Get the free Insurance Verification Policy - accc-cancer

Show details

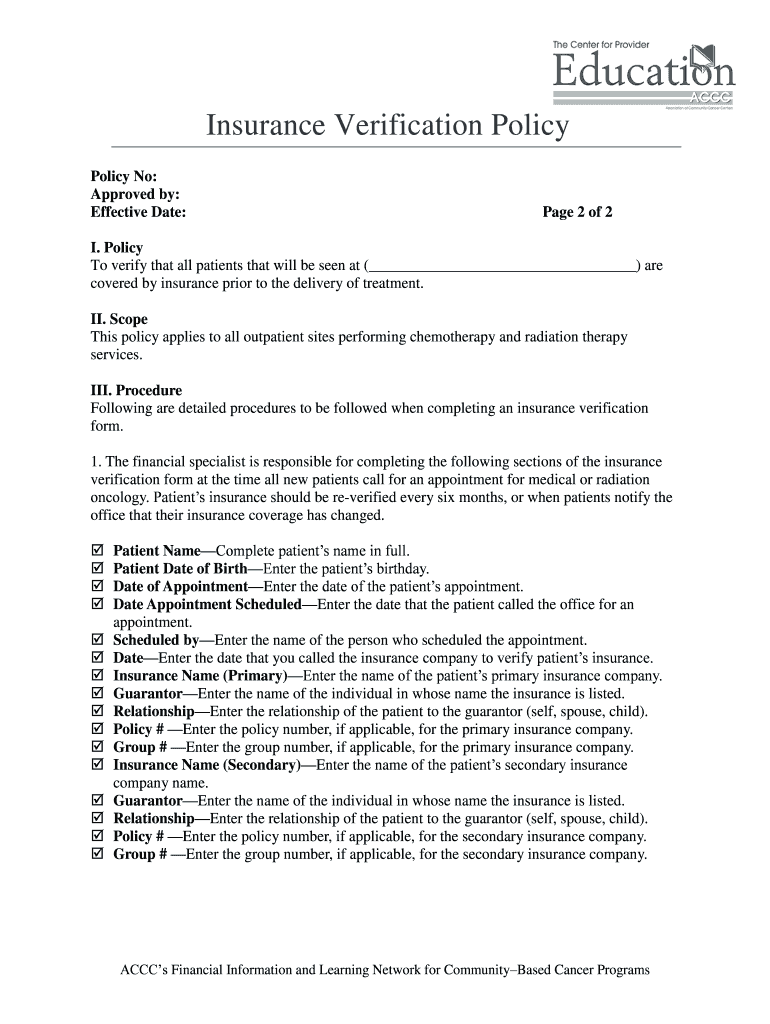

This policy outlines the procedures for verifying that patients are covered by insurance prior to the delivery of chemotherapy and radiation therapy services.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance verification policy

Edit your insurance verification policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance verification policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance verification policy online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit insurance verification policy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

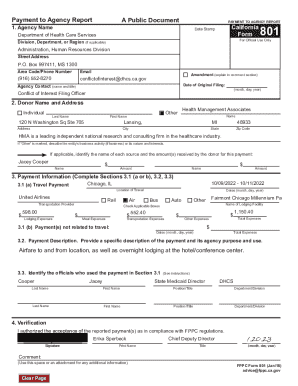

How to fill out insurance verification policy

How to fill out Insurance Verification Policy

01

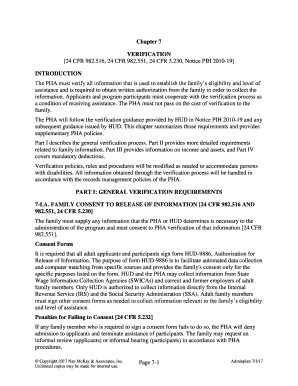

Gather necessary information about the patient, including full name, date of birth, and insurance details.

02

Contact the insurance company using the provided phone number on the insurance card.

03

Verify the patient's eligibility by providing relevant details to the insurance representative.

04

Request information on coverage specific to the services the patient will receive.

05

Document all details obtained during the verification process, including the representative's name and confirmation number.

06

Communicate the verification results to relevant parties involved in the patient's care.

Who needs Insurance Verification Policy?

01

Healthcare providers seeking to confirm patient insurance coverage.

02

Billing departments requiring verification for claims processing.

03

Patients wanting to ensure their insurance is accepted by a provider.

04

Facilities that need to address financial responsibilities before providing services.

Fill

form

: Try Risk Free

People Also Ask about

What is insurance verification skill?

An insurance verification specialist double checks the status of patients' medical insurance. Their primary responsibility is to ensure that a patient's insurance will cover required medical procedures or hospital stays.

What are top 3 skills for an insurance verification specialist?

Skills Required by EmployersShare Communication Skills 12.43% Detail Oriented 12.02% Clinic 11.63% Accuracy 9.10%6 more rows

What is verification of documents?

Document verification is all about checking the authenticity of documents to make sure they are accurate, genuine, and suitable for their intended use. Common documents used for identity verification, like driver's licenses, ID cards, and passports, must be validated to ensure they truly represent the person.

What is the preferred order for insurance verification?

