium unit, including the purchase agreement and financial statements.

02

Obtain information about the condominium project, such as the declaration, bylaws, and any amendments.

03

Verify that the condominium project meets the lender's eligibility criteria, including occupancy rates and financial stability.

04

Complete the Lender Certification form, providing accurate details about the borrower and the condominium unit.

05

Ensure all signatures and dates are properly recorded on the form.

06

Submit the completed Lender Certification to the lender for review and approval.

Who needs Lender Certification for Individual Condominium Unit Financing?

01

Individuals seeking financing to purchase a condominium unit.

02

Lenders providing loans for individual condominium unit financing.

03

Real estate agents involved in the sale of condominium units.

Fill

form

: Try Risk Free

People Also Ask about

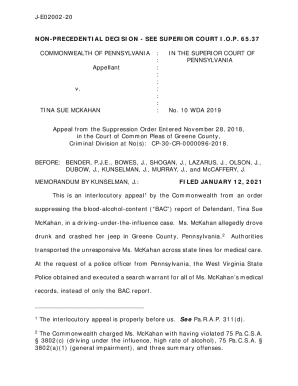

What is the HRAP approval process?

HRAP stands for HUD Review Approval Process. This is where FHA itself approves a complex based on the package sent in by the condo's governing body, usually the homeowner's association or management company. The other type of approval is called DELRAP, or Direct Endorsed Lender Review Approval Process.

Why are most condos not FHA approved?

Some condos aren't able to accept FHA loans because they don't meet the eligibility requirements necessary to receive FHA approval. Others may choose not to participate in the lengthy approval and recertification process.

What LTV do you need for a FHA single unit approval?

The minimum down payment for FHA loans is 3.5% with a credit score of 580 or higher, or 10% with a score of 500-579. However, FHA guidelines require that borrowers purchasing SUA condos either receive approval through HUD's automated underwriting platform or have a maximum loan-to-value ratio** (LTV) of 90%.

What makes a property FHA approved?

The FHA's minimum property standards cover three requirements: Safety: The house should provide a safe and healthy environment. Security: The property should offer its occupants protection. Soundness: The home shouldn't have any structural defects.

How does Hoa get FHA-approved?

In communities with at least 10 units, up to 50% of the units can be FHA-insured. For communities with fewer than 10 units, only two units can be FHA-insured. At least 50% of all units must be owner-occupied. The condo association must keep at least 10% of the HOA budget in a cash reserve.

Why do some HOAs not accept FHA?

Unfortunately FHA tends to require the building to be 80% owner occupied so a lot of HOAs may choose not to seek FHA approval. If the building isn't on FHA's approved list there is no way to buy that particular unit with a FHA loan.

What will disqualify you from an FHA loan?

The three primary factors that can disqualify you from getting an FHA loan are a high debt-to-income ratio, poor credit, or lack of funds to cover the required down payment, monthly mortgage payments, or closing costs.

What does FHA certified mean?

FHA documents require an authorized association representative to certify that (i) to the best of their knowledge and belief, the information and statements contained in the inium project application are true and correct, and (ii) they have reviewed the inium project application and it meets all current

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Lender Certification for Individual Condominium Unit Financing?

Lender Certification for Individual Condominium Unit Financing is a document that lenders complete to verify that a condominium project meets specific eligibility criteria for financing, ensuring compliance with lending guidelines.

Who is required to file Lender Certification for Individual Condominium Unit Financing?

Lenders who wish to provide financing for individual condominium units are required to file the Lender Certification.

How to fill out Lender Certification for Individual Condominium Unit Financing?

To fill out the Lender Certification, lenders must complete the required sections with detailed information about the condominium project, including its financial standing, ownership structure, and adherence to relevant regulations.

What is the purpose of Lender Certification for Individual Condominium Unit Financing?

The purpose of the Lender Certification is to assess the risk and eligibility of condominium projects for individual unit financing, ensuring they meet certain standards for lending.

What information must be reported on Lender Certification for Individual Condominium Unit Financing?

The information that must be reported includes details about the project’s legal and financial status, ownership, occupancy rates, and any outstanding legal issues affecting the condominium association.

Fill out your lender certification for individual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lender Certification For Individual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.