Table of contents: Collect the patient's insurance information. Contact the insurance company before the patient's initial visit. Contact by Phone. Search Online. Deploy Automatic Verification Services. Gather all the crucial benefits information and record it in your EMR.

How to do an insurance verification?

How to verify insurance eligibility and benefits Collect patient information: Obtain accurate details such as insurance ID, group number and personal data during scheduling. Contact insurance providers: Use online portals or call centers to confirm active coverage, co-pays, deductibles and out-of-pocket limits.

Which of the following is required for insurance verification?

Basic information needed Before you get on the phone with an insurance company, you'll need to have specific information about your client and their insurance plan, including: Client's full name. Client's date of birth. Copy of the client and the policyholder's ID.

What are top 3 skills for quality assurance specialist?

4 Transferable Skills That Can Benefit Your Career in Insurance Communication skills. This involves speaking and writing effectively and persuasively. Creativity. This is the ability to see patterns and make connections that often elude others. Organization and management skills. Problem-solving.

Which tasks are completed during insurance coverage verification?

The insurance verification process includes deductibles, policy status, plan exclusions, and other items that affect cost and coverage and are done before patients are admitted to the hospital as it is the first step of the medical billing process.

What are the questions needed to be asked for insurance verification?

Questions for in-network insurance What type of plan is it? Is the patient eligible for the visit date? Does the patient have any other insurance? Does their plan cover the type of visit? Does their plan cover specific benefits? Does the patient's plan have out-of-network benefits?

What is a verification of insurance documents?

In any context in which an insurance plan must be verified by an employer, regulatory body, legal representative, a business associate, or a client, a COI is the final proof. A COI is not a contract, but it is evidence that an insurance contract exists, between the named insured and the insurance carrier.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

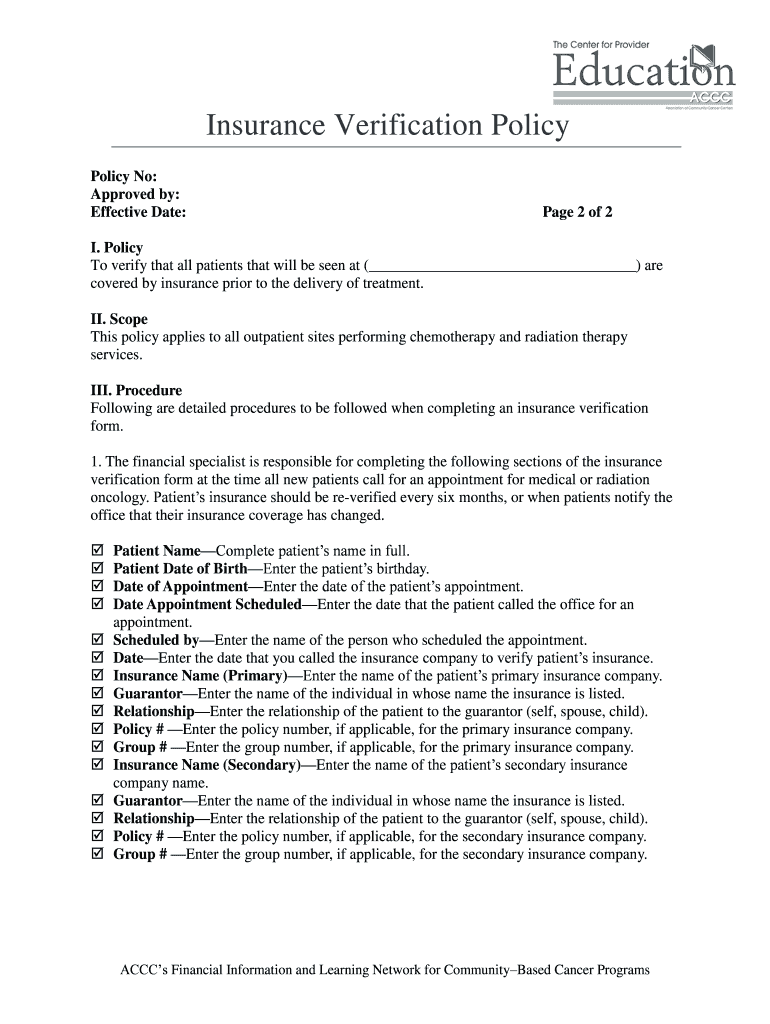

What is Insurance Verification Policy?

An Insurance Verification Policy is a protocol that outlines the standards and procedures for confirming the validity of a patient's insurance details before providing medical services.

Who is required to file Insurance Verification Policy?

Healthcare providers, medical facilities, and billing departments are typically required to file an Insurance Verification Policy to ensure compliance with insurance requirements.

How to fill out Insurance Verification Policy?

To fill out an Insurance Verification Policy, one should gather the patient's insurance information, verify it with the insurance company, and complete any required forms accurately, including patient and insurance details.

What is the purpose of Insurance Verification Policy?

The purpose of the Insurance Verification Policy is to ensure that eligible patients receive benefits and that healthcare providers are reimbursed for the services rendered.

What information must be reported on Insurance Verification Policy?

The information that must be reported includes the patient's name, insurance policy number, effective dates, coverage details, and any exclusions or limitations as specified by the insurance provider.

Fill out your insurance verification policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Verification Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